SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

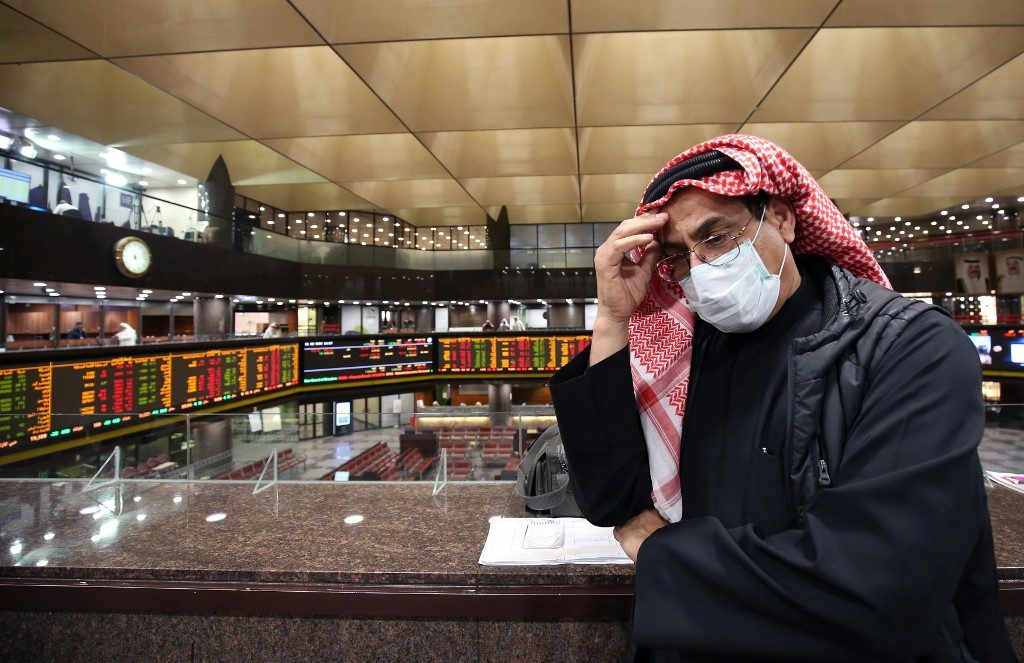

DUBAI, United Arab Emirates (3rd UPDATE) – Stock markets in the oil-rich Gulf states plunged Sunday, March 1, over fears about the impact of the coronavirus which also battered global bourses last week.

The crisis threatens to undercut Gulf economies, which are already battling a downturn and struggling to wean themselves from their decades-old addiction to energy revenues.

The Saudi bourse, the region’s largest and one of the world’s top 10 equity markets, closed down 3.7% to its lowest level in 18 months.

Energy giant Saudi Aramco, the world’s biggest listed firm, dropped 2.1% to 32.65 riyals ($8.70), its worst performance since listing to much fanfare on December 11 in a record-breaking initial public offering.

The other 5 markets operating Sunday in the region, which were closed the previous two days for the Muslim weekend, were also hit badly as oil prices sagged below $50 a barrel.

The region’s slide was led by the Kuwait Bourse, where the All-Share Index fell 10%, triggering its automatic closure. Kuwait’s bourse was closed for most of last week for national holidays.

The Dubai Financial Market dipped 4.5%, while its sister market in Abu Dhabi was down 3.6% at the close of trading, both one-year lows.

Bahrain’s bourse ended 3.4% down and the Muscat Securities Market in Oman finished down 1.2%, in a dismal day for the Gulf Cooperation Council (GCC) bloc.

“GCC equities witnessed a downfall as panic over coronavirus spread across the region,” MR Raghu, head of research at Kuwait Financial Centre (Markaz), told Agence France-Presse (AFP).

“Initial expectations that the outbreak would be contained within China have proved elusive,” he said.

At least 117 cases of the coronavirus have been reported by the Gulf states to date, with the majority of infections among people returning from pilgrimages to Iran.

Global contagion

Global stocks slumped on Friday, February 28, marking the largest weekly drop since the 2008 global financial crisis, as concerns grew that the spread of the virus could wreak havoc on the world economy.

Crude oil prices tumbled as well and analysts said central banks, led by the United States Federal Reserve, might have to shift into crisis-resolution mode with urgent interest rate cuts.

The Gulf states count China as their main trading partner and crude buyer, soaking up about a fifth of their oil, but China’s energy demand has sagged as authorities lock down millions of people to prevent the spread of the virus.

All 6 GCC states – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates – have taken measures to curb the spread of the virus, including cutting off transport links with Iran, where some 54 people are confirmed to have died.

Saudi Arabia also banned Muslim pilgrims from traveling to perform the “umrah” to Islam’s holiest sites in Mecca in the west of the kingdom.

The move is likely to deprive the kingdom of billions of dollars in spending by millions of pilgrims and also creates uncertainty over the annual hajj pilgrimage scheduled for July.

Oman said Sunday it was suspending tourist flights from Italy, where the virus has killed 29 people and infected more than 1,000 – the worst toll in Europe.

The sultanate’s civil aviation authority, however, said flights would continue between Milan and Muscat for “Omanis and transit passengers only,” to guard against any further spread of the disease.

Dubai, which boasts the region’s most diversified economy, is hosting the Expo 2020 global trade fair from October, with the hope of attracting around 25 million visitors.

Asked Sunday whether the event may have to be reviewed, the organizers said they were working closely with health authorities.

“Expo does not open until October this year, and we will continue to follow the situation closely. We are hopeful that global efforts will succeed in managing the virus,” one official told AFP.

The Gulf equities sell-off came as China reported a fresh spike in infections and after the US reported its first death from the virus. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.