SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

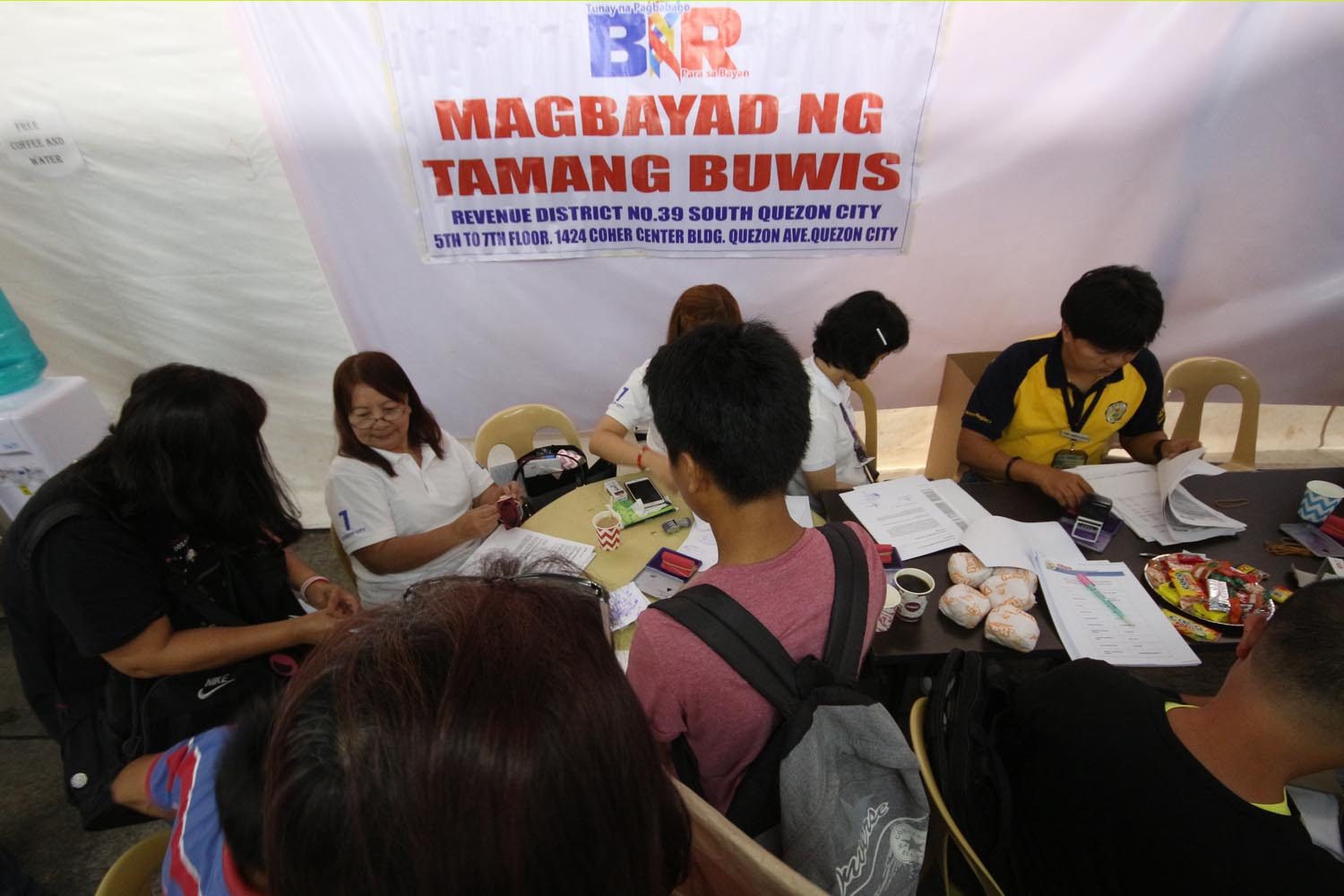

MANILA, Philippines – The Bureau of Internal Revenue (BIR) is keeping its deadline for filing of taxes on April 15, as it encourages taxpayers to file through online means.

In a memorandum circular dated Monday, March 16, but received by its Records Management Division on Tuesday, March 17, the BIR said “the filing of the annual income tax return for the calendar year 2019 shall not be extended.”

“Hence, its filing shall still be done on or before April 15, 2020,” the bureau said.

In a March 16 memo, the Bureau of Internal Revenue says that tax filing will not be extended. The deadline will still be on April 15, 2020. @rapplerdotcom pic.twitter.com/mltLr93rf6

— Aika Rey (@reyaika) March 17, 2020

The memorandum was crafted when Metro Manila was only under a “general community quarantine.”

On Monday night, President Rodrigo Duterte had placed the entire island of Luzon under an “enhanced community quarantine” – which, in effect, is a total lockdown – restricting land, air, and sea travel in a bid to curb the spread of the COVID-19 disease. Mass transportation was suspended too.

To limit exposure to possible carriers of COVID-19, the BIR encourages taxpayers to use its online facilities such as the Electronic Filing and Payment System (eFPS) and the eBIRForm facility.

The BIR added that those who will file through the eFPS may settle tax liabilities through an authorized bank where the taxpayer is enrolled.

The eBIRForm facility, meanwhile, has online payment options. These include the following:

- Land Bank of the Philippines LinkZiz Portal – for Landbank account holders or those using the PesoNet facility

- Development Bank of the Philippines’ Pay Tax Online

- UnionBank online web and mobile payment facilities

- Mobile payment schemes GCash and PayMaya

Manual filing of tax returns is still allowed, the BIR said, if there are tax dues. If there are none, the BIR advised taxpayers to just file through the eBIRForm facility.

In a statement on Tuesday, Senator Francis Pangilinan urged BIR Commissioner Caesar Dulay to extend the deadline by one month or until May 15, noting that some accountants are outsourced.

Under Section 53 of the Tax Code, the revenue chief has the power to extend the period of filing under “meritorious cases,” subject to payment of taxes and deficiencies.

“The accountants who prepare the returns cannot report for work as 1. they are not considered employees of essential or vital industries; 2. the finance and accounting documents are in their respective offices; 3. they would not have enough time to examine the documents from April 12, when the quarantine is lifted, and April 15, the deadline for the filing of tax returns,” Pangilinan said.

“In effect, kung ma-extend ang time period for filing, walang ma-i-impose na penalty, basta ma-file within the extended period (In effect, if the time period for filing is extended, penalties would not be imposed, as long as they file within the extended period),” he added.

Duterte on Monday night ordered work-from-home arrangements for all industries, except for frontliners, security forces, and the media, among others. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.