SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

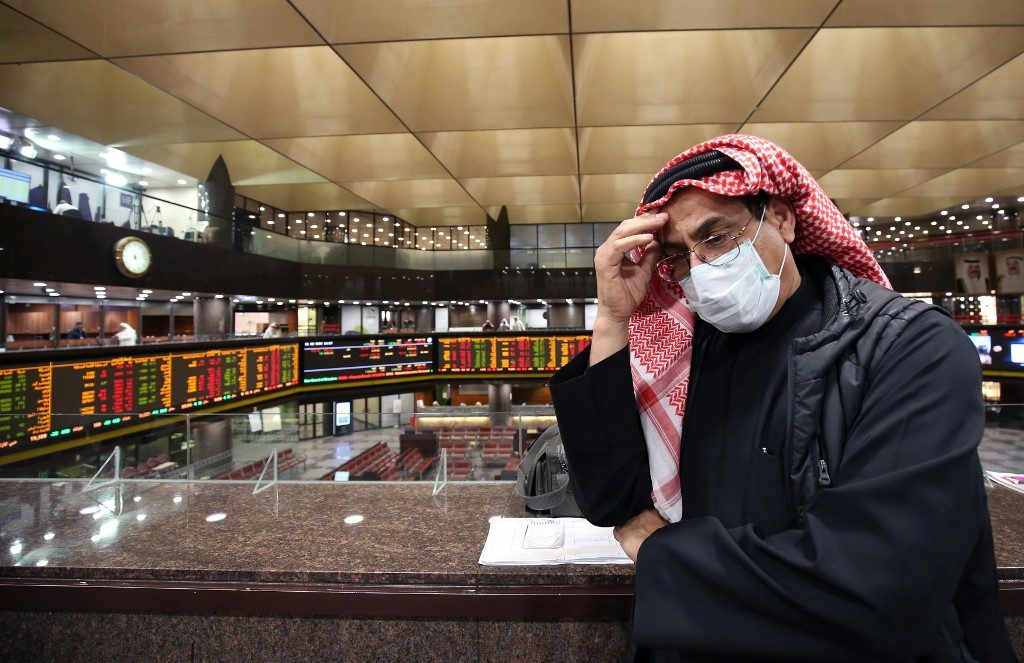

DUBAI, United Arab Emirates – Stock markets in the energy-rich Gulf states slumped to multi-year lows in the 1st quarter of this year over coronavirus shutdowns and crashing oil prices.

The 5 major bourses in the region, which pumps a fifth of the world’s crude supplies, plummeted in the first 3 months of the year, with Dubai’s market losing more than a third of its value.

The majority of the losses were sustained in March which saw the collapse of the OPEC+ production cut agreement and the implementation of shutdowns to counter the spread of the coronavirus, bringing most businesses to a standstill.

The declines were also triggered by a price war between Saudi Arabia and Russia that sent oil prices crashing to 18-year lows, spooking investors into a panic sell-off.

The sharp decline led Standard & Poor’s ratings agency to cut its projections on average oil prices this year by half to $30 a barrel.

This means the 6 Gulf states – Bahrain, Oman, Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates – will lose at least $100 billion in oil revenues this year.

Ratings company Moody’s estimated that Kuwait’s oil income would decline by 10% of gross domestic product (GDP), while the drop in other states will be between 4% and 8% of GDP.

Capital Economics projected Middle East and North Africa growth this year to contract by 1.7%, the worst since early 1980s.

Dubai Financial Market led the slide in the 1st quarter, shedding a massive 36% since the start of the year, followed by its UAE partner Abu Dhabi Stock Exchange which dipped 26.4%.

In March, the two bourses posted their worst monthly performance in a decade, according to CNBC Arabiya channel.

The UAE’s largest real estate firm Emaar Properties dived a massive 45% in the 1st quarter.

The Saudi Tadawul market, the largest in the Arab world, plunged 22.5% to close the quarter at levels last seen in November 2016.

Saudi Aramco, the world’s biggest listed firm, gave up 15.3% since January to end 30.15 riyals ($8) a share, below its listing price of 32 riyals.

The energy giant was listed on the domestic bourse in December following the world’s largest initial public offering, which generated $29.4 billion.

Kuwait’s Premier Index dipped 24.1% and Qatar’s index dropped 21.3%. The tiny bourses of Bahrain and Oman dropped 16.1% and 13.4% respectively. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.