SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I registered a small business in 2019 and as expected I incurred a loss after operating for 6 months. Am I still required to file my annual income tax return (AITR)? How about those registered as a barangay micro business enterprise (BMBE) who are exempted from paying income tax? Are there any taxpayers exempted from filing or not required to file an AITR?

All businesses registered with the Bureau of Internal Revenue (BIR) are required to file an AITR whether they earned profit or incurred a loss. In your case, you don’t need to pay income tax, but you still have to file an AITR via eBIRForms.

Although BMBE taxpayers are exempted from income tax, they are still required to file an annual information return as provided in Republic Act (RA) No. 9178.

Overseas Filipino workers, seafarers, and Filipino migrants are exempted from filing ITRs except if they have a registered business in the Philippines under their name. Meanwhile, employees with only one employer for the year and no other sources of income are qualified for the substituted filing tax system. It means they are not required to file a separate ITR since their employer will file on their behalf and provide them with BIR Form 2316 in lieu of an AITR.

Can the April 15 deadline for filing AITRs be extended? I read in the newspaper that the deadline was actually extended by the Tax Reform for Acceleration and Inclusion (TRAIN) law. Is it true? In this extraordinary time when the entire Luzon is on total lockdown, can the BIR extend tax deadlines without legislation? When is the extended deadline? How about the other returns and reportorial requirements? Are the deadlines for local business taxes, real property tax, and other taxes or fees due to the local government units (LGUs) also extended?

Section 53 of the tax code provides that the BIR commissioner may, in meritorious cases, grant a reasonable extension of time for filing returns. But in the event April 15 falls on a weekend or holiday, the deadline is automatically moved to the next working day.

As for TRAIN, that’s a misinterpretation of the law. The law only extended the deadline for filing 1st quarter income tax returns of the current year from April 15 to May 15, but for the AITR of the previous year, the deadline remains on April 15.

For the 2019 AITR, however, the BIR has extended the deadline for this and other returns, in light of the “enhanced community quarantine” (ECQ) declared by President Rodrigo Duterte for Metro Manila until April 14, and for the entire Luzon until April 12.

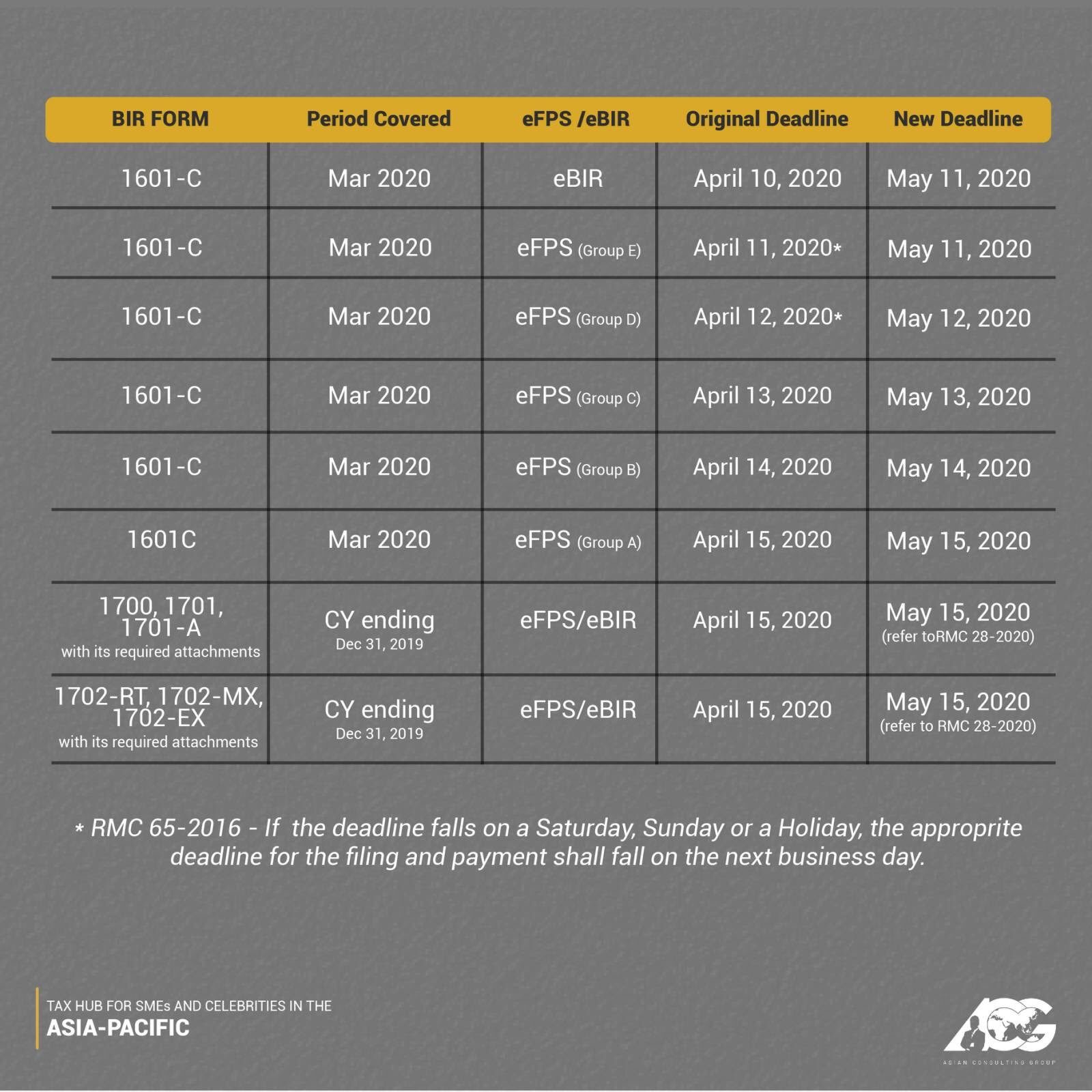

Internal Revenue Commissioner Caesar Dulay issued Revenue Memorandum Circulars (RMCs) 28-2020 and 30-2020 extending the deadline of 2019 AITR filing from April 15 to May 15, 2020, without imposition of penalties. The payment was likewise made easier by allowing that it be done through the nearest authorized agent bank or the revenue collection officer under the revenue district office (file and pay anywhere).

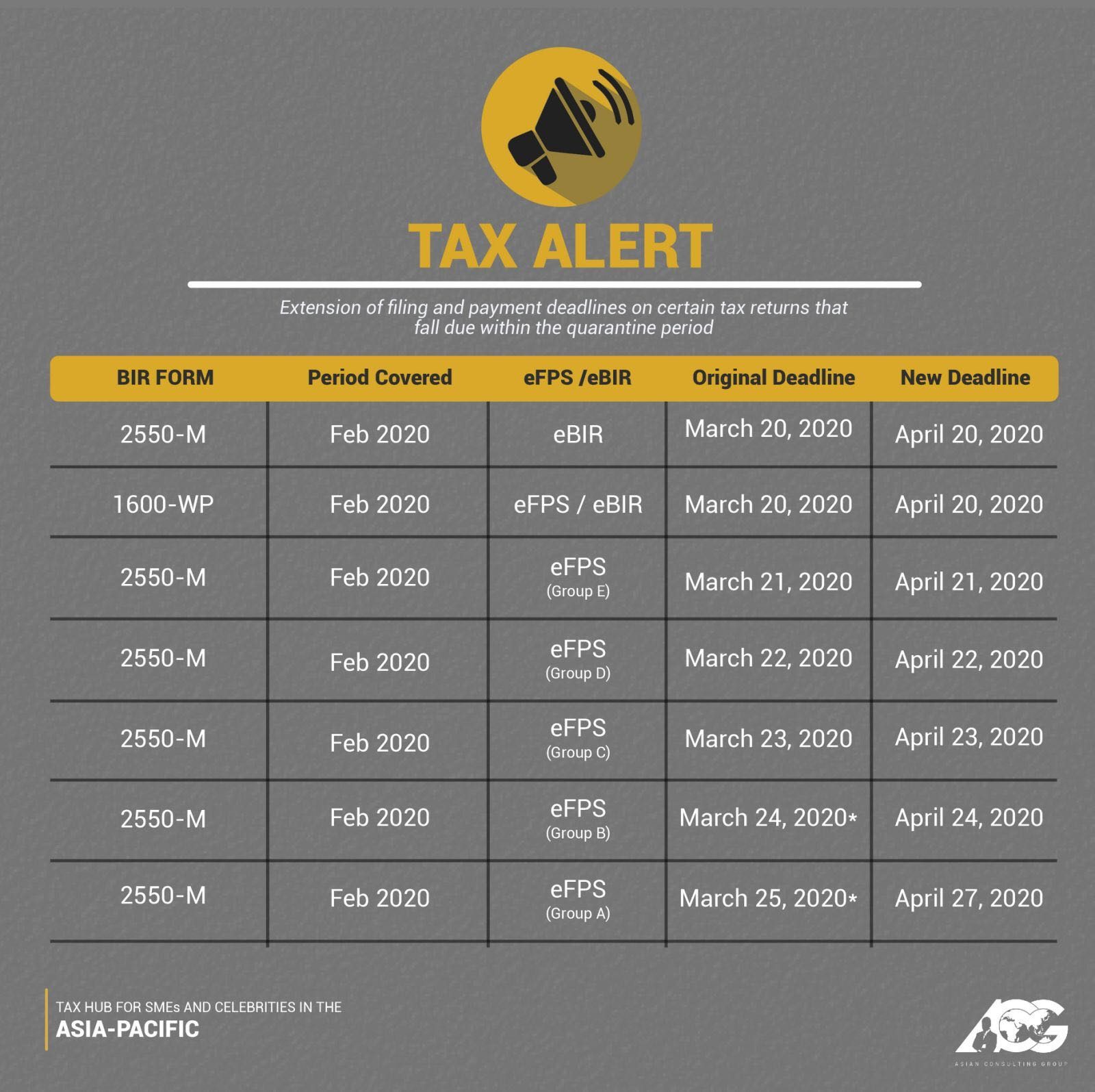

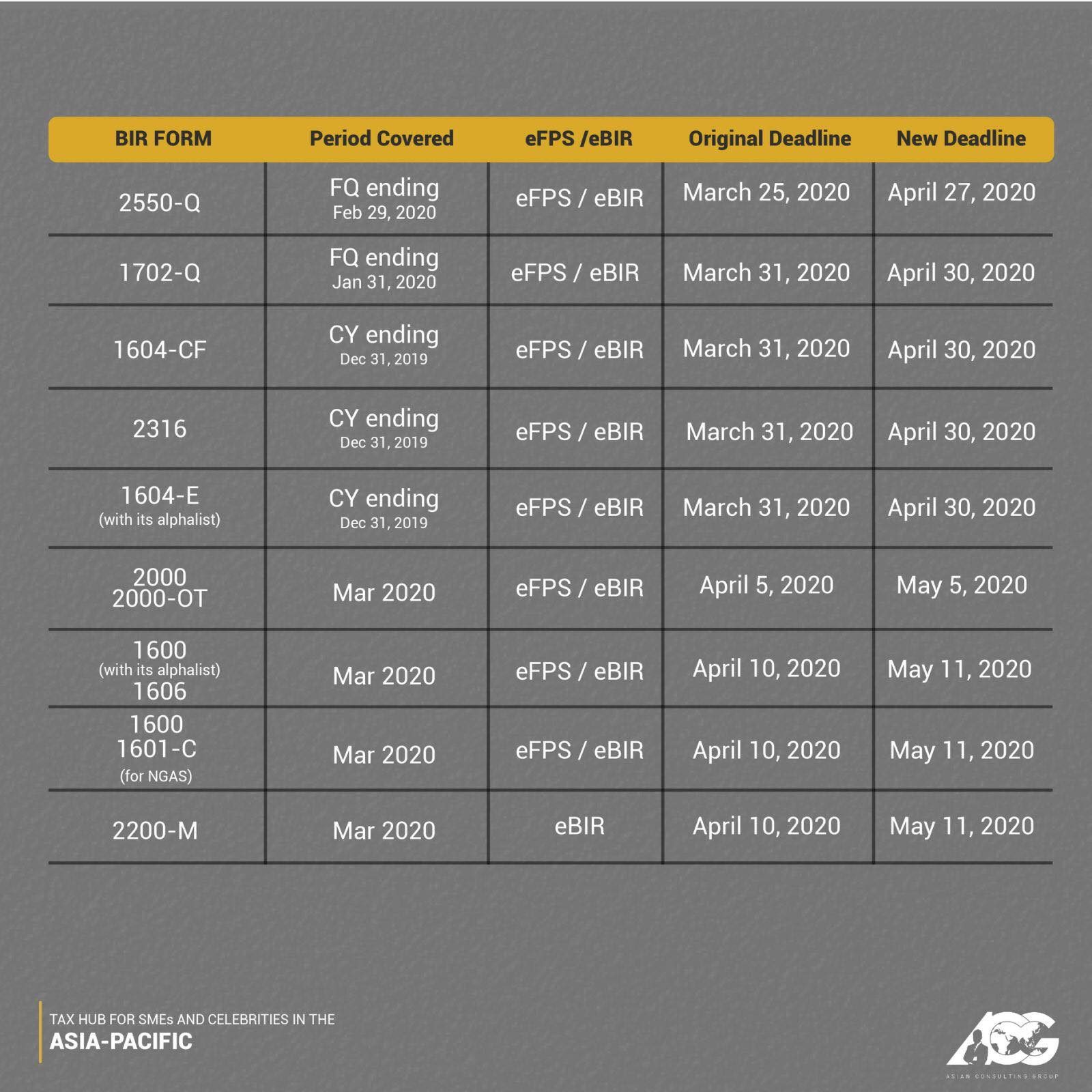

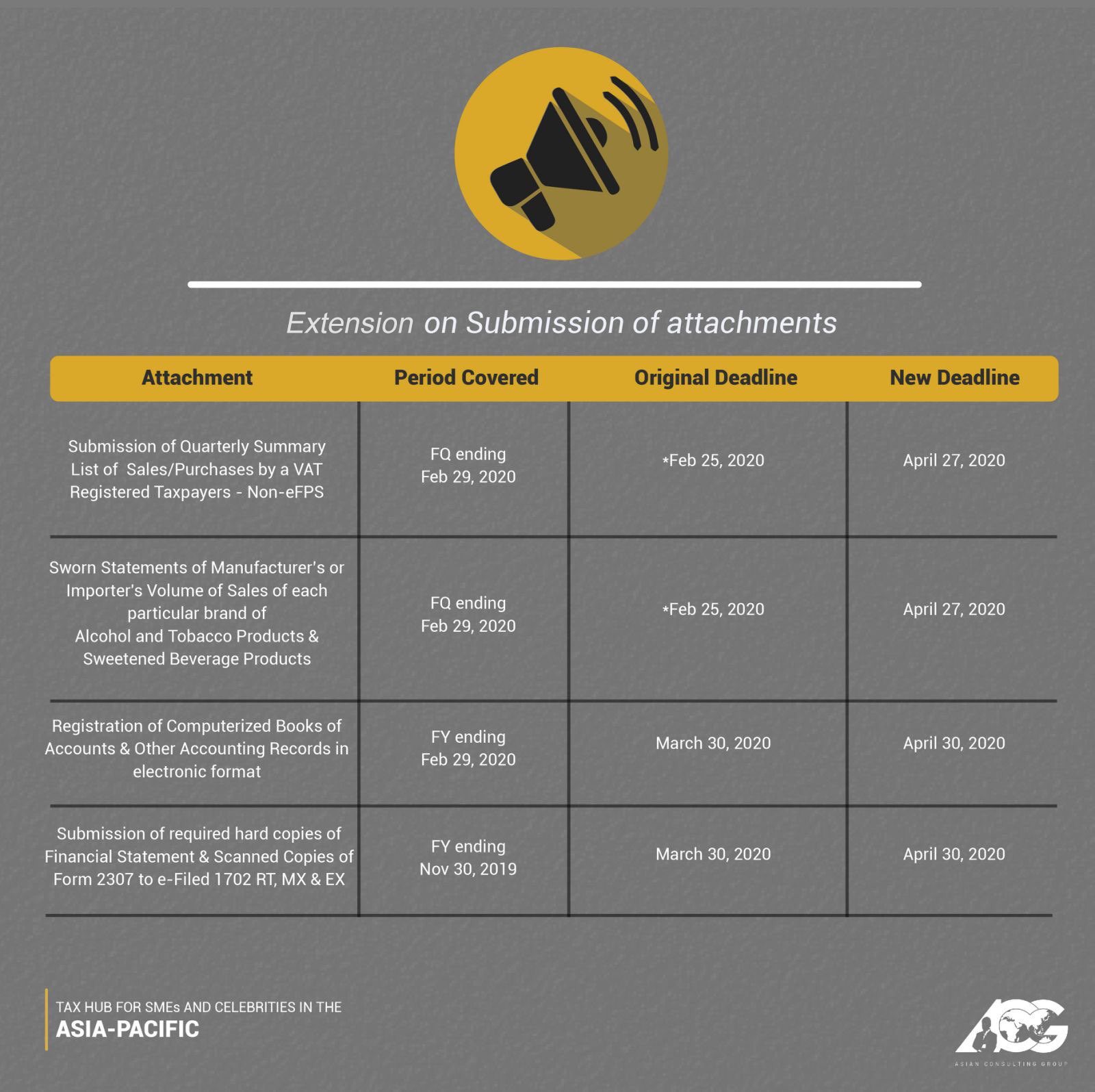

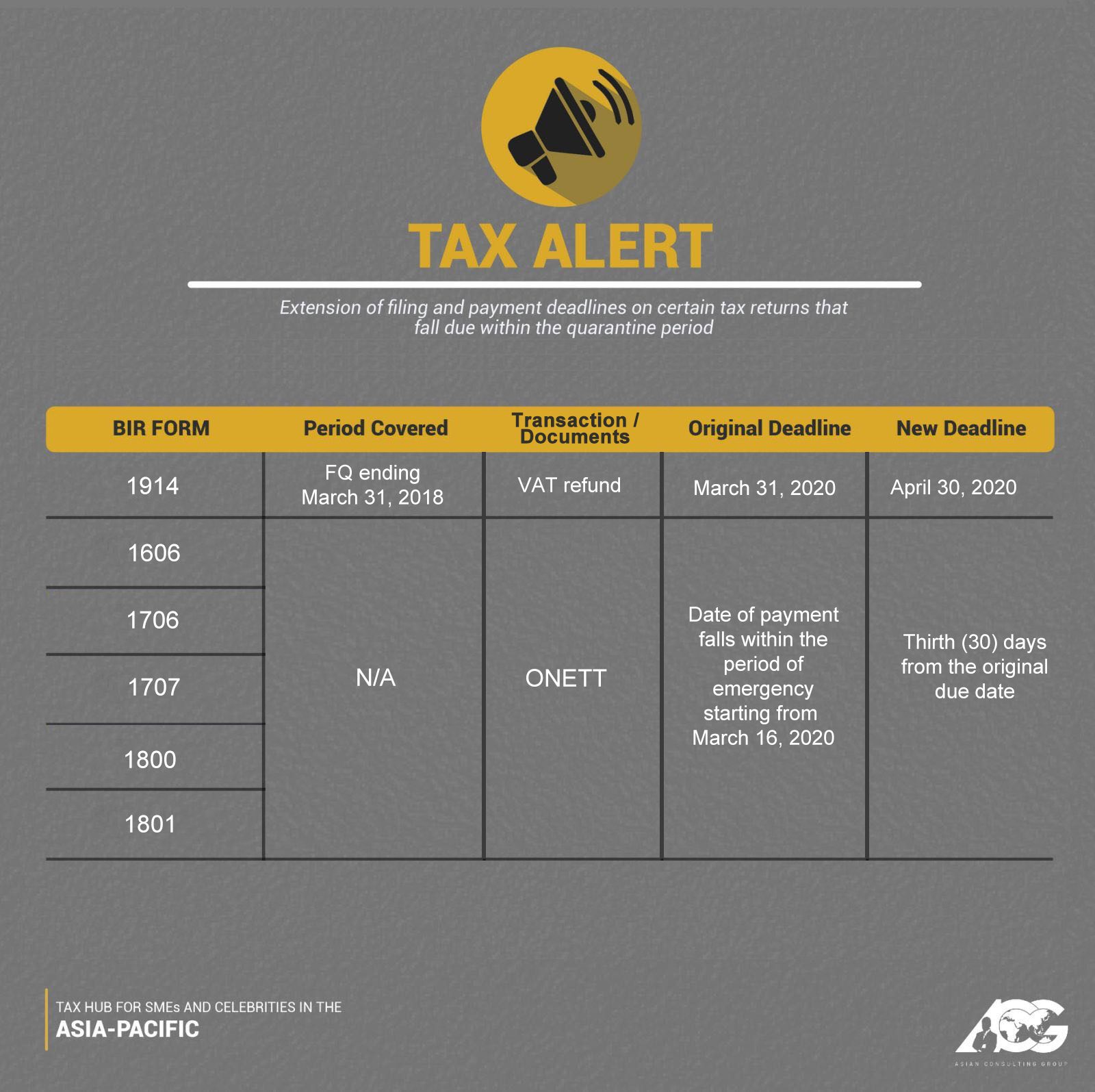

Other returns as well as reportorial requirements where the deadlines fall within the ECQ have an additional 30 calendar days from the original due date to file or e-file and pay. Value-added tax (VAT), percentage tax, withholding tax, documentary stamp tax, excise tax, and one-time transactions are among the tax returns included in the extension, based on a BIR media release approved by Assistant Commissioner Teresita Angeles.

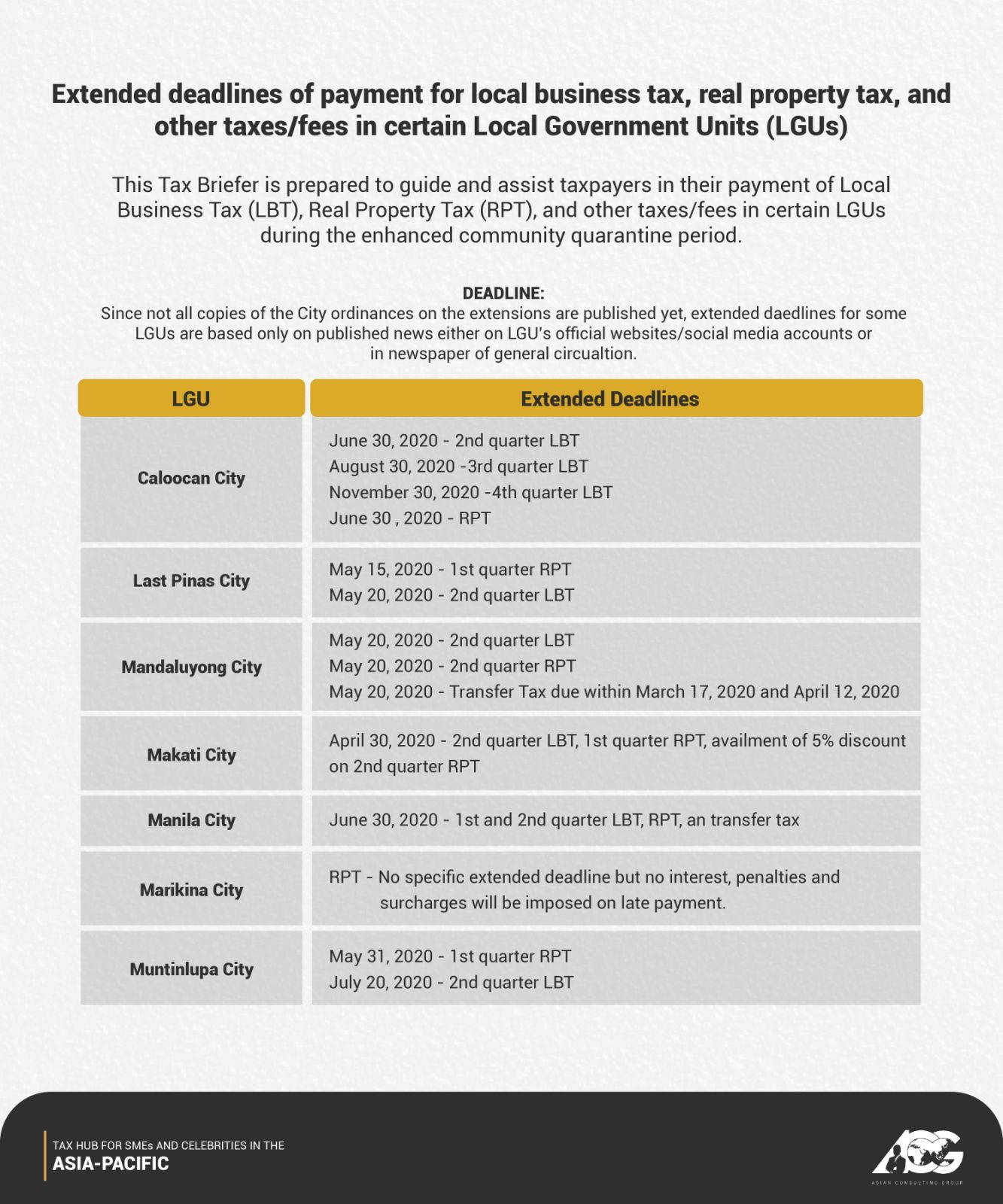

Regarding the extension of deadlines for local taxes, it depends on the LGU. Here is a summary of some of the extended deadlines for some LGUs, consolidated by the Asian Consulting Group (ACG) based on published city ordinances:

Can we still avail of the tax amnesty after the lockdown? For those with VAT refunds, can they still apply? How about those with pending BIR audits – will the taxpayers be given consideration since they cannot go to a BIR office to submit letters and other documents? Is there a way we can avoid all these hassles and confusions like a mobile app where we can ask tax questions, alert us of BIR deadlines, and if possible, use it to file and pay our taxes anytime, anywhere?

Yes. BIR Commissioner Dulay provided further relief to taxpayers by issuing various RMCs and Revenue Regulations (RR) in consideration of the circumstances:

- RR 5-2020 circularized by RMC 33-2020 extended the deadline for the availment of the tax amnesty on delinquencies from April 23 to May 23, 2020. However, for estate tax amnesty, the deadline is still on June 15, 2021, so there is no need for an extension.

- RMC 27-2020 extended the filing of VAT refund applications to cover the quarter ending March 31, 2020 until April 30, 2020.

- RMC 31-2020 allowed taxpayers who are required to respond to a notice for informal conference (NIC), preliminary and final assessment notice (PAN/FAN), formal letter of demand (FLD), supporting documents to support request for reinvestigation, appeals and request for reconsideration to the commissioner on the final decision on disputed assessment (FDDA), a 30-day extension from date of lifting of the ECQ if the required response and other similar notices fall due on the dates within the period of the ECQ.

Please refer to the summary of all extended deadlines consolidated by ACG based on various circulars issued by the BIR, particularly RR 7-2020 implementing Section 4 of RA No. 11469, known as the Bayanihan to Heal as One Act:

In 2018, the BIR launched its Electronic Tax Software Provider Certification (eTSPCert) System in partnership with the United States Agency for International Development (USAID). It is an online system where tax software providers (TSPs) can apply to have their e-filing and e-payment software tested, evaluated, and certified by the BIR.

In 2019, the BIR launched the HACKATAX innovation challenge which aims to bring talented and skilled IT professionals and students across the country to help develop innovative technology solutions for taxpayers. This is again in partnership with USAID, DEVCON, and the private sector including ACG.

The good news is you can already download the TaxWhizPH mobile app for free! It is an on-the-go digital platform for filing and payment of taxes especially developed for the self-employed and professionals, but available and accessible to all including employees and freelancers. Watch here.

To learn more about taxes in the Philippines, subscribe to the TaxWhizPH YouTube Channel where I talk to celebrities and entrepreneurs about how to deal with taxes without stress, penalties, and compromises.

For inquiries, email consult@acg.ph, call (02) 7622-7720, or follow TaxWhizPH on Facebook and Instagram. – Rappler.com

Mon Abrea is the co-chair of the Ease of Doing Business (EODB) Task Force on Paying Taxes. He was recognized as one of the 2017 Outstanding Young Persons of the World, 2016 Digital Mover, one of the 2015 The Outstanding Young Men of the Philippines (TOYM), and an Asia CEO Young Leader because of his tax advocacy. Currently, he is the chairman and senior tax advisor of the Asian Consulting Group (ACG) and founding trustee of the Center for Strategic Reforms of the Philippines (CSR Philippines).

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.