SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines [UPDATED} – Renewed concerns over the European debt crisis and mixed economic data in the US did not stop investors from snapping up Philippine stocks, which reached a new record on Tuesday, April 17.

Analysts said expected strong first-quarter corporate results and improvements on the economy buoyed investor sentiment.

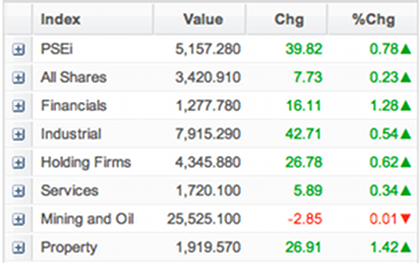

The key Philippine Stock Exchange index (PSEi) rose 39.82 points or 0.78% to close at 5,157.28. This was the index’s all-time high, breaching the previous high of 5,145.89 set on March 16.

The broader all-share index went up 7.73 points or 0.23% to 3,420.91.

Except for the mining and oil sector, all subindices ended in positive territory, led by property stocks, which gained 1.42%.

A total of 1.48 billion shares valued at P6.7 billion were traded.

The PSEi’s rise bucked the trend of many Asian markets that were affected by bad news from Europe and the US.

Investors fear that Spain could follow Greece, Ireland and Portugal in needing a bailout and could slip into a recession due to spending cuts it made to reduce its deficit.

In the US, there were inconclusive data as to whether the world’s biggest economy was getting better.

The US Commerce Department reported overall retail and food service sales expanded by a better-than-expected 0.8% last month. On the other hand, the New York state manufacturing index plunged to 6.6 in April, from 20.2 in March.

Overnight, the Dow Jones Industrial Average rose 0.56%, but the S&P 500 inched down 0.05% and the Nasdaq fell 0.76%.

At home, however, analysts said investors focused on the local economy and companies’ financial results.

“We defied the regional trend. The reason is plain and simple. Investors are looking at stronger Q1 numbers and the economy. That’s what’s keeping the bears at bay,” Jun Calaycay of Accord Capital Equities Corp. told Rappler.com.

Calaycay said the uptick in public spending, recovery of exports and the planned rollout of big infrastructure projects under the public-private partnership scheme are pointing to higher growth in gross domestic product.

“It’s all about the economy and how that will rub off on corporate numbers,” he noted. – Rappler.com, with a report from Agence-France Presse

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.