SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Asian Development Bank commissioned the Economist Intelligence Unit to assess the 11 Asian developing countries’ readiness and capacity to implement sustainable infrastructure projects under a public-private partnership (PPP) scheme.

The study, called EIU 2011 Asia Infrascope, also includes Australia, Republic of Korea, Japan and the United Kingdom as benchmark countries.

The study shows an increasingly open environment for PPPs, though with individual countries at different stages of readiness.

- Australia was the top scorer, reflecting its developed institutions and sophisticated investment climate and financing mechanisms, with the UK next for similar reasons. Both are ‘mature’ benchmark countries.

- Republic of Korea, India and Japan, are the top performing countries in Asia with robust institutional and regulatory frameworks.

- India came in slightly ahead of Japan, reflecting strong political will and rising capacity for PPPs, although implementation problems remain a challenge.

- The study also includes the Indian state of Gujarat as a sub-national entity, which with its progressive state-level regulations and favorable investment environment, rates higher than India overall.

- People’s Republic of China (PRC) topped the list for operational maturity in dealing with PPPs, with 614 projects reaching financial closure between 2000 and 2009.

- The PRC’s large market size, strong investment environment and support for PPPs by provincial governments, stimulated activity.

- Vietnam, Mongolia and Papua New Guinea (PNG) are at the lower end of the index, due to a lack of experience with PPPs and underdeveloped regulatory frameworks.

- Other emerging countries had mixed success, but along with Vietnam, Mongolia and PNG, they are updating regulations and their capacity to carry out PPPs.

- The majority of Asian countries have either recently reformed infrastructure investment regulations or initiated efforts to do so, showing growing political will for PPPs.

- Improvements have focused on the bidding process in particular, with a strong emphasis on the development of more competitive markets for procurement.

- While overall prospects for PPPs remain bright, weak implementation and political distortions remain a threat to sustainable projects in the region.

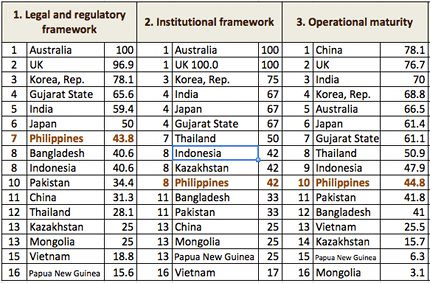

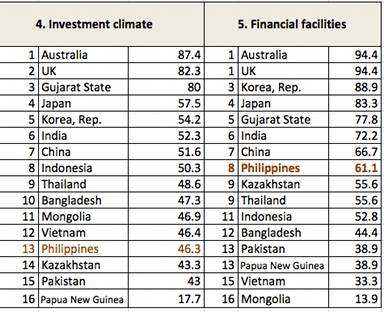

In the 2011 Infrascope, the ADB said the Philippines ranked 8th overall and first among ASEAN countries with a score of 47.1 out of 100. Countries’ scores were from zero to 100, with 100 representing the ideal environment for PPP projects.

A country’s overall score was based on its performance on regulatory framework, institutional framework, operational maturity, investment climate, financial facilities and sub-national adjustment factor.

– Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.