SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Banco de Oro (BDO), owned by the Philippines’ richest man Henry Sy, is all set for what will be the biggest share sale in the country as it announces the most important detail of its planned stock rights offer: the final price.

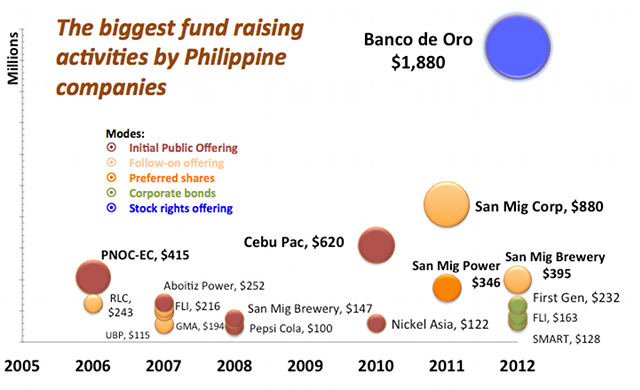

BDO, the Philippines’ top lender by assets, told public investors on Tuesday, June 5, it will sell 895 million common shares in a rights offer to investors at P48.60 apiece to raise P43.5 billion ($1.88 billion) — the biggest ever equity deal in the country.

The final price represents a 25% discount to BDO’s closing price of P65.05 in the local market the same day.

The bank is selling one share for every 3 held by existing shareholders on record as of June 14. The offer will run from June 18 to 27.

If fully taken up, the sale will surpass the record $611 million raised by the Gokongweis’ budget carrier Cebu Pacific in its initial public offering (IPO) in October 2010, and the $505 million raised by taipan George S.K. Ty’s GT Capital Holdings IPO in April this year.

BDO has appointed Citigroup, Deutsche Bank and J.P. Morgan as joint international lead managers and underwriters, while BDO Capital & Investment Corp. is issue manager and domestic underwriter.

The share offer marks another milestone for Sy’s empire, which started out as small shoe store in Manila and grew to become one of the large-scale conglomerates with interests in retail, mall, real estate and banking.

The Sy group plans to use the fresh capital from BDO’s offering for a major undertaking, and one that the bank has spearheaded in the country — financing of big-ticket infrastructure projects under the government’s Public-Private Partnership (PPP) scheme.

Capital ratio, PPP

Companies usually turn to rights offers when they need money and want to raise it immediately. A rights offer is a type of issue that give shareholders the “rights” to purchase new shares in a company at a price lower than what the market offers. While troubled companies are the ones that typically undertake a rights issue, many with clean balance sheets also use it to fund acquisitions and growth strategies.

In a disclosure to the stock exchange, BDO said its huge offer “is intended to support BDO’s medium-term growth objectives and is being conducted in anticipation of the more stringent Basel 3 capital requirement expected to be implemented by the Bangko Sentral ng Pilipinas.”

The fresh capital is expected to bring the bank’s capital adequacy ratio above 15% or the level the central bank will be requiring universal and commercial banks starting January 2014.

More important however is BDO’s plan to participate in the government’s PPP program through financing.

Teresita Sy-Coson, the bank’s chairman and eldest child of Sy, said in May they would collaborate with other local financial institutions in raising a $1-billion fund that will bankroll infrastructure projects under PPP, the centerpiece of the Aquino government’s economic agenda. The government has lined up a total of 22 PPP projects to be bid out to private investors this year.

In 2011, BDO led a syndicate of banks that financed the P11.5-billion construction of the Tarlac-Pangasinan-La Union Expressway, a major infra project crucial to the growth of Northern Luzon.

BDO is 46% owned by Sy’s holding firm, SM Investments Corp. Around 5% of the bank is held by International Finance Corp, the private sector arm of the World Bank, and the rest is held by the public.

Now the Philippines’ largest bank by assets, BDO posted a net income of P10.5 billion in 2011, up 19% from 2010, owing to the 24% growth in its loans, which outpaced the industry’s average growth of 19%. – Rappler.com

Click on the links below for related stories.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.