SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (UPDATED) – The patriarch of the family behind the holding firm that controls corporate giants like Philippine Long Distance Telephone Co. (PLDT), Metro Pacific Investments Corp. (MPIC) and Philex Mining has passed away, an official announcement said.

“The board of directors of First Pacific Company Limited announces with deep regret that Mr. Soedono Salim (Liem Sioe Liong), Honorary Chairman and Advisor to the Board, passed away in Singapore on 10 June 2012 due to old age,” Manuel V. Pangilinan, the CEO of the Salim Group’s Hong Kong-based listed holding firm First Pacific Company Ltd, told the exchange in a disclosure.

The Indonesian industrialist and one of Asia’s richest was 97. Liem Sioe Liong was also referred to as Soedoeno Solim or Sundono Salim.

“The late Mr. Salim…served as its first Chairman from 1981 until February 1999, when he assumed the title of Honorary Chairman and Advisor to the Board. From the outset, the late Mr. Salim provided steadfast support and leadership to First Pacific and has contributed greatly to the success of the Company since its establishment in 1981,” Pangilinan’s statement added.

“The Board would like to express its appreciation for his valuable contribution to the development and growth of the Company. The Board extends its profound condolences to the family of the late Mr. Salim,” he shared.

Earlier, Pangilinan assured the investing public and the conglomerates’ stakeholders that Liem’s death will not impact business operations, including those in the Philippines.

“He remains the acknowledged patriarch of the group – the quintessential Mandarin guru…We pray that he finds peaceful and eternal rest after a long and distinguished life, which started as a young immigrant from (China’s) Fujian province, settling first at Kudus, central Java, supporting family and relatives with his first job – coffee trading,” he told The Philippine Star.

Philippine interests

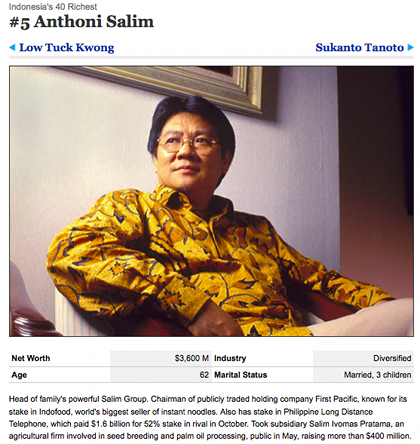

First Pacific chairman Anthoni Salim is Liem’s youngest son who has taken over the reigns of the business since 1992. The younger Salim, together with Pangilinan, rebuilt the business then at the brink of collapse after the dark days of the Asian financial crisis, which hit Indonesia hard in 1997-98.

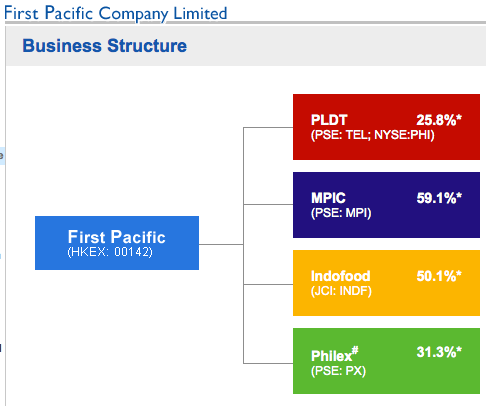

From the investment decisions in those days, First Pacific’s assets are now largely (around 80%) in the Phillippines. See breakdown below.

Suharto ties

Liem was a son of a poor Chinese from Fujian and emigrated to Indonesia as a young man in the 1930’s. He died a very wealthy man, with his vast fortunes closely linked to Indonesia’s political and economic history.

He has been compared to Lucio Tan, the Filipino tycoon also with Chinese descent. Their vast empires now both benefited from connections with the power that be. Liem with autocratic Suharto and Tan with dictator Ferdinand Marcos.

Liem, who started as a small-time peanut oil and clove trader, began supplying goods to the military to support Indonesia’s bid for independence from the Netherlands in 1949. He became friends with young officer, Suharto.

As a general, Suharto would go on to mount a military coup, seizing control of the country and, like Marcos, staying on for decades.

Historians said that Liem benefited from his close relationship with Suharto through lucrative full or partial monopolies in the import of commodities and products, as well as manufacturing. His business dominated crucial industries that provided basic needs for one of the world’s most populous nation. He had interests in cement, banking, cars, food.

Before Suharto’s fall, however, Liem has already transitioned “from a well-connected crony thriving on monopoly licenses to a successful businessman with relatively competitive businesses,” the FT said. It was in the 1990’s when his son Anthoni created the country’s largest maker of instant noodles, Indocement, a building materials supplier, and Bank Central Asia (BCA).

The transition was interrupted by, or changed its course due to, the dark days in 1997, when the Asian financial crisis precipitated the fall of Suharto the year after, and when visceral anti-Chinese sentiment boiled over into violence.

Liem’s bank, BCA, collapsed, was nationalised, and made the Salim group the biggest debtor to the Indonesian government, owing about US$5 billion. Under Anthoni, Salim group was also one of the first to settle its debts after the crisis.

Indonesia recovered, but Liem never lived there again.

Anthoni, on the other hand, is the 5th richest man in Indonesia, according to Forbes magazine.

The Philippine assets of First Pacific, led by Pangilinan, has expanded aggressively from its first foray into telecommunications into infrastructure (NLEx, SCTex), hospitals (Makati Medical Center, etc), power (Meralco), mining (Philex), among others.

. – Rappler.com

. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.