SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

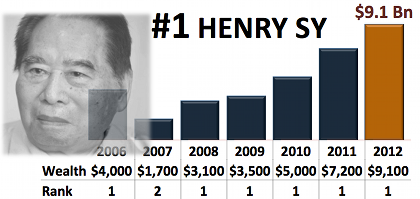

MANILA, Philippines (UPDATED) – Mall magnate Henry Sy is still the Philippines’ richest man, holding the top spot for the 5th year in a row in 2012, while port operator Enrique Razon Jr is the biggest gainer, jumping 4 places to become the third-richest, according to Forbes Magazine’s Philippines’ 40 richest list.

The 87-year-old Sy controls the SM group, which operates the country’s biggest retail business (SM Malls) and biggest bank (Banco de Oro or BDO, by assets).

The 40 richest people in the Philippines enjoy higher fortunes this year as the Philippine economy outperforms most of its neighbors, despite the debt crisis in Europe and slow growth in US.

Their collective wealth rises over $13 billion from a year ago to $47.4 billion this year. There are now 15 billionaires in the country, against only 11 in 2011.

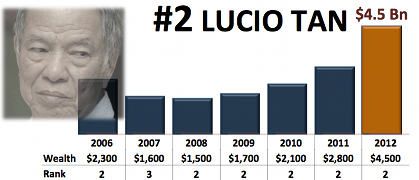

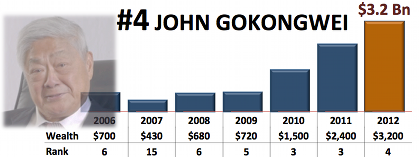

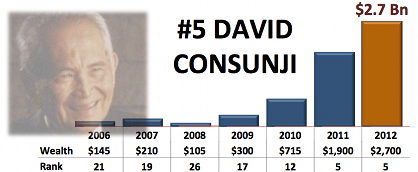

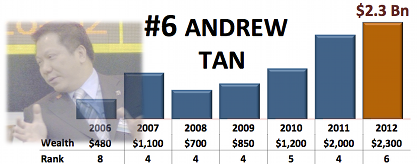

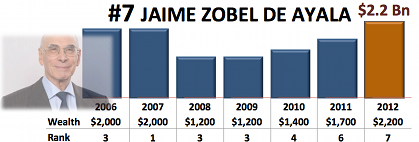

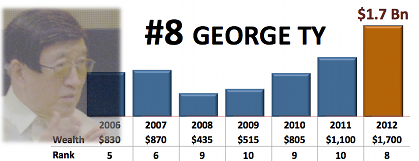

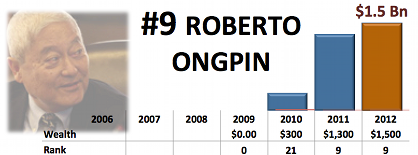

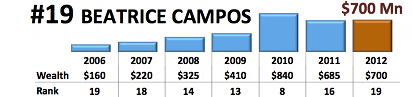

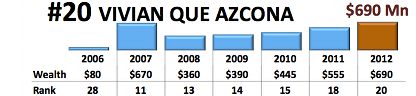

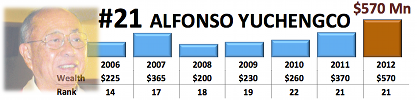

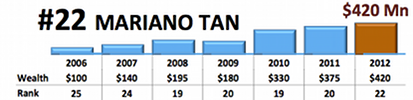

See how the country’s richest grew — or lost some of — their wealth (in million US dollars), and how their rank changed since 2006:

Tan retains his place for the 5th consecutive year. He has ceded control of his Fortune Tobacco Manufacturing Corp to a joint venture with multinational Philip Morris, sealing a virtual monopoly of the local cigarette market, one of the world’s most lucrative. His group also sold a minority but controlling stake in financially ailing Philippine Airlines (PAL) to the San Miguel group. Forbes counts his real estate stakes in Eton, which has assets abroad.

Razon is the top gainer, jumping to 3rd from 7th place, with a net worth of $3.6 billion, up from $1.6 billion in 2011. Razon is known for his global port business, but much of the growth in his wealth this year comes from his stake in casino operator Bloomberry Resorts, which debuted in the market in May.

Razon grabs the 3rd spot from John Gokongwei.

Gokongwei falls one place to become 4th richest in the Philippines. The Gokongwei family controls conglomerate JG Summit and budget carrier Cebu Pacific, which has edged out PAL as the biggest player in the lucrative domestic market. The Gokongwei group also sold its stake in Digital Telecoms, which operates aggressive budget brand Sun Cellular to the telco industry leader, Philippine Long Distance Telephone Co (PLDT) in 2011.

Consunji’s business group is behind DMCI Holdings, a construction giant that has added related businesses, including real estate and water, in its portfolio. The group also has a stake in Semirara Mining.

Tan is behind Alliance Global, a conglomerate that controls active real estate player Megaworld, the local franchise of fast food McDonalds, and is among the 4 investors that will build and operate gaming and hotel-tourism facilities at the upcoming Pagcor Entertainment City in Manila.

Ayala was the country’s richest man (according to Forbes) in 2007. His family’s wealth continues to grow on the back of strong real estate, banking, telecommunications, and water businesses. The conglomerate Ayala Corp is joining hands with the group of telco rival-turned partner Manuel Pangilinan to bid for rail projects the government plans to bid out.

Ty is the patriarch behind the business group that controls financial giants, including Metrobank, one of the country’s largest universal banks. It recently listed GT Capital, its holding firm and corporate vehicle to diversify into power, infrastructure, and other potentially high-growth industries.

Ongpin complained why he was included among the richest in the Philippines since, according to him, the funds in some of the companies he is associated with–San Miguel, Petron, and other large local companies–are not his but Ashmore’s, a fund headquartered in London. He said Alphaland, a real estate firm, is where he and his other partners have put in their own.

The Senate is conducting a probe on his firms’ alleged illegally borrowings from a state-owned bank used to buy and sell shares of Philex Mining Corp in 2009. Ongpin denied wrongdoing.

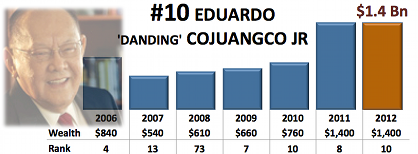

Cojuangco’s personal stake in San Miguel Corp, the country’s biggest conglomerate has been cleared by the courts as not illegally acquired during the Marcos era. He remains chairman of San Miguel, which has been diversifying away from its stable food-and-drinks business and into potentially faster growing but capital-intensive power, infrastructure, telecommunications, mining, and recently, airline, businesses.

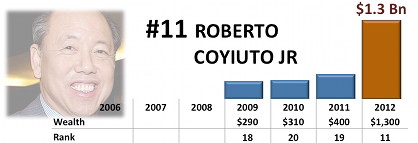

Coyiuto’s wealth grew a massive 225%, the steepest in 2012, noted Forbes. The new billionaire partly owns power transmission monopoly National Grid, as well as insurance firms Prudential Guarantee and First Guarantee Assurance Co. He is president of PGA cars, which locally distribute luxury brands Porsche, Audi and Lamborghini.

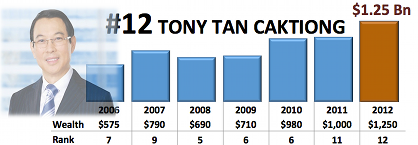

Caktiong’s family founded homegrown food giant, Jollibee Foods Corp, which has been consistently growing through aggressive expansion in the country and abroad, as well through acquisitions. Caktiong was hailed as the World Entrepreneur of the Year in 2004 by Ernst & Young for edging past global giant McDonalds.

While Forbes has estimated his wealth to have been consistently increasing for the past years, he slips to #12 since the others in the list have grown their wealth faster.

This husband-and-wife team is one of the two newcomers in this Forbes list and immediately joined the ranks of billionaires. The Co couple operates hypermarket chain Puregold Price Club, the second largest retail chain next to the Sy family’s SM. Puregold listed in the stock exchange in September 2011.

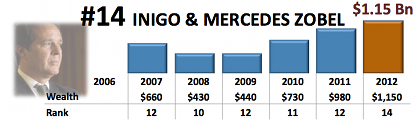

The Zobels inherited stakes in conglomerate Ayala Corp, the country’s oldest conglomerate. Mr. Zobel is also representing Ongpin-led Top Frontier on the board of San Miguel Corp, and was appointed head of the budget unit of Philippine Airlines in April after the conglomerate acquired the legacy carrier from the Lucio Tan group.

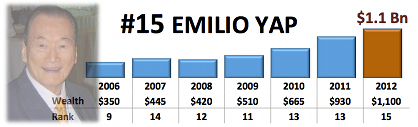

The 86-year-old Yap joins Forbes’ billionaires club for the first time this year. He chairs broadsheet Manila Bulletin and has stakes in Manila Hotel and Centro Escolar University, but Forbes estimates that bulk of his fortune is from Philtrust Bank where he is chair.

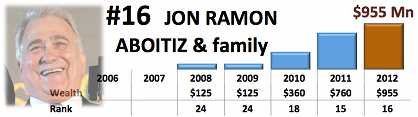

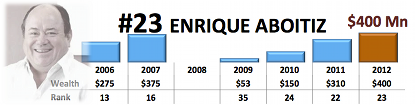

The Aboitizes’ fortune grew consistently through the years while others tumbled and spiked. Jon Ramon chairs conglomerate Aboitiz Equity Ventures, which experienced a whopping 78% jump in 2011 net income, boosted by power (Aboitiz Power) and banking (Unionbank) assets.

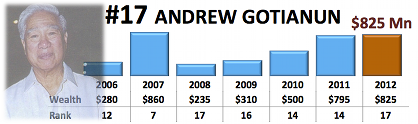

Gotianun founded real estate developer Filinvest Land and also has stakes in biofuel power plants and sugar mills. The family founded Family Bank and Trust Co, which they sold to the Ayala’s Bank of the Philippine Islands in the 1980’s. They later returned to banking when they acquired East West Banking Corp, which raised over P5 billion when it listed in the exchange last May.

The family’s fortune dipped in 2008, when the global financial crisis first erupted. Mr. Gotianun is part of the Cebu-based Go clan and is a cousin of John Gokongwei.

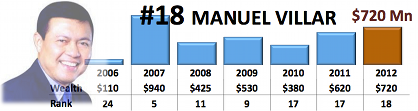

Senator Villar is the richest legislator in the Philippines. After he failed to win the presidential race in 2010, the businessman-turned-politician said his real estate business became a solace. Vertical and horizontal property developer Vista Land & Lifescapes is behind Villar’s rags to riches story. Villar said he watched Henry Sy’s landbanking style closely when he was starting out. Vista Land is currently expanding its portfolio nationwide and plans to enter the retail space, as well as venture out into mining.

She is the widow of Jose Campos of giant local drugmaker Unilab. Forbes noted the family’s stake in Del Monte Pacific, which is listed in the Singapore stock exchange and reported a 70% hike in profits in 2011.

She is president of Mercury Drug Corporation, the country’s decades-long industry leader with its over 500 drugstore and retail outlets nationwide. Her father, Mariano Que, sold pharmacy items out of a pushcart in 1945.

Below are the remaining 10 in the list:

| Wealth in | |||

| 2011 | 2012 | ||

| #31 | Oscar Lopez | $280 |

$245 |

|

Chairman emeritus of Lopez Holdings, which controls media firm ABS-CBN, and also heads power firm First Philippine Holdings Corp. |

|||

| #32 | Felipe Gozon | $163 |

$240 |

|

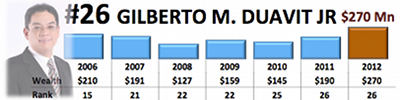

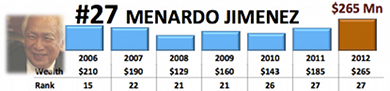

Chairman and CEO of GMA Network Inc, which he runs with Duavit (#26) and Jimenez (#27) |

|||

| #33 |

Betty Ang |

$165 |

$235 |

|

President of Monde Nissin, the maker of biscuits and Lucky Me! instant noodle brand. |

|||

| #34 | Wifred Uytengsu Sr | $150 |

$230 |

|

Sold family’s stake in Alaska Milk to Dutch dairy firm Royal FrieslandCampina last March. He still runs the firm and sits on the board. |

|||

| #35 |

Juliette Romualdez |

$155 |

$200 |

|

Widow of Benjamin “Kokoy” Romualdez, the brother of Imelda Marcos. Has stakes in Benguet Corp and minority shares in Sy-led Banco de Oro. |

|||

| #36 |

Bienvenido R. Tantoco Sr. |

$95 |

$195 |

|

Behind Rustans Group, the leading high-end retail chain and brand network. Sold almost half of supermarket unit to Hong Kong’s Jardine Matheson in May. |

|||

| #37 | Jacinto Ng Sr. | $115 |

$190 |

|

Founder of Rebisco biscuit maker and controls Asia United Bank. Also called “Jack” Ng. |

|||

| #38 | Tomas Alcantara | $160 |

$160 |

|

Controls Alsons Consolidated, which is into power, property, and mining. |

|||

| #39 | Michael Cosiquien | – | $150 |

|

This 38-year-old is a first-timer in the Forbes list. His firm, Megawide Construction had built several SM malls and lists the Gotianuns as clients. It went public in 2011. |

|||

| #40 | Edgar Sia II | $85 |

$140 |

|

The youngest in the list at 35. He sold Mang Inasal to giant Jollibee in 2010. He joined the PBCom board in December 2011. |

|||

– Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.