SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

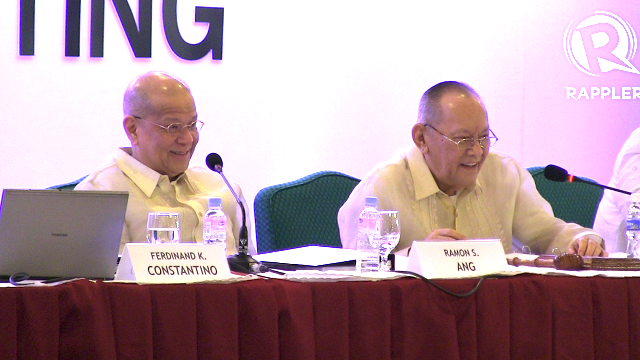

MANILA, Philippines (2nd UPDATE) – San Miguel Corp chairman and CEO Eduardo Cojuangco Jr has turned over control of the company to its president and his trusted ally, Ramon Ang.

San Miguel’s assistant vice president for communications Jane Llanes told Rappler that Cojuangco sold his remaining 14.7% stake in the Philippines’ most diversified conglomerate for P37 billion. An 11% stake was sold to Ang, and 3.7% to San Miguel’s biggest shareholder, Top Frontier.

“There is no other person deserving of this opportunity to control a significant stake in the company that is so close to my heart than Ramon,” the 77-year-old Cojuangco said in a separate statement to media.

“San Miguel has made a distinctive impact because of him and he cares about the company and its people. I am confident he will lead San Miguel to further greatness,” he added.

Ang, whom Cojuangco described as “a trusted friend,” is known to have led San Miguel’s diversification from traditional food and beverage into heavy industries such as energy, telecoms, mining, infrastructure and recently, airlines.

Cojuangco is passing down control, but will retain his posts as chairman and CEO.

“With Ramon at the helm, I now have the luxury of devoting more time to my personal endeavors, though I will continue to oversee and participate in the unending commitments of SMC to make everyday life a celebration, maintain business excellence, further enhance shareholder value, and become a partner in the country’s growth story.”

The move comes two years after Cojuangco won a Supreme Court decision that declared him the rightful owner of his disputed stake in the company.

It formalizes Ang’s control over San Miguel, along with Top Frontier head, former trade minister Roberto Ongpin.

The deal

The transaction consisted of 368.14 million common shares sold to Ang, and 125.23 common shares sold to Top Frontier for P75 per share or a total of P37 billion.

The shares were covered by an “option to purchase” granted Top Frontier when it initially bought shares in San Miguel in 2009. However, Top Frontier decided to only partially exercise that option.

“Mr. Cojuangco offered the balance of the option shares to me and I accepted primarily for the following reasons: the San Miguel vision set by management during my term is far from being achieved, and; I have a continuing commitment to ECJ, the company’s stakeholders and the employees to see through the realization of this vision in the near future,” Ang said.

Top Frontier is now the single biggest voting block in San Miguel, with over 40% stake.

The two companies have interlocking ownership. Top Frontier is owned by San Miguel itself as represented by Ang, and by an investor group that includes Ongpin, his nephew Eric Recto and businessmen Iñigo Zobel and Joselito Campos.

SC decision

Cojuangco’s decision to sell comes two years after he won a Supreme Court decision that favored his claim on some 17% stake in San Miguel.

Cojuangco’s stake was disputed after the government alleged he used coco levy funds to acquire it in the 1980s. Cojuangco, a close ally of the late president Ferdinand Marcos, was the brains behind a Marcos-era system of imposing levy on every copra sold by coconut farmers from 1973 to 1982.

While the battle was waging between Cojuangco and the government, the government won claim over another block of shares in San Miguel, representing 24%, that was also subject of a long-running case connected to the coco levy funds.

In 2010, the Supreme Court allowed the government to convert the said block of shares, which had voting rights, into preferred shares, which did not have voting rights. This decision paved the way for San Miguel to proceed with its plan to diversify.

Cojuangco’s right-hand man

The architect behind San Miguel’s grand diversification is Cojuangco’s right-hand man, Ang.

The two go back a long way.

Ang, who is known for his love of cars, met Cojuangco’s son, Mark, in auto-racing circles back in the 1980s. He eventually met and won the trust of the older Cojuangco, who left him to run his business while in exile a few years after the fall of the Marcos regime.

Fast forward to the 2000s, Ang led the transformation of the 122-year-old San Miguel.

In 2007, he and Cojuangco surprised investors with a radical growth plan: diversify away from the dominant food and brewery business into high-yielding but risky industries.

That year, San Miguel was on a sell-off spree, unloading its holdings in Coca-Cola, Australian dairy and juice producer National Foods and other assets to raise money for expansion.

Credit ratings agencies were skeptic of the plan, with some downgrading their ratings for the company, fearful of its lack of track record in complicated and capital-intensive businesses.

But San Miguel was confident. It started grabbing stakes in power distribution, oil refining, infrastructure, telecommunications and mining. By 2010, San Miguel announced its much-criticized plan was starting to pay off.

From P8.351 billion in 2007, its net profit rose to P24.056 billion in 2010, with revenues reachinng P246 billion. Its oil refining and power units accounted for 61% of the revenues.

San Miguel, which is now also into airlines, sees P1 trillion revenues by 2016. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.