SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Dear Mr Tax Whiz,

I hope you could enlighten me about my current tax situation. It’s really complex but I’m positive that you would know how to deal with it.

Anyway, I started as an independent contractor (freelance writer) in March 2014. Since then, I have had a steady stream of projects. Thus, I decided to formally register as a self-employed individual.

I called the Bureau of Internal Revenue (BIR) Contact Center to find out what revenue district office (RDO) I’m registered at and to request for a transfer as I’m currently living in Naga City.

However, I learned that my tax identification number (TIN) is still on a 1904 status and that my RDO is in Valenzuela where I have never resided. (Confession: As embarrassing as it is to admit, my mom got my TIN card from a fixer. I needed a valid ID to open a bank account after college graduation and that was the most convenient way to get one. I learned my lesson now.)

Before being an online independent contractor, I worked as a consultant in a media network from August 2012 to January 2014. My contract is quite unusual because I, along with other colleagues, was considered only as a “CONTRACTOR” and therefore a self-employed individual.

However, even if we were “CONTRACTORS,” the company deducted 10% income tax from their monthly payment to us.

When the company asked for my TIN, I just gave them the one I had. This was right after college so I had no idea about government processes. I did not know that there is a need to update my status on BIR first. No one from the Human Resources (HR) told me that I had to update anything.

Here are my questions:

- What are the implications of my failure to update my BIR status from 1904 to 1901? How do I change or update my registration?

- Are the deductions made by the media network legal?

Sorry for the lengthy narrative. I really don’t know what to do. I’m hesitant to directly consult the BIR because they might charge me with tax evasion right away.

I would like to resolve these concerns for I know it is my responsibility as a Filipino citizen.

Kimpee (Name withheld)

Hi Kimpee,

Thank you for sharing your experience and questions. Let me answer it as numbered:

1. Failure to update your registration from one-time taxpayer to self-employed individual prevented you for paying the P500 ($11.31) annual registration fee and filing the monthly tax returns.

If you decide to declare all your income from 2012 to 2014, it will be subject to 25% surcharge and 20% annual interest plus compromise penalty.

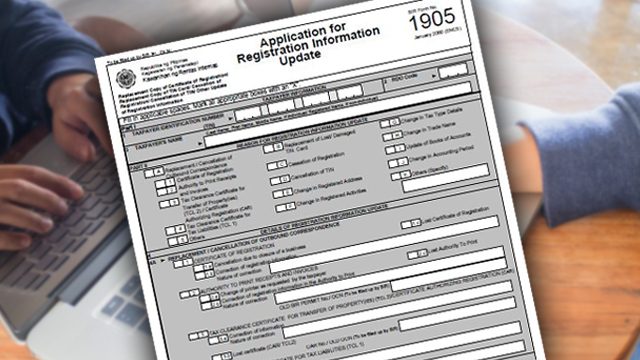

You need to file BIR Form 1905 to update your registration from 1904 (one-time transaction) to 1901 (self-employed) in the RDO of Valenzuela where you got your TIN.

Don’t forget to include the change of address from Valenzuela to Naga City where you will be required to file and pay monthly tax returns.

2. Yes. As a contractor or professional, income payment made to you is subject to 10% expanded withholding tax if your annual gross income does not exceed P720,000 ($16,285.67). Otherwise, it will be subject to 15% expanded withholding tax.

In return, you should be receiving BIR Form 2307 quarterly as a proof of withheld taxes, which can be used as tax credit to reduce your quarterly income tax payment.

Upon registration as self-employed, you will receive BIR Form 2303 or the Certificate of Registration where your tax types and deadlines are provided.

Make sure to comply properly and inquire to your RDO if uncertain as to what you need to do.

Got a question about taxes? #AskTheTaxWhiz! Tweet @rapplerdotcom or email us at business@rappler.com. – Rappler.com

Mon Abrea is a former BIR examiner and an advocate of genuine tax reform. He serves as chief strategy officer of the country’s first social consulting enterprise, the Abrea Consulting Group, which offers strategic finance and tax advisory services to businesses and professionals. Mon’s tax handbook, Got a Question About Taxes? Ask the Tax Whiz! is now available in bookstores nationwide. Follow Mon on Twitter: @askthetaxwhiz or visit his group’s Facebook page. You may also email him at consult@acg.ph.

US$1 = P44.21

Working space with coffee image via Shutterstock

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.