SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Financial analysts from COL Financial Group Inc, formerly CitisecOnline.com Inc, say the Philippine Stock Exchange index (PSEi) could reach 10,000, or nearly twice its current level, within 3.5 to 8 years.

At a press briefing on August 1, COL’s Head of Research April Lee Tan said that likelihood of reaching that target is as follows:

- 40% in 3.5 years

- 50% in 5.5 years

- 10% in 8 years

Their message was clear: now is a good time to invest in the Philippines. Even if the growth “goes back to what people are used to and it takes 8 years… the compounded annual growth for the market would be 8.7% per annum, [meaning] the market would still be better than investing in bonds,” said Tan.

The PSEi closed at 5,298 level on August 1. Year-to-date, the index is already the 2nd best performing index in the world, after only Venezuela, said COL’s head of Customer Service & Sales Juanis G. Barredo.

While Tan acknowledged there is concern that Philippine stocks are more expensive than all their regional neighbors, she said that could be addressed by corrective adjustments in the short-term. She considered brief falling back of stock prices from their peaks an opportunity to buy more stocks.

Growth in the local market is good for Filipinos since the index is regarded as a leading economic indicator. “PSEi means business confidence. If it’s rising, businessmen are confident,” said Conrado F. Bate, President and CEO of COL Financial Philippines.

As the stock market continues to rise, Barredo said more Filipinos will likely eventually feel growth trickle down. “If they don’t feel it directly, they will feel it in the infrastructure,” he said.

The Aquino administration’s big-ticket infrastructure projects lined up under its public-private partnership (PPP) program require private investments and mostly long-term financing schemes, both also considered signs of business confidence in the country.

What’s in PSEi’s favor?

The analysts said long term prospects remain positive for a number of reasons: the resilience of consumer spending, and the government’s ability and willingness to spend as seen in the growing momentum of the infrastructure projects under the PPP scheme.

1. Resilient consumers

With remittances from overseas Filipino workers (OFW) still resilient despite the fiscal-turned-economic crisis of host countries, Tan said consumer spending will most likey remain resilient.

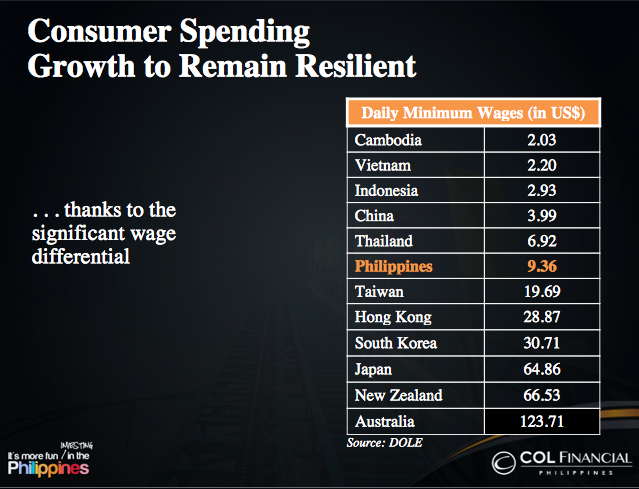

Tan also explained that the robust business process outsourcing (BPO) industry will probably continue employing Filipinos and help boost consumption. She pointed out that the relatively low minimum wage will keep the Philippines competitive in the global bid for outsourced business of companies in the west.

While there are lower wages in neighboring countries, she said, “those cheaper countries are not English-speaking countries so we still have an advantage.”

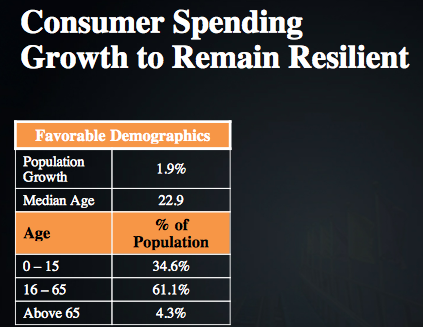

The Philippines’ young population is also expected to boost consumption.

“Another benefit of having a growing working population is you don’t have to shell out a lot of benefits. If you have an aging population there are retirement and health care (costs to contend with),” noted Tan.

2. Money from traditional safe havens

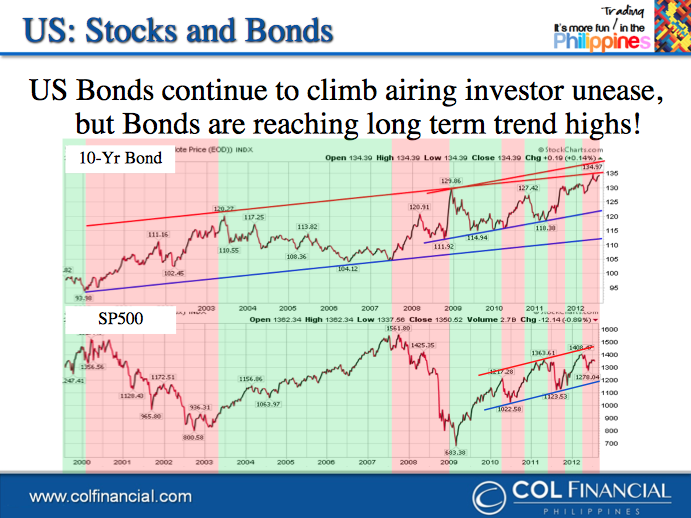

Barredo said the Philippine market could benefit from the saturation of other markets. He explained that bonds are reaching long term trend highs since they are considered not only a safe haven for Americans but also Europeans.

As seen in the graph, increasing investments in bonds are traditionally accompanied by decreasing investments in stocks. Barredo said recently, both are rising. He said if bonds reach saturation level, some of the capital that was going into them could come to the Philippines.

3. Pick-up in PPPs

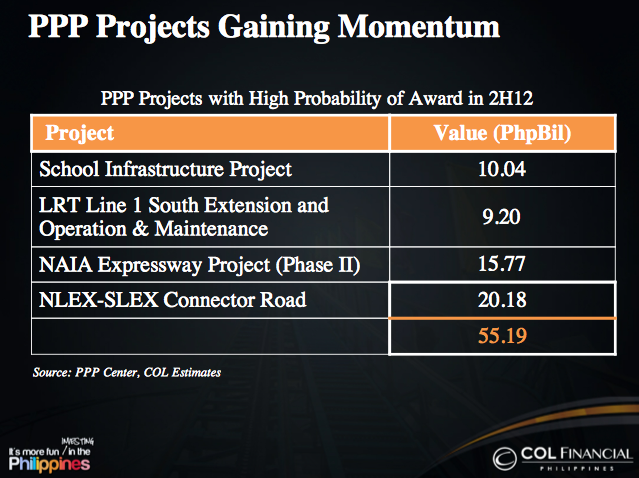

“Last year people were disappointed,” admitted Tan. Only one of the government’s promised infrastructure projects was bidded out in 2011 and she said it did not help boost gross domestic product (GDP).

However, she estimated that P55.19 billion worth of projects could still be bidded out in 2012, which would boost GDP by adding 0.5% in the annual economic growth. She outlined the 4 projects likely to be bidding out in the second half.

By COL Financial’s estimates, another P112.49 billion worth of projects will be awarded in 2013, which would add 1% to GDP.

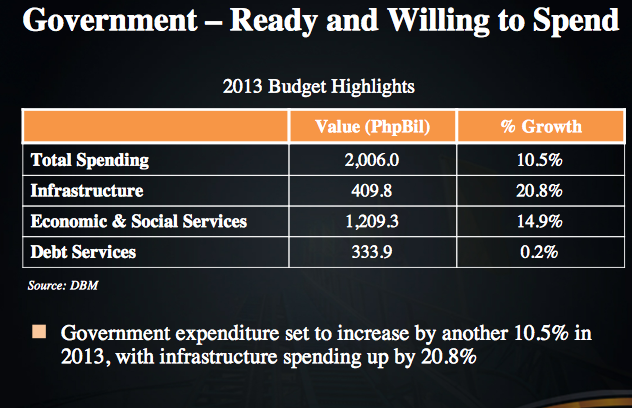

4. Government spending on an upward trend

After the government failed to spend most of its 2011 budget, it has been ramping up budget releases and disbursed 74.9% of the national budget by June 30.

Increased and timely spending is a trend Tan expects to see again in 2013. She said, “The budget is already at the House deliberation level… paving the way for immediate action at the start of 2013.”

5. More room to grow

The analysts believe the local index is still in its early stages compared to neighbors in the region. Tan said the investments-to-GDP Ratio is only 22% compared to Vietnam’s 39%, Thailand’s 26% and Indonesia’s 32%.

“It just means that there is still a lot of investment potential in the country,” she said.

The analysts said a number of sectors were poised for growth, including banking, property, retail and construction.

They said their model portfolio would include stocks in these sectors since they are mainly consumer-oriented.

Two sectors the analysts said won’t likely find their way into a model portfolio are mining companies and telecommunications firms.

Tan said she was not bullish about mining, which was considered a darling last year, since commodity prices have been falling.

Meanwhile, Barredo wasn’t optimistic about telcommunications companies. “We feel like the telcos are [in] a mature industry. Right now they’re… engaging into television and media broadcast. We feel cellphone growth is stagnating unless they can open some new market.”

Given these practical indicators, Tan is fairly certain of market growth. But she also admitted, “We believe it won’t be a smooth ride up due to serious problems prevailing overseas, expensive valuations, and numerous share placements that are sapping liquidity.”

“Nevertheless, investors should stay invested,” she said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.