SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Following corporate governance concerns in the past years, key reforms implemented by the Philippine Stock Exchange (PSE) to boost investor protection are starting to bear fruit.

Regulators are investigating trading in a newly listed firm, whose share price spiked over threefold two weeks after its market debut.

The Securities and Exchange Commission (SEC) confirmed in a text message to reporters that it has launched an investigation into trading in agribusiness firm Calata Corp, which listed its shares on the PSE last May.

“Our people is prioritizing Calata,” said SEC Commissioner Jenny Cueto on Thursday, August 2. She did not divulge details of the investigation, however.

The SEC acted on a report earlier filed by the Capital Markets Integrity Corp (CMIC), which discovered suspicious trades in Calata’s stock.

CMIC is the successor company of a PSE regulatory arm, the Market Regulatory Division (MRD), which was spun off into an independent entity. With CMIC now lies the task of policing the trading activities of brokers and listed companies.

The creation of CMIC is meant to remove perceived conflicts of interest at the exchange, boosting confidence that regulators prioritize the interest of public investors rather than its brokers.

Stock price manipulation

A CMIC report filed with the SEC last month cited suspicious trading of Calata shares by few brokerage firms for clients who were allegedly dummies of an unidentified person, the ABS-CBN News Channel reported.

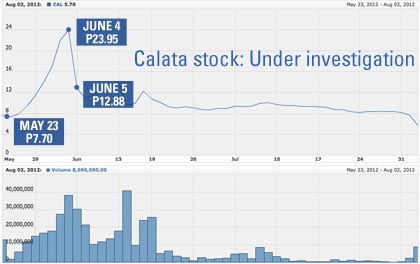

Calata held on May 23 an initial public offering (IPO) of shares for P7.50 apiece. It closed at P7.70 per share the same day. From May 23 until June 4, the company’s shares skyrocketed 219% to P23.95.

On June 5, it dropped by a steep 46% to P12.88, and from then on, traded near its IPO price again.

Baltazar Endriga, a member of Calata’s board, told Rappler in a phone interview they were the ones who asked that the spike in the company’s share price be investigated.

He said they wrote the PSE about it, but did not receive a response.

“Our [chairman and] president, Joseph Calata, was surprised by the behavior of the shares that’s why we requested PSE to look into it,” he said. “We were not informed that a probe was launched. We have not been informed of anything.”

PSE President Hans Sicat said, meanwhile, that the exchange is not involved in the investigation and “the ball is now in the hands of the SEC.”

CMIC and other PSE reforms

The PSE, through MRD, used to handle cases like this. But due to reforms the new board and management of the exchange implemented, this task was turned over to a separate regulatory body — CMIC — to eliminate conflicts of interest.

CMIC is an independent company with a self-regulatory organization status. Unlike MRD, it is under the direct supervision of the SEC, not the PSE.

Two to three years ago, corporate governance concerns were raised against the PSE after it was hit by an exodus of officials, many of whom belonged to divisions with regulatory functions.

The resignations came after PSE’s management got into disputes with its board of directors, some of whom were market brokers.

The disputes sprung up as moves of the regulatory units to penalize brokers and listed companies didn’t sit well with directors affiliated with the erring parties.

The board-management disputes raised the question as to whether the PSE could police its own ranks as part of its highest mandate to protect public investors.

In a bid to address the concerns, the PSE implemented a number of reforms.

The spin-off of the MRD was in the to-do list as well as the acquisition of a new system that would increase surveillance of trades in the market. The introduction of a trading board for companies with good corporate governance ratings was also being eyed.

Analysts said adherence to strict corporate governance standards is key to further boosting investments in the stock market. The PSE index has been considered one of the best performing markets in the world this year, largely due to the eastward flow of foreign funds from markets in the west, which are facing fiscal-turned-economic crisis.

Nonetheless, concerns about the ability of the small Philippine market to erase doubts it can keep trades honest and police its ranks linger among bigger fund managers.

Whatever happens in the Calata probe, which was already keeping CMIC busy just months after its incorporation in March, will be closely watched. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.