SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Philippine central bank hiked interest rates weeks ahead of its policy meeting, a day after the United States reported inflation reaching a four-decade high.

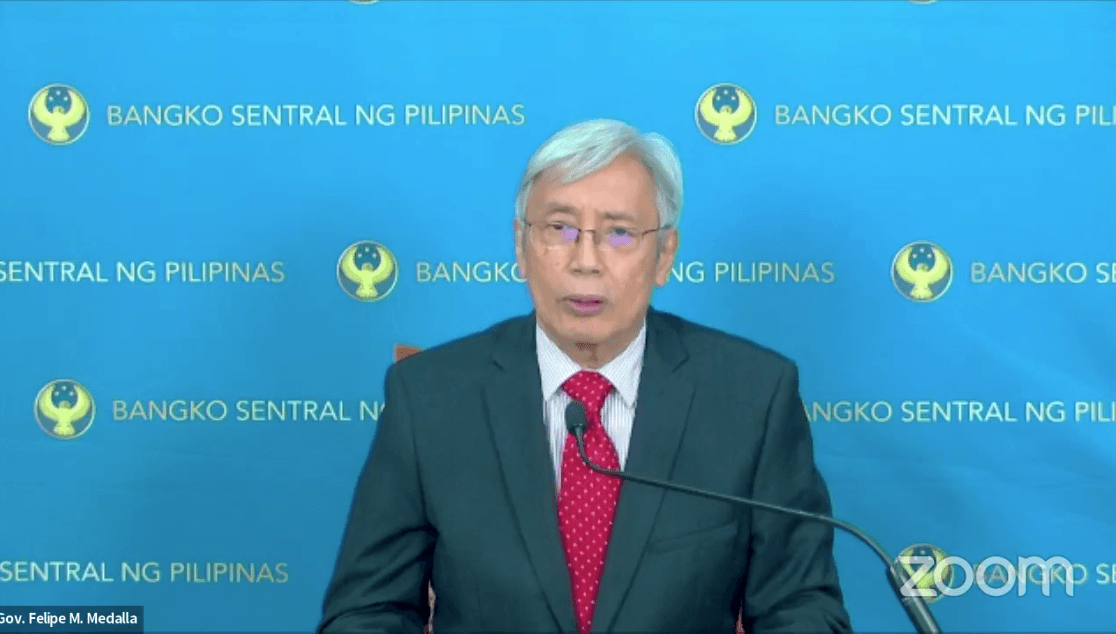

On Thursday, July 14, Bangko Sentral ng Pilipinas (BSP) Governor Felipe Medalla announced an off-cycle interest rate hike of 75 basis points, bringing the key policy rate to 3.25%.

The overnight deposit facility and overnight lending facility were also increased to 2.75% and 3.75%, respectively.

The new rates were immediately imposed on Thursday.

The announcement came as inflation in the US jumped to 9.1% in June, the highest since November 1981.

In the Philippines, inflation went up to 6.1% in June.

“In raising the policy interest rate anew, the Monetary Board recognized that a significant further tightening of monetary policy was warranted by signs of sustained and broadening price pressures amid the ongoing normalization of monetary policy settings,” Medalla said.

He added that the “strong rebound” of the Philippine economy in 2022 suggests that it can accommodate higher interest rates.

“By taking urgent action, the Monetary Board aims to anchor inflation expectations further and temper mounting risks to the inflation outlook. In particular, policy action is intended to help manage spillovers from other countries that could potentially disanchor inflation expectations,” Medalla said.

Earlier, analysts were worried that the BSP would remain dovish amid rising costs, as it only hiked rates by 25 basis points last June.

Interest rates explained

The BSP determining interest rates is the heart of monetary policy. It is the central bank’s main tool for keeping prices in check or slowing down inflation.

Interest rates influence consumer and business spending. They have an impact on cost of borrowing as well as return on savings.

Higher interest rates mean higher bank loan costs, and consumers must cut back on spending. (READ: PRICE WATCH 2022: Food, fuel products in the Philippines)

High interest rates also encourage more people to save because they receive more on their savings. But demand falls and companies sell less.

Meanwhile, low interest rates over a long period can cause inflation. Prolonged period of low interest rates encourages financial institutions to lend more. – Rappler.com

Add a comment

How does this make you feel?

![[In This Economy] A counter-rejoinder in the economic charter change debate](https://www.rappler.com/tachyon/2024/04/TL-counter-rejoinder-apr-20-2024.jpg?resize=257%2C257&crop=267px%2C0px%2C720px%2C720px)

![[Vantage Point] Joey Salceda says 8% GDP growth attainable](https://www.rappler.com/tachyon/2024/04/tl-salceda-gdp-growth-04192024.jpg?resize=257%2C257&crop_strategy=attention)

![[ANALYSIS] A new advocacy in race to financial literacy](https://www.rappler.com/tachyon/2024/04/advocacy-race-financial-literacy-April-19-2024.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.