SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines — The Philippines is likely to have a “new normal” of economic growth slower than the pace that made the country Asia’s economic star in the past years, a global markets veteran said.

“In my own view, we are entering a new normal in GDP (gross domestic product) growth. A 6% to 7% GDP is on the high side. What is more realistic for the Philippines at this stage is 5% to 6% GDP growth. That would be the new normal of the Philippines,” Bank of the Philippine Islands (BPI) Securities Corporation CEO and Managing Director Michaelangelo Oyson said in a media roundtable on Wednesday, September 9.

Last year, the Philippine economy grew to 6.1% or P12.63 trillion ($286.20 trillion) – below the government target of 6.5% to 7.5%, and lower than the record-high 7.2% growth in 2013.

This year, BPI Securities’ Oyson expects GDP growth to further slowdown at 5% to 6%, which is far from the government’s initial 2015 economic growth target of 7% to 8%. (READ: Second half will be better – economists)

“The GDP can only grow to 6% if the government spends a lot of money; but so far, we have yet to see that,” Oyson said, who also gave a timely report and assessment of the Philippine banking sector before the onset of the 1997 Asian Financial Crisis.

GDP, which measures the amount of final goods and services produced in a country, rose 5.6% last quarter, way below the 6.7% recorded the past year.

Public spending on infrastructure totaled some P81.8 billion ($1.75 billion) in the second quarter, 37.3% more than 2014’s P59.6 billion ($1.28 billion).

Household consumption continued to anchor growth, accelerating to 6.2% last quarter from 5.7% the past year.

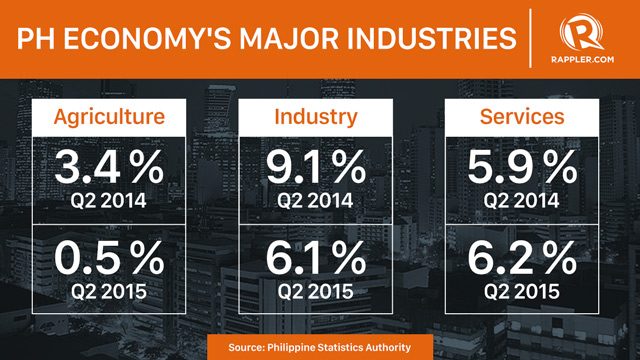

However, some of the major industries were weaker in the second quarter this year than the same period in 2014.

Tempering growth in the second quarter was agriculture, hunting, forestry and fishing, which contracted by 0.5% year-on-year.

The industries and services also reported a slower growth in the second quarter this year than the past year.

PSE index could hit 6,600-7,200

Meanwhile, the Philippine Stock Exchange index (PSEi) — a direct barometer of the economy’s fundamentals — could rise to anywhere from 6,600 to 7,200 this year if US Federal Reserve chair Janet Yellen does not raise interest rates in its meeting on September 16 to September 17, Oyson said.

“Once Yellen starts raising rates, eventually the market will settle and the fair value of the market will probably be around 7,600 moving towards 8,200 next year,” the head of BPI Securities said.

The local stock market, according to Oyson, is “not yet out of the woods.”

“This is partly because other markets have not been stabilized in terms of their valuations,” he added.

The Philippines, according to Oyson, appears to be more expensive than the valuations of other countries in the region.

“Global funds look at relative valuations in terms of looking at the markets. Our stock market cannot continue to trade with high valuations without preference to other markets such as Indonesia, Thailand and even Malaysia,” he explained.

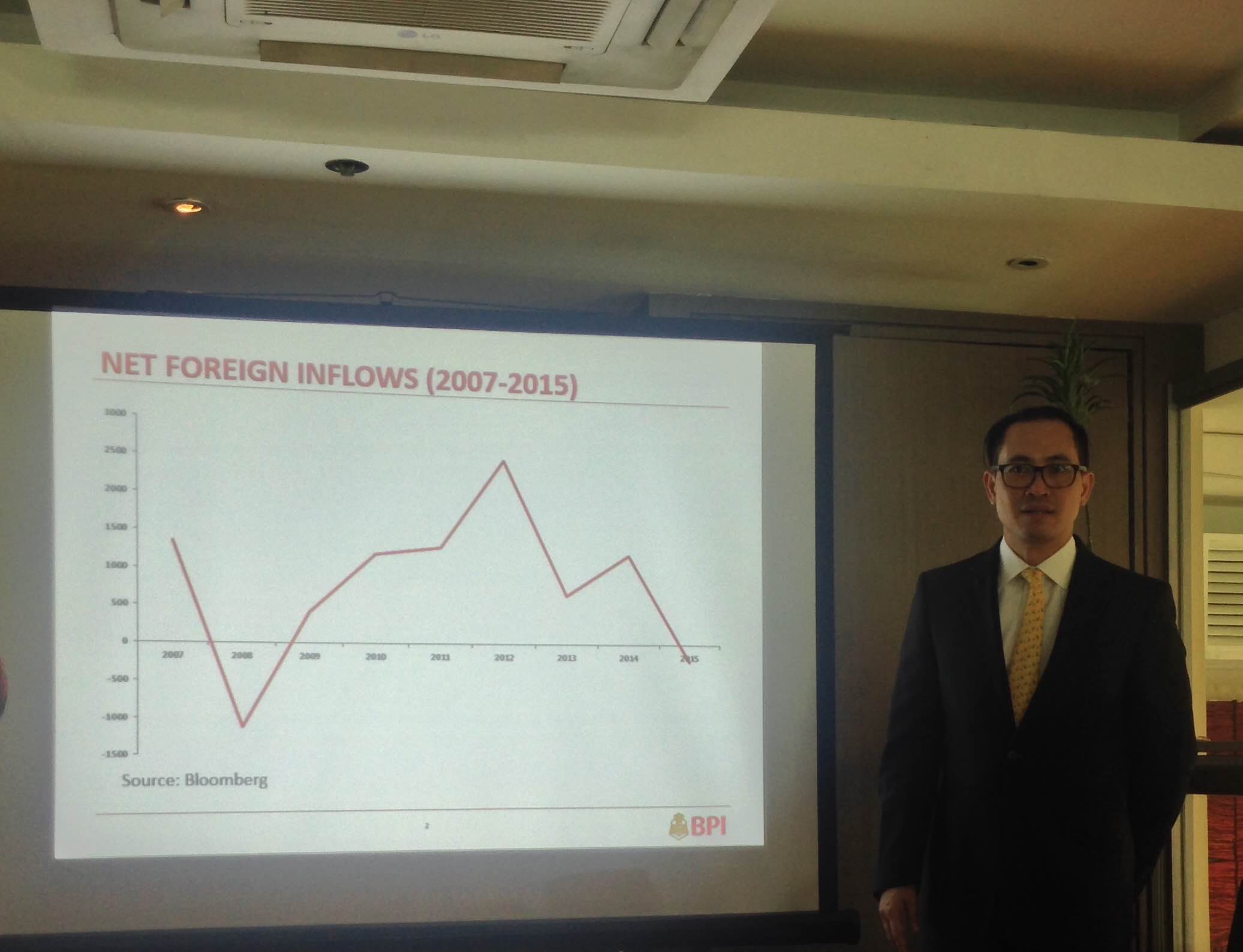

The Philippines, according to Oyson, is still depedent on the “macro overhang” of international developments such as the US Federal Reserve interest rate hike and the slowdown in China.

“[The situation] of the global financial crisis in 2008 and probably, some resemblance on what happened in May 2013. The key message is we are not yet out of the woods in terms of the stock market. We will yet to see the the guidance from Yellen. And second, we have to have a clear understanding on how deep the problem is in China,” he said.

“Until there’s clarity of the US interest rates, the Philippine peso can shoot up to P47 ($1.001) a dollar,” he added.

The BPI chief cited that big consumer names will be the best bet for the next 4 to 5 years, saying the economy is still “very much a consumption-driven economy so companies that are exposed to the consumer sector will continue to do very well.”

This, however, does not mean the economic growth is synonymous with stock market growth.

Oyson explained that the stock market feeds off from investor sentiment on the pace of the economy, rather than a direct correlation of GDP and equities.

In terms of sectors, consumer stocks under services and power are in for a positive stride. The sectors seen to underperform, on the other hand, are banking and gaming sectors while property and holding firms sectors are viewed neutral.

Oyson cited 5 stock picks that investors should buy: Semirara Mining and Power Corporation, Manila Electric Company, Century Pacific Food Incorporated, Max’s Group Incorporated, and Ayala Land Incorporated. — Rappler.com

$1=P46.93

Add a comment

How does this make you feel?

![[ANALYSIS] A new advocacy in race to financial literacy](https://www.rappler.com/tachyon/2024/04/advocacy-race-financial-literacy-April-19-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[In This Economy] Can the PH become an upper-middle income country within this lifetime?](https://www.rappler.com/tachyon/2024/04/tl-ph-upper-income-country-04052024.jpg?resize=257%2C257&crop=295px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.