SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Economic growth is now reaching the country’s poor and if the current trend is sustained, “then poverty can be eliminated within a generation,” said the World Bank’s lead economist for poverty reduction and economic management in the Philippines.

Speaking at the 3rd Manila Times Business Forum on Tuesday, February 23, Rogier van den Brink noted that recent economic gains finally reached the bottom 40% in the past 3 years.

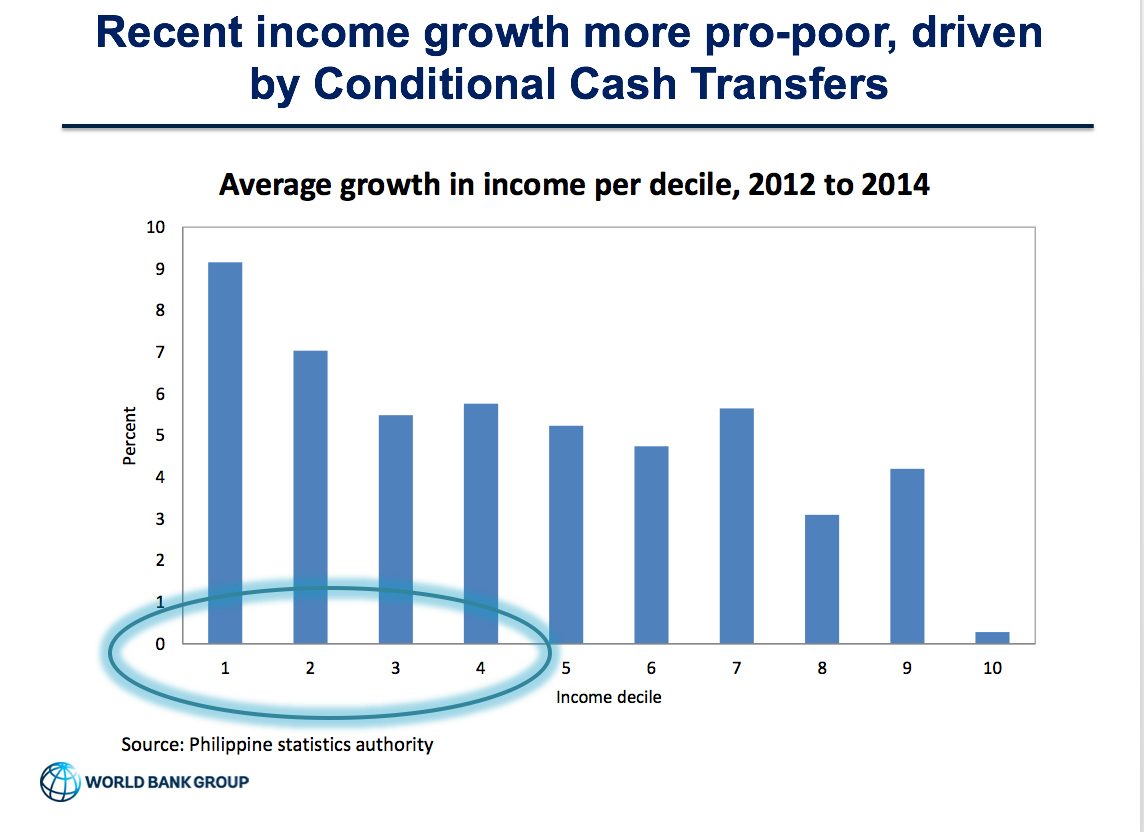

“If we look at the average scores in income per decile [10%] from 2012 to 2014, we see that the poor, their income has been growing faster than that of the richer deciles. That’s good news,” he said. “Now, arguably, this is a recent phenomenon and this would have to be sustained.”

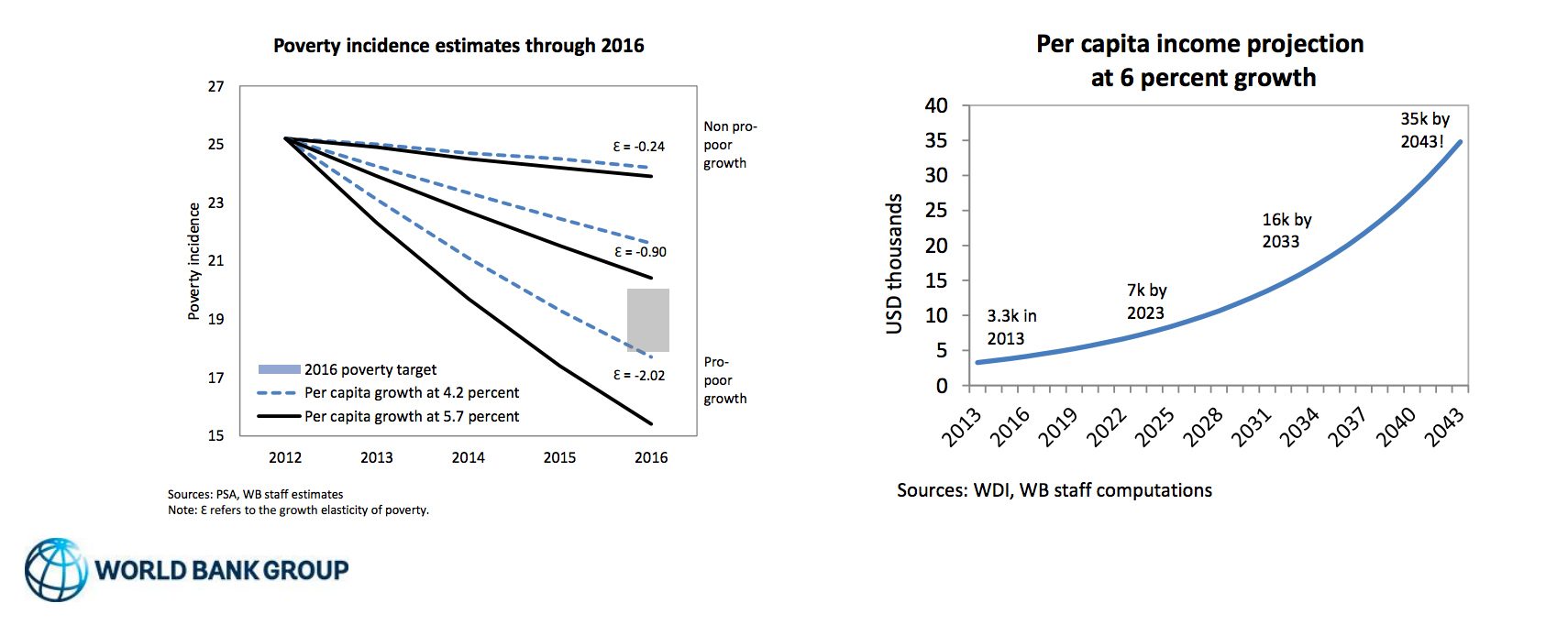

Despite the impact of Super Typhoon Yolanda (Haiyan) and high rice prices, poverty fell by 2.1 percentage points from 2012 to 2014.

Van den Brink credits the Conditional Cash Transfer (CCT) program for driving this, saying that the program is “now the biggest in the world and is very effectively targeted.”

He did point out, however, that these are early signs, and a very small sample which doesn’t make for a rule.

But if this recent trend is sustained, the prospects are bright.

If income continues to reach the bottom of the pyramid then sustaining GDP growth of 6% per year is enough to double per capita income within a decade, raise it by 5 times in two decades, and by 11 times in 3 decades, he said.

Economic base

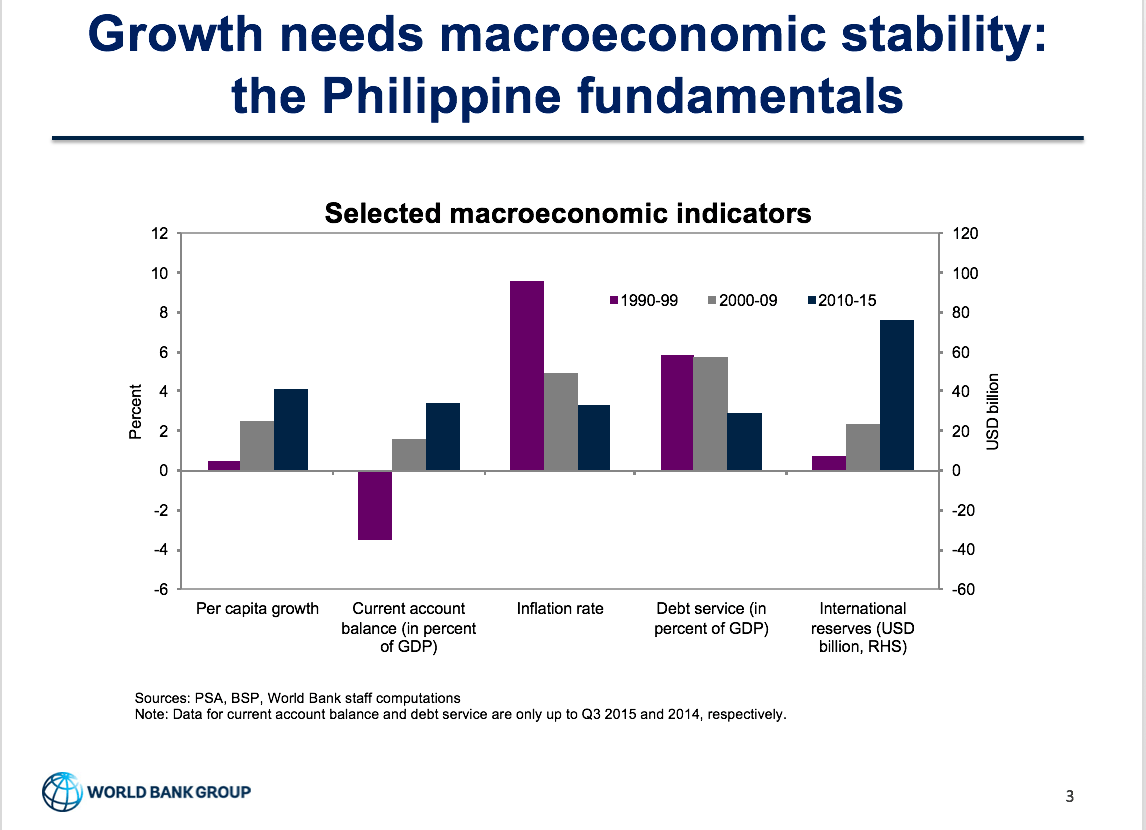

To sustain this new trend, two crucial things need to happen.

First, overall economic growth must be sustained. For this, Van den Brink pointed out that current conditions are ideal.

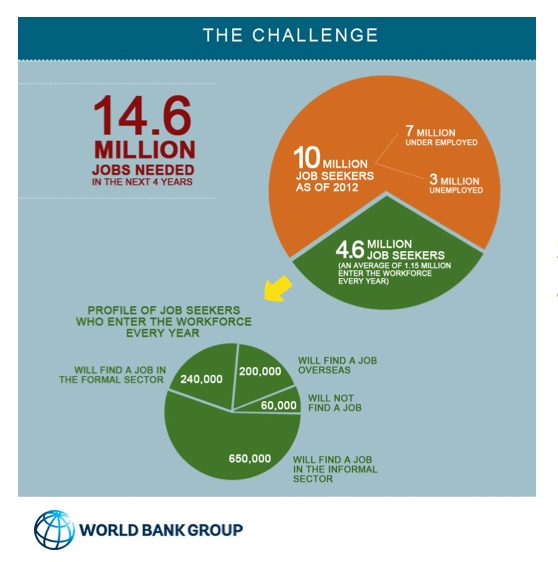

Second, the economic growth must be channeled more effectively towards the poor – making it inclusive. This, however, is a “perennial challenge” for the country, according to Van den Brink.

“In a nutshell, the inclusive growth challenge is a jobs challenge. It explains why poverty has only slowly been reduced, although current trends, both on job creation and poverty reduction, are hopeful,” he said.

Van den Brink, an agricultural economist, supports the structural reform model of growing agriculture, then shifting to manufacturing and services. This model has been followed by many Asian nations, most famously China.

Assessing the Philippines’ development, he noted that a long history of policy distortions has led to incomplete structural transformation.

Growth in agriculture has been slow. Manufacturing never really took off. These forced many to earn a living in a low-productivity, low-wage skill services sector, Van den Brink explained.

That services sector, mostly informal, has now emerged as the dominant sector of the economy.

Focus on agricultural sector

Elaborating on the benefits of boosting agriculture, Van den Brink said that “GDP economic growth that originates in agriculture benefits the poor more than growth emanating from any other sector.”

Boosting farmers’ productivity and raising their income are crucial as most of the Philippines’ poorest are in rural areas. The effects also multiply.

“Once farmers have some money in their pockets, they typically spend it locally, and that produces a stimulus to the local economy. Highly productive farmers lower food prices that makes the consumption basket, especially of the poor, cheaper, and that benefits many, many people,” Van den Brink explained.

He added that poor Filipinos spend 41.5% for food consumption on average, leaving little else for forward-looking investments like education and entrepreneurial activities.

For instance, World Bank data show that as of January 2015, Filipinos pay P35 for one kilogram of rice. Thai and Vietnamese consumers, in contrast, are paying the equivalent of P15.

As a short-term fix, Van den Brink recommends removing quantitative rice import restrictions and stepping up efforts to monitor rice prices throughout the country. Over the long term, this should be followed by strong investment in agricultural productivity and infrastructure.

Focus on entrepreneurship

Small to medium enterprises (SMEs) are also important throughout the process of reform as they are the main source of job creation.

The problem is that the business environment for SMEs in the country isn’t as friendly as it should be.

Van den Brink pointed out that despite recent improvements, even just starting a business is a clear obstacle that entrepreneurs have to face.

Once set up, another problem is the lack of financing available for entrepreneurs to expand, said Alexander Cabrera, chairman and senior partner of PricewaterhouseCoopers Philippines.

Cabrera recommends creating a separate tax regime with much lower taxes for SMEs to give them room to grow, noting that the “eternal problem for local SMEs is that all resources go for operations, leaving nothing for taxes.”

“Since most of them are underground, we should have a separate system,” he emphasized.

Addressing the investment deficit

Although there have been gains, investments in key areas for development like education, health, and infrastructure are still insufficient, said Van den Brink.

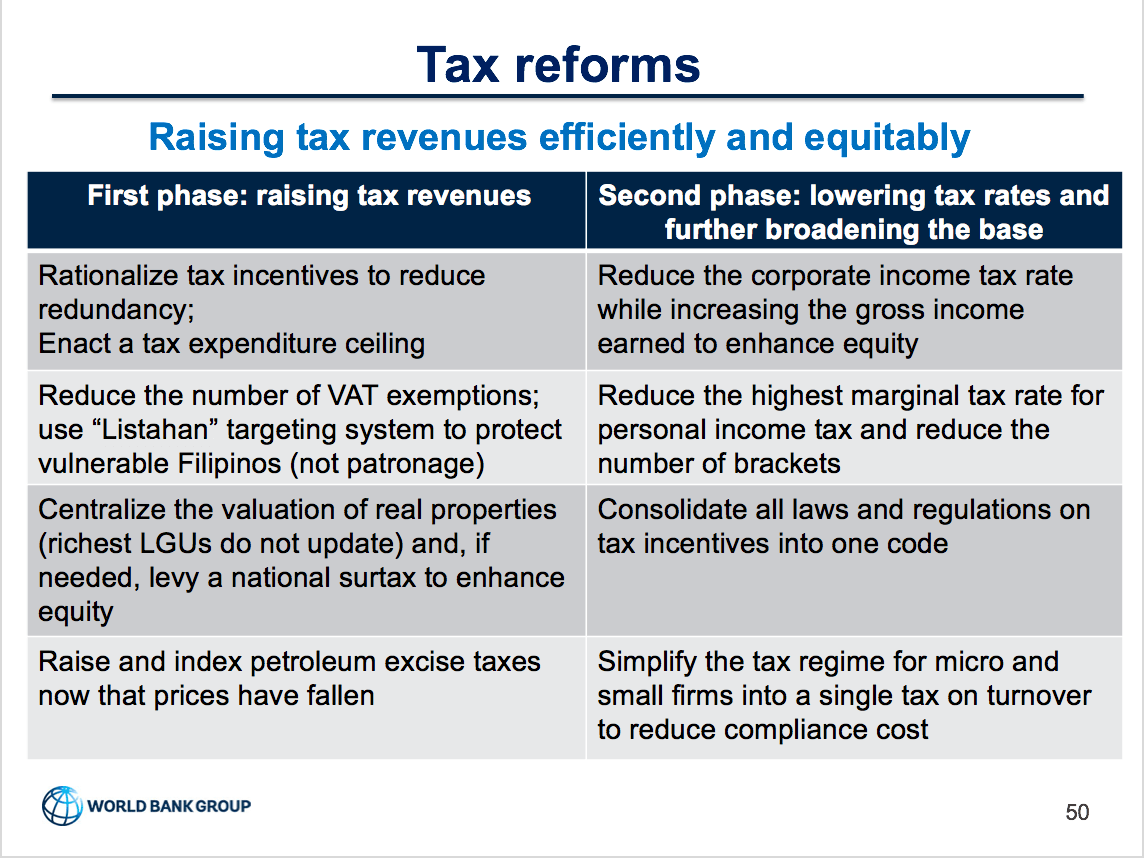

The key is strengthening the national budget through reforms to the tax system, which features a high rate of corporate tax but low collections.

Instituting these reforms will be hard given the strength of vested interests in the country, Van den Brink said.

He noted that sin tax, which would be “politically easy to sell” in theory since it targets vices, only passed by one vote, but it turned out well for the country.

Similarly, he credited the law that broke up the telecommunications monopoly for laying the groundwork for the country’s vibrant BPO industry.

“These reforms, tax or otherwise, may be hard, but in the end it involves people trading off pros and cons in the short run, to make everybody better off in the long run,” Van den Brink said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.