SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Major credit rating agency Moody’s Investor Service said that the Permanent Court of Arbitration (PCA) ruling in favor of the Philippines against China won’t immediately affect either country’s credit rating.

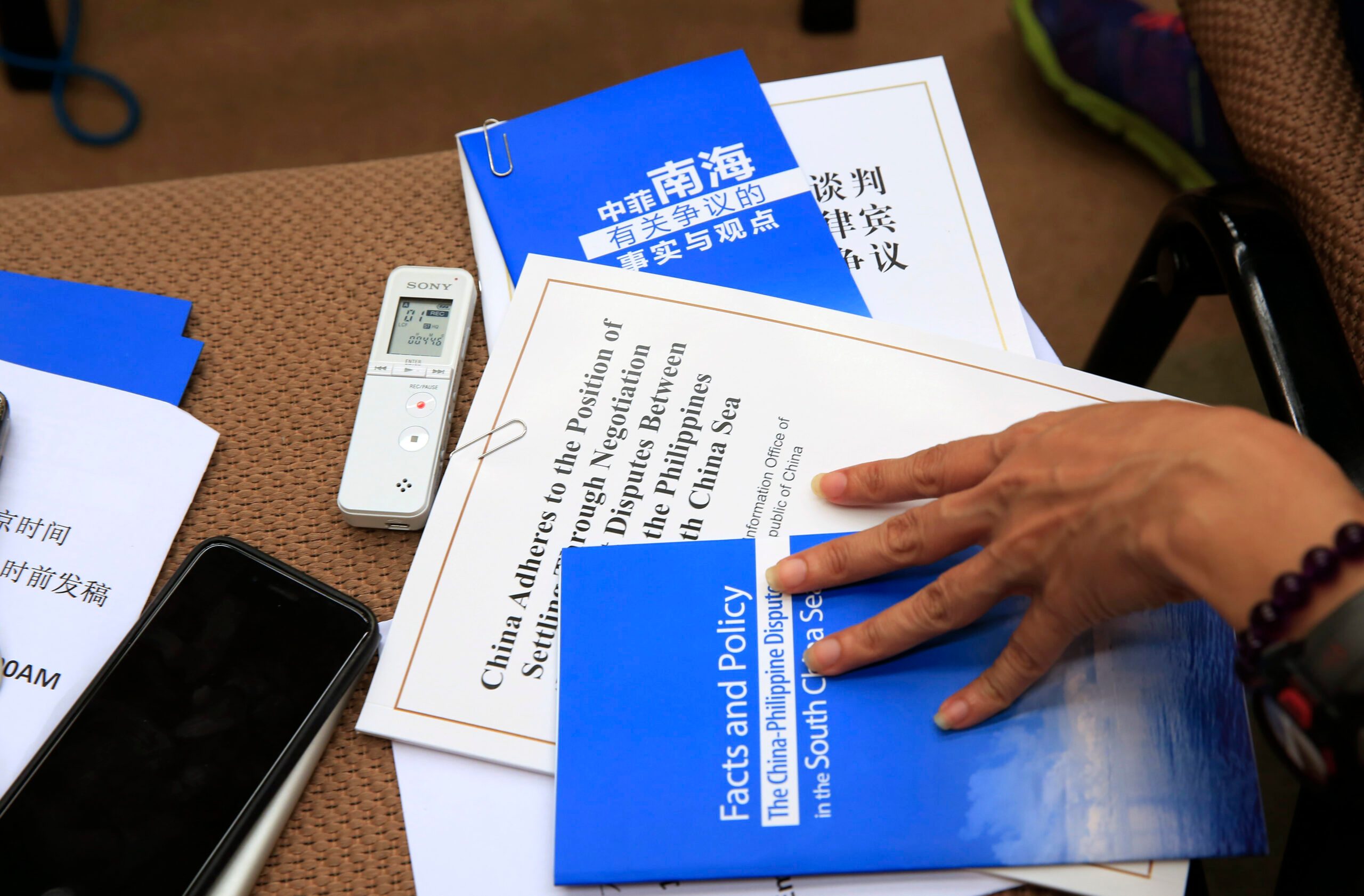

This is despite increased geopolitical tensions in the region following the finding by the United Nations-backed tribunal that China’s so-called 9-dash line in the South China Sea (West Philippine Sea) is baseless.

“The PCA ruling does not change this assessment because we do not expect the ruling to substantially affect either country’s economy, budget, or policy effectiveness,” said Moody’s senior vice president Marie Diron on Wednesday, July 13.

“This expectation is underpinned by our baseline assumption that there may be actions or statements that stoke strains temporarily but these will not lead to a marked and protracted escalation of tensions,” she added.

Moody’s retained its Baa2 rating – a notch above the minimum investment grade – with a stable outlook for the Philippines last year.

Diron explained that “geopolitical tensions could affect countries’ credit profiles if they are likely to have a negative economic impact or if they entail significant fiscal costs or if they hamper policymaking.”

She added: “Nonetheless, the dispute does highlight emerging geopolitical issues for the two countries and for the region as a whole. Per our sovereign methodology, we assess geopolitical strains as posing a very low risk of weighing on sovereign credit trends in China or the Philippines.”

Eyes on the US Fed and Japan

For his part, Bangko Sentral ng Pilipinas (BSP) Governor Amando Tetangco Jr said the debate over the US rate hike and Japan’s stimulus program may have greater effects on financial markets.

The stock market saw slight gains on Wednesday, with the Philippine Stock Exchange index (PSEi) closing at 7,994.02. It had breached the 8,000 mark earlier in the day.

The peso also saw slight gains, closing stronger against the dollar at P47.21 to $1 from Tuesday’s P47.32 to $1.

“We haven’t actually seen an impact so far. I guess what the market would be looking at is how China is going to react to the decision. The market is reacting to developments elsewhere, basically from the US and Japan,” Tetangco said.

Japanese Prime Minister Shinzo Abe has drawn up a new round of fiscal stimulus spending after winning the elections over the weekend.

Tetangco also pointed out that the US Federal Reserve “is now seen as not really in a hurry to tighten and may actually increase interest rates towards the latter part of the year once.”

“Remember, at the beginning of the year, the expectation was 4 increases,” he added. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.