SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (4th UPDATE) – The Philippines won its first ever investment grade debt rating from global credit rating firm Fitch.

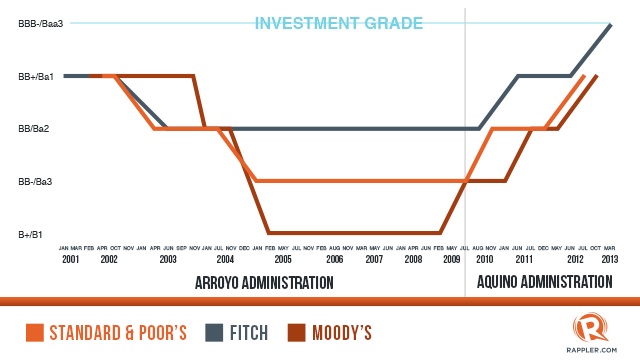

By upgrading the Philippines’ sovereign credit rating to BBB- from BB+, Fitch gives the country a vote of confidence, and marks the first time the Philippines, once a basket case in Asia, joins the A-lister countries considered safe to invest in.

The Philippines follows in the footsteps of Indonesia, which secured investment-grade status in January 2012 with upgrades by Fitch Ratings and Moody’s Investor Service.

In a statement on Wednesday, March 27, Fitch added a stable outlook and cited a robust economy and improved fiscal management.

“The Philippine economy has been resilient, expanding 6.6% in 2012 amid a weak global economic backdrop. Strong domestic demand drove this outturn,” Fitch said.

Fitch was the first among the other international credit rating firms — Standard & Poor’s (S&P) and Moody’s Investors Service — that granted the Philippines a long-awaited investment grade. S&P and Moody’s still rate the country one notch below investment grade. S&P currently rates the Philippines a BB+ market, while Moody’s gave it a Ba1.

“This is an institutional affirmation of our sound good governance agenda,” President Benigno Aquino III said in a statement. He also called this “a national pride.” (READ: Aquino admin downplays Arroyo role in investment grade)

“The task now is to ensure that the investments will be used to empower the economy.” he added.

Finance Secretary Cesar Purisima, who has been leading the efforts toward a credit rating upgrade, called Fitch’s decision “a landmark achievement.”

“This is the clearest and most definite affirmation that good governance is indeed good economics,” he said in a statment.

What a credit rating means

An investment grade is a seal of good housekeeping. It tells investors it is safe to do business in the country, and encourages them to put huge capital here.

An investment grade means the Philippines, as a borrowing country, has a strong ability to pay its debt. This lowers its borrowing costs, generating savings, which may be spent for social services. For Filipinos, it means better education and health care, and affordable loans for major purchases.

View: INFOGRAPHIC: What a credit rating upgrade means for Filipinos

What led to the upgrade?

In summary, these are the reasons Fitch granted the Philippines an upgrade:

- RESILIENT REMITTANCES. Remittances, which account for 8% of the Philippine economy in 2012, stayed resilient despite the global financial crisis. The inflows from overseas Filipino workers (OFWs), which grew 6.4% to US$23.8 billion in 2012, supported a strong net external creditor position, which accounted for 12% of GDP in 2012. This means there are more dollars flowing into the country than those being paid out (like payment for imports).

- RESILIENT ECONOMY. The 6.6% growth rate in 2012 made the Philippines stand out amid the struggling economies of rich countries in the west. “The Philippines has experienced stronger and less volatile growth than its ‘BBB’ peers over the past five years,” Fitch said.

- FISCAL PRUDENCE. Fitch cited the improvements in the fiscal management during the administration of former President Gloria Macapagal Arroyo. These reforms, which included the passing of the VAT reform law in 2005, “have made general government debt dynamics more resilient to shocks.” Fitch noted that under President Benigno Aquino III, the government ably managed the country’s foreign debts, which has fallen to 47% of total government borrowings, from 53% at end-2008.

- PRUDENT MONETARY STRATEGY. Fitch has cited the Bangko Sentral ng Pilipinas’ (BSP) inflation management track record and proactive use of monetary tolls to support the economic growth.

- GOOD GOVERNANCE. Fitch noted that governance reforms, which have been a centrepiece of the Aquino administration’s policy efforts, must remain a priority of the Aquino government and institutionalize these beyond 2016. Fitch also said that the Philippines’ good governance scores based on standards of international groups like the World Bank “remain weaker than ‘BBB’ range norms but are not inconsistent with a ‘BBB-‘ rating as a number of sovereigns in this rating category fare worse than the Philippines.”

More upgrades coming?

BDO Capital chief market strategist Jonathan Ravelas told Rappler that upgrades from Moody’s and S&P’s are key to sealing this vote of confidence.

“We need another credit rating agency to give us an investment grade to really be considered of the upgrade.”

Economist Victor Abola echoed this. “I will not be surprised that the other two (Moody’s & S&P) will give their own upgrades this semester,” he told Rappler.

“The credit rating upgrade of Fitch is an indication of the reflection of what the market is already doing,” he added.

On Wednesday, the Philippine Stock Exchange main index rallied to a new high, closing at 6,847.47 points, up 182.35 points or 2.74%. This marks the 24th time this 2013 that the PSEi hit a record high.

“It’s primarily considered a gold standard in the financial community and…would unleash and allow some funds that only invest in stock and countries to invest in Philippines stocks,” John Forbes, president of the American Chamber of Commerce of the Philippines, told Rappler.

Industry boost, peso impact

Aside from the capital markets, other industries expected to get a boost from the investment rating upgrade include the property market.

“This is a great news particularly for the property market and especially since there have been a lot of foreign investors looking into the market. This tells foreign investors it’s about time to invest in the Philippines,” Karlo Pobre, research analyst at Colliers International, told Rappler. (READ: ‘Hot’ PH attracts multinationals)

“There is more opportunity in the commercial or industrial sector since the residential sector is already slightly competitive. There should be increased expansion from BPO’s (business process outsourcing) and there may be more financial insitutions coming in to set up office,” he added.

Lylah Fronda, associate director market of property consultant Jones Lang Lasalle, echoed this: “The upgrade will encourage more businesses to expand and relocate to the Philippines. If last year’s total office space take up was around 400,000sqm, we are expecting a better performance this year — probably 20% more.”

“With a lot of job opportunities that will come available and possibly significant growth in expat community we see more demand in luxury destinations and leisure properties. Manila will continue to be a favorite among real estate investors and developers as a good alternative market in Asia,” she added.

The upgrade, however, may further result in a stronger peso, which does not bode well for dollar earners, including overseas Filipino workers to send money home, as well as exporters and BPO firms.

“It’s good in a sense that it gives confidence of the investors to come. However the effect of that is the peso appreciation, which affect the cost efficiency of the third party and ones who are outsource. The BPO industries are already suffering from that.” Fronda noted.

Trickle effect?

Making the rest of the Filipinos, especially those who consider themselves poor, benefit from these investments remain a challenge.

“[The investment grade] has relatively little to do with the specifics of actual investment in direct job investing activities such as agro business, mining, or manufacturing. Those investors are concerned with the actual cost of investment, quality of infrastructure and labor issues,” Forbes noted.

“Prudent measures to attract investment, improve the business climate and diversify the economy have paved the way for growth. Now it’s up to the authorities to make that growth more inclusive by creating more and better jobs,” Norio Usui, Country Economist at the Asian Development Bank (ADB), said in a statement.

“This rating is unprecedented in the Philippines and can trigger the kind of investment that will help carry the country into its next phase of development,” he added. (READ: PH needs ‘judo economics’ to further grow)

BSP governor Amando Tetangco echoed this: “The upgrade to investment grade status should inspire the entire government bureaucracy and the Filipino people to capitalize on the opportunities that will arise from this positive credit rating action.”

“We should continue to work together not only to achieve higher credit ratings but also to ensure that the gains from these benefit most of our people,” he stressed. – with reports from Lala Rimando, Cai Ordinario, Lean Santos and Aya Lowe/Rappler.com

Fitch Rating headquarters image via Shutterstock/Gary Yim

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.