SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

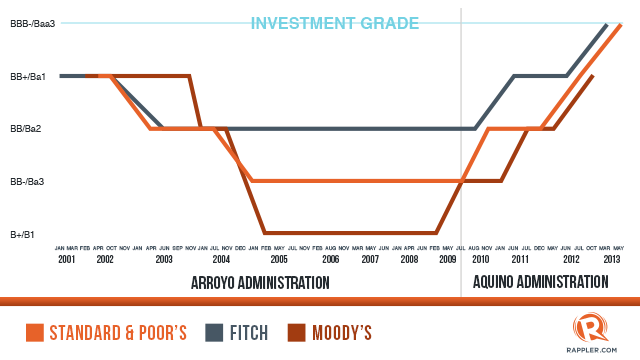

MANILA, Philippines (4th UPDATE) – The Philippines won its second investment grade, this time from international credit rating firm Standard & Poors.

Seen as another vote of confidence in the country, S&P upgraded the Philippines’ credit rating to BBB- on Thursday, May 2, from BB+. The outlook is stable.

“The upgrade on the Philippines reflects a strengthening external profile, moderating inflation, and the government’s declining reliance on foreign currency debt,” said S&P’s credit analyst Agost Benard.

This was the second investment grade rating for the Philippines in less than two months.

Malacañang hailed the news. “We welcome the upgrade,” it said in a statement, citing this as “the latest institutional affirmation of the Aquino administration’s good governance initiatives” as well as another indication of “sustained confidence in the Philippine economy.”

“We are very pleased that S&P, along with Fitch, has also now affirmed the Philippines’ strong economic and fiscal gains, progress that has been made thanks to the discipline and prudence in financial management instilled by President Aquino in his administration,” Finance Secretary Cesar Purisima also said in a statement.

Purisima said S&P’s new rating only reflects “what the markets already recognize.”

“This investment grade rating is another resounding vote of confidence in the Philippines… Our economy’s underlying soundness is on par with countries rated investment grade or higher,” he added.

Bangko Sentral ng Pilipinas (BSP) Governor Amando Tetangco Jr. said the S&P upgrade “cements the Philippines’ status as an economy with one of the brightest prospects globally.”

An investment grade is a seal of good housekeeping. It tells investors it is safe to do business in the country, and encourages them to put huge capital here.

An investment grade means the Philippines, as a borrowing country, has a strong ability to pay its debt. This lowers its borrowing costs, generating savings, which will be spent for social services.

(VIEW OUR INFOGRAPHIC: What a credit rating upgrade means for Filipinos)

What led to the upgrade?

In summary, these are the reasons S&P granted the Philippines an upgrade:

FISCAL FLEXIBILITY. The creditor rating firm cited the government’s efforts to reduce the share of foreign-denominated debts to total borrowings, as well as the more robust domestic capital and improvements in revenue collections.

HEALTHY FOREX BUFFER. With foreign reserves buffer reaching substantial levels following sustained surplus in current accounts, modest net foreign direct investment (FDI) and hot money inflows, S&P said the Philippines has “low refinancing risk and an import cover ratio well above prudential norms.”

RESILIENT REMITTANCES. Despite slowdown in economies that host overseas Filipino workers, S&P noted that remittances continue to be resilient. Coupled with the strong performance of the business process outsourcing (BPO) sector, another dollar earner, both could “generate foreign exchange earnings of approximately 15% of GDP, comfortably covering trade deficits of 6% to 9% of GDP.”

MANAGEABLE INFLATION. S&P also noted the role of the healthy inflation environment, which supports economic growth. “Despite some shortcomings in monetary policy transmission, inflation is low and fairly stable, helped partly by currency appreciation,” S&P’s Benard said.

However, S&P cited the following factors the Philippines could improve:

LOW PER CAPITA INCOME. The “low income level remains a key rating constraint. Per capita GDP, at a projected US$2,850 in 2013, is below that of most similarly rated sovereigns,” S&P said.

LIMITED JOB OPPORTUNITIES. S&P noted that “the economy is also unable to absorb its entire productive and workforce, as suggested by the high level of emigration.” It cited the “concentrated nature of the economy, infrastructure shortfalls, and restrictions on foreign ownership, which deter foreign investment, are factors that hamper growth.”

INCLUSIVE GROWTH. “Real GDP per capita growth averaged 3.3% over the past decade–somewhat slow at this stage in the country’s development. Based on ongoing structural changes in the economy, rising private sector investment, and with increased fiscal space allowing greater public spending, we expect real GDP per capita growth to rise to 4.5% in the forecast period to 2016,” S&P said.

Higher portfolio inflows

S&P’s upgrade was not a surprise. University of Asia and the Pacific economist Victor Abola told Rappler that the debt watcher’s decision was expected after Fitch’s historic announcement in March.

Abola said with two credit rating agencies giving the country investment grade status, the Philippines can expect a steady inflow of portfolio investments.

“It was not a surprise, the market was expecting it. Nonetheless, its a confirmation that two out of 3 credit rating agencies has come to the same conclusion that the Philipppines is worthy of investment grade status,” Abola said.

BDO chief market strategist Jonathan Ravelas said the credit rating upgrade given by S&P confirms that the Philippines is a worthy investment destination.

“This is a confirmatory upgrade. The market itself has anticipated this from Standard & Poor’s. It just highlighted what was eventually happening in the market already,” he said.

“This second (credit rating) upgrade will eventually allow investors to start looking at the Philippines as a serious investment destination.”

Stronger peso?

Ravelas added that while the peso could further strengthen as a result of the investment grade, the BSP could counter any appreciation of the peso.

Abola, for his part, said the FMIC-UA&P Capital Market Research Center does not plan to revise its forecast on the peso following S&P’s move. He said they still expect the peso to appreciate by 4% to 5% in 2013.

Philippine Economic Society (PES) President Alvin Ang told Rappler that the impact of the credit rating upgrade would be immediate on the bond and equity markets, but would not have a drastic effect on the peso.

Ang explained that the peso is stable at around P40 to P41.20 to the dollar and this could hold even with the second investment grade rating.

BSP’s Tetangco said the central bank would remain vigilant against the risks associated with greater inflows. He expressed hope that these inflows would also include much-needed FDI that would help create more jobs for Filipinos.

“With our investment grade rating, we are more confident that these inflows, particularly of more FDIs, will swing toward increasing the country’s productive capacity, thereby generating more employment and higher incomes,” Tetangco said.

Infrastructure

Ang said the government still needs to focus on improving the business environment, particularly the ease of doing business in the country. He said the Philippines still has a long way to go in terms of making it easier for businesses to set up shops here.

Among the country’s development constraints is lack of infrastructure, not only in terms of roads, but also power supply.

“The credit rating has no direct impact on the local economy,” Ang said. “What (government) needs to do now is to go into the details to improve the country’s investment climate.”

Ravelas agreed and said there is still a lot more work to be done on infrastructure for growth to be inclusive. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.