SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – If the government wants to improve its tax collections, it should broaden the country’s tax base and increase collections from self-employed professionals.

Speaking at the membership meeting of the Federation of Philippine Industries (FPI) on Wednesday, June 19, Finance Secretary Cesar Purisima said the Bureau of Internal Revenue (BIR) should broaden its tax base to efficiently and equally collect from all taxpayers.

“What is needed (for BIR) is the ability to broaden its tax base, to make sure that we collect from everyone,” he said.

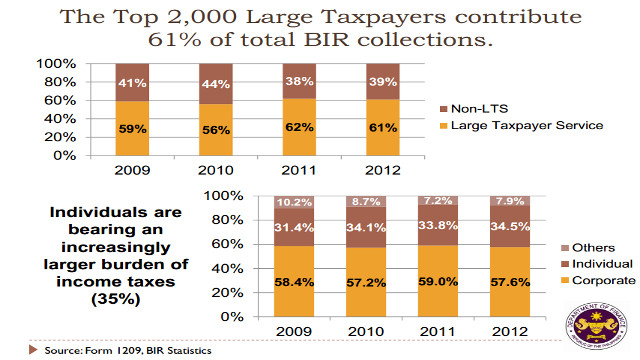

According to data from the BIR, 61% of the P1.058 trillion tax collection in 2012 came from the top 2,000 companies or large taxpayers.

“If you look at our data, 61% of our collection comes from 2,000 companies. That, I think, is a sad fact.”

“If you ask SEC (Securities and Exchange Commission) or DTI (Department of Trade and Industry), the number of companies in the Philippines is much higher,” he said.

In 2011, there are about 820,255 businesses operating in the Philippines comprising of 3,496 large companies and 816,759 small and medium enterprises (SME), according to data from DTI.

The goal of BIR, according to Purisima, is to collect taxes from these remaining companies.

Focus on the self-employed

Another initiative the government’s main tax agency can do is focusing on the self-employed professionals (SEP).

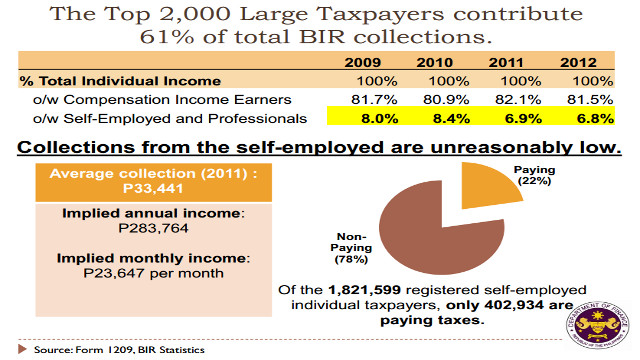

Purisima noted the increasing burden of income taxes shouldered by individual earners. In 2012, 34.5% of all income taxes came from paid workers, a 0.7% increase from the 33.8% in 2011.

A major reason for this increase, according to him, is the increasing number of SEPs in the country.

He admitted, however, despite the increase, many SEPs are still not paying their income taxes.

In March, Purisima and BIR commissioner Kim Henares said they would “wage war” on the SEP tax evaders.

According to data from the BIR, there are approximately 1.8 million SEPs in the country but only 22% or 403,00 are filing and paying their taxes. The average payment in 2011 is P33,441.

For 2013, Purisima said the government plans to increase the number of SEP income tax filers to 1.5 million and increase the average payment to atleast P200,000. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.