SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

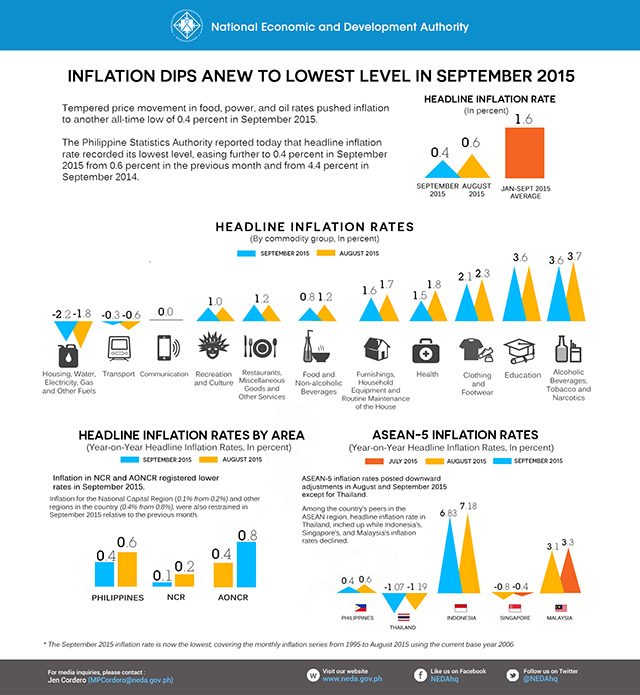

MANILA, Philippines – Headline inflation continued to hit below 1% for the third consecutive month, as September 2015 record fell to 0.4%, the National Economic and Development Authority (NEDA) reported Tuesday, October 6.

Inflation, the rate at which prices of goods and services rise, has steadily been easing from 2.5% in February; 2.4% in March; 2.2% in April; 1.6% in May; 1.2% in June; 0.8% in July; and 0.6% in August.

The Philippine Statistics Authority (PSA) reported Tuesday that September headline inflation rate recorded its lowest level at 0.4% from 4.4% in September 2014. The September 2015 inflation was pushed to lowest by tempered price movement in food, power, and oil rates.

Economic Planning Secretary Arsenio M. Balisacan said they expect the current low inflation environment in the first 9 months of 2015 to persist throughout the rest of the year, as international oil prices continue to remain low and are not expected to increase significantly in the near-term.

Inflation for the National Capital Region (NCR, 0.1% from 0.2%) and other regions in the country (0.4% from 0.8%), were also restrained in September 2015 relative to August.

Core inflation – which excludes selected volatile food and energy prices – slid further to 1.4% from 1.6% in August 2015 and 3.4% in September 2014.

Core inflation in the first 9 months of 2015 averaged at 2.1%.

Balisacan said the slowdown of core inflation further indicates that prices across a broad range of consumer items continue to remain stable.

Defying expectations

The Bangko Sentral ng Pilipinas (BSP) Officer-in-Charge Diwa Guinigundo said inflation is expected to bottom out as the impact of the prolonged and severe El Niño weather condition and the weak peso is expected to kick in.

BSP has set an inflation forecast of between 0.2% and 1% for September. Monetary authorities have set an inflation forecast of 1.6% for this year; 2.6% for 2016; and 3% for 2017.

The benign inflation gives the BSP’s Monetary Board more space to keep interest rates steady.

On September 23, BSP kept interest rates steady for the eighth straight policy-setting meeting since October 2014. After raising key policy rates by 50 basis points last year, BSP has kept the overnight borrowing rate steady at 4% and the overnight lending rate at 6%. (READ: For the 8th time, key interest rates still unchanged)

Credit Suisse also lowered its inflation forecasts for the country to 1.4% instead of 2.2% for this year and to 2.4% instead of 3.7% in 2016 due to the benign inflation environment.

Standard & Poor also said the country’s inflation easing to 2.1% this year before accelerating to 4% next year.

When inflation rises, purchasing power falls. The low inflation environment defied analysts’ earlier expectations that it would not go any lower than 1.6%, the record for May 2014, citing strong pressures from the probable impact of drought, poor agricultural harvest, and election-related spending in the coming months. (READ: Philippine inflation unlikely to go lower than 1.6%)

ING Bank Manila senior economist Joey Cuyegkeng said, “modestly higher inflation is expected toward the end of the year and in 2016 due to the impact of El Niño that is now being addressed by the Aquino administration.”

For his part, Barclays Bank economist Rahul Bajoria said overall price pressures remain muted despite poor weather conditions and September inflation remained close to multi-year lows.

Bajoria said BSP appears largely comfortable with its monetary policy stance but could tweak the reserve requirement ratio of banks even with historically low levels of inflation.

“We believe BSP is watching liquidity conditions more closely, and it is likely to inject liquidity, possibly by easing banks’ reserve requirement ratio, if conditions were to deteriorate,” Bajoria added.

Easing continues

Inflation in the food sub-group continued to ease in September 2015, (0.7% from 1.1%) following slower price adjustments in majority of its sub-items such as breads and cereals, fish, fruits, and rice, NEDA said.

The declining prices of regular milled rice due to sufficient supply partly supported the downward trend in overall food prices.

On the other hand, meat (0.4% from 0.3%) and vegetables (2.3% from 2.0%) exhibited slightly faster upward price adjustments relative to the previous month. The government also cited cheaper prices of the heavily-weighted food items such as corn, fish, cooking oil, calamansi, and ginger.

Non-food inflation also declined (-0.2% from 0.2%) resulting in the sustained lowering of prices of electricity, gas, and other fuels in NCR and in many provinces.

PSA noted that slower annual increases were seen in the indices of all the other commodity groups, except the indices of communication, recreation and culture, education and restaurant, and miscellaneous goods and services.

Bracing for El Niño

While low oil prices are likely to provide a cushion to upside inflationary pressures, government should remain wary of the upside risks to inflation such as the current El Niño episode in the country.

Balisacan said the government must ensure that food supply is sufficient by improving the level of inventories and efficiency of the distribution system.

“Continued monitoring of drought occurrence in agricultural areas is necessary to ensure timely policy actions, including importation of rice and other basic commodities to augment domestic supply,” he said.

The National Food Authority (NFA) is set to import 750,000 metric tons of rice in preparation for the impact of El Niño on the price of rice.

The NEDA director-general added that expanding agriculture support structures from production areas to the demand centers will also further bring down the cost of transporting goods and services.

As El Niño intensifies, the government may consider increasing the number of agricultural workers as potential beneficiaries in the Pantawid Pamilyang Pilipino Program (Conditional Cash Transfer) to offset farm output losses, Balisacan said.

He said government must also ensure that access to finance in the agriculture and fisheries sectors remains unhampered. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.