SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

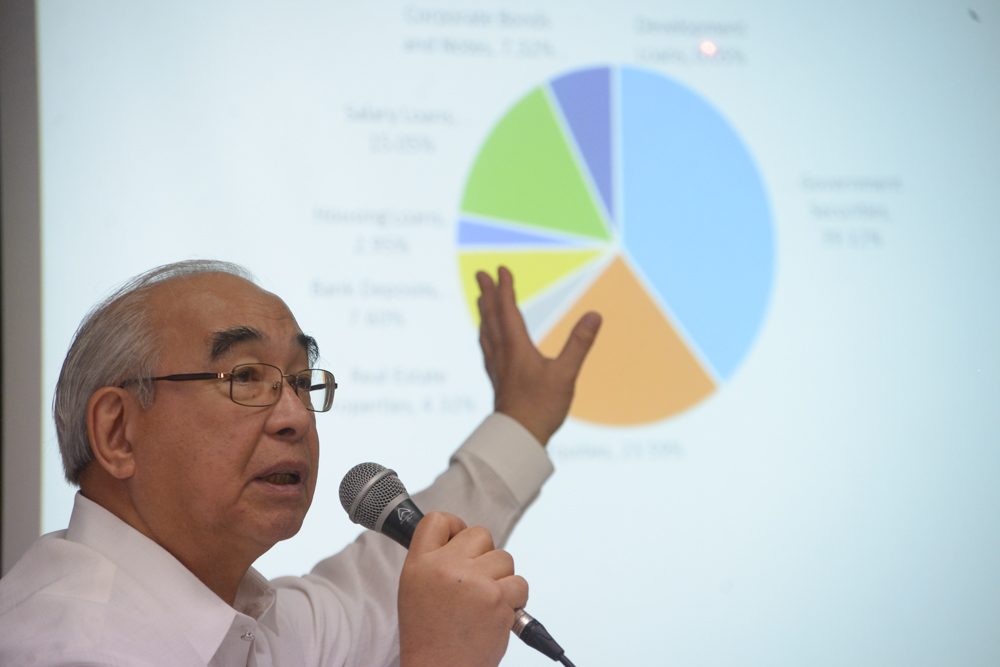

MANILA, Philippines – After President Benigno Aquino III rejected the proposed P2,000 monthly pension hike last week, Social Security System (SSS) executives finally answered issues hounding the state-run insurance firm, including proposals for more amenable increases.

At a press conference on Monday, January 18, SSS president Emilio de Quiros Jr said they cannot accommodate even the proposed P500 and P1,000 increases without raising the rates of members’ contributions.

After vetoing House Bill 5842 last Thursday, Aquino said he tasked concerned government agencies to look into the feasibility of increasing the SSS monthly pension by P500. Meanwhile, House Speaker Feliciano Belmonte Jr said he is calling on the SSS for a P1,000 raise. (READ: Aquino defends veto on SSS pension hike)

De Quiros stressed that, as it is, the current contributions are not enough to cover increased pensions. He noted that members even receive big interest for their contribution. According to the SSS chief, for every P1 contribution, members are given a benefit of P6 to 15.

“This is an unfunded liability. May malaking gap. (There is a big gap),” De Quiros told reporters.

If approved, the P1,000 increase would result to an additional expense of P28 billion out of the pension agency’s average income of P33 billion.

“Mag-uumpisa kaming kumain sa investment [fund], iiksi ang buhay ng SSS [fund],” he said. (We’ll have to get money from the investment fund, which will shorten the lifespan of the SSS fund.)

“We would be forced to raise the contributions from the current 11% to 15.8% to revert the fund’s lifespan to 2042,” he also said in Filipino.

Authorizing SSS

House leaders believe that if the Senate approved the pension hike proposal’s accompanying bill, House Bill 6112, Aquino would have approved HB 5842, which seeks to increase the monthly pension of SSS members by P2,000.

Without HB 6112, SSS cannot independently approve any step-up in the contribution rates without the President’s approval, unlike other government-operated insurance funds like PAG IBIG and the Government Services Insurance System (GSIS).

Before Congress resumed session on Monday, Belmonte told reporters that he would ask Aquino to prompt SSS to increase pension by P1,000 since Senate President Franklin Drilon had committed to pass the complementary bill.

Since 1980, SSS contribution rates have increased 3 times while pension rates have increased 22 times.

| Increases in Contribution Rate vs. Pension | ||

| CONTRIBUTION RATE | PENSION INCREASES | |

| 2014: 11.0% | 2007: 10% | 2014: 5% |

| 2007: 10.4% | 2000: 10% | 2006: 10% |

| 2003: 9.4% | 1997: 8% | 1999: 10% |

|

No increase in 23 years |

1994: 5% | 1996: 10% |

| 1993: 10% | 1993: 10% | |

| 1991: 10% | 1992: 10% | |

| 1990: 15% | 1991: 15% | |

| 1987: 20% | 1989: 15% | |

| 1986: 20% | 1987: 20% | |

| 1982: 20% | 1984: 15% | |

| 1980: 8.4% | 1980: 20% | 1981: 20% |

| RATE INCREASED 3 TIMES | PENSION INCREASED 22 TIMES | |

Former SSS president Corazon dela Paz compared SSS with its public service counterpart, the GSIS, which requires steeper contribution from its members.

“GSIS’ rate is 21%. That is 9% from the employee and 12% from the employer,” Dela Paz explained in Filipino.

“Maraming members ng SSS, nagbabayad lang on the basis of income na P1,000. So P100 lang, eh papano mabubuhay ‘yung SSS member na aasa lamang sa contribution?”

(Many SSS members only pay on the basis of the [minimum] income of P1,000. That’s just P100. How can an SSS member live by just depending on his or her contribution?)

Improving collections

While SSS pointed to the need to increase contributions to provide for better pension payouts, leftist groups slammed the SSS for its inefficiency in collecting contributions.

Bayan Muna Representative Neri Colmenares earlier told the state-run insurance firm to improve its current collection rate of 35-38%.

During Monday’s press conference, De Quiros refuted Colmenares’ claims, saying SSS’ average revenue reached P33 billion from 2010 to 2014 compared to 2000-2009’s P8 billion average.

He also argued that the P13.5 billion employer delinquency will not cover the P56 billion additional expenditure if the P2,000 pension hike was approved. (READ: Senior citizens: ‘We can’t afford medication without SSS pension hike’)

SSS Commissioner Michael Alimurong said that majority of uncollected contributions were from the informal sector.

“This is composed of the self-employed, migrant workers, and people who recently lost their jobs, who we can’t force to pay,” Alimurong said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.