SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

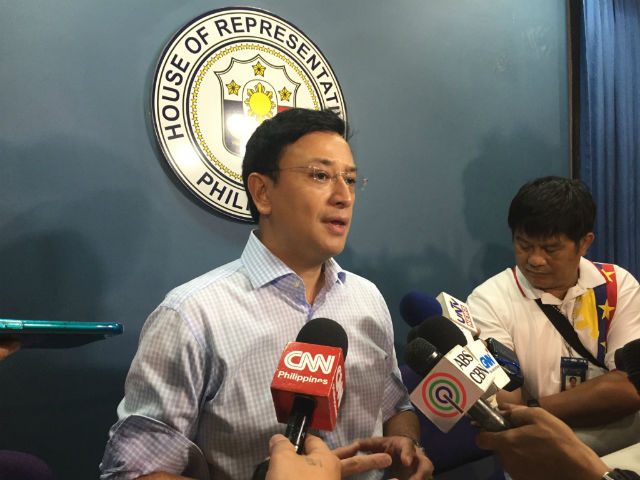

MANILA, Philippines – Taking the cue from President Rodrigo Duterte, Deputy Speaker Miro Quimbo has filed a bill that seeks to cut corporate income tax to improve the Philippines’ competitiveness.

Quimbo filed House Bill (HB) Number 2379, which seeks to adjust the income tax rate from 30% to 25% by amending the National Internal Revenue Code of 1997.

In his explanatory note, the Marikina 2nd District Representative said the current corporate income taxation framework in the country poses a “great threat” in light of the Association of Southeast Asian Nations (ASEAN) integration.

According to Quimbo, the ASEAN integration is a “prime opportunity” for the Philippines to boost its economic growth through the influx of capital.

“However, in order for the country to fully enjoy the benefits of this integration, there is a need to establish a better tax scheme to strengthen its competitiveness,” he said.

“With lower tax rates, higher investments are projected, potentially bringing Philippine investment levels closer to the ASEAN member-countries. In turn, this may increase the country’s competitiveness, stimulate the country’s economic growth, and consequently, encourage the growth within the ASEAN,” Quimbo added.

In his State of the Nation Address, Duterte promised to lower personal income and corporate taxes. (READ: The pet bills of President Duterte)

The gallery had applauded him loudly because the Philippines currently has the second highest tax income rate in Southeast Asia and the highest corporate tax rate among its peers in the 6 biggest economies in the region. (READ: Why PH has 2nd highest income tax in ASEAN)

Duterte’s predecessor, former president Benigno Aquino III, also said he was “not convinced” that lowering income tax was necessary. The Aquino administration also did not impose new taxes under its watch. (READ: Dominguez bares tax reform plans to businessmen)

Quimbo said that while the Philippines has the highest corporate income tax rate in among ASEAN member-nations at 30%, “it only had a tax effort of 13.6% of GDP (gross domestic product) in 2014.”

“On the other hand, Vietnam outpaces the Philippines’ tax effort but with only a corporate income tax rate of 20%. Not only does the high corporate income tax blunt the country’s competitive edge, it also does not lead to desired revenue outcomes,” he added.

The lawmaker explained that HB Number 2379 is the second phase of his income tax proposal, earlier filing HB Number 20 which seeks to adjust individual income tax to inflation “to give immediate social justice to salary workers.”

“While my proposal is done in steps, it is far-reaching as it seeks to address all the problems in our tax structure to cover all taxpayers….It is calibrated but comprehensive, partitioned but correlated, and phased but realistically doable,” said Quimbo. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.