SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

LOS ANGELES, United States – China, as expected, was very much a topic of discussion here at the annual Milken Institute Global Conference. This premier conference on America’s Pacific Coast attracted the who’s who in finance, business, government and civil society – from former UK Prime Minister Tony Blair to basketball legend and businessman Earvin “Magic” Johnson and CEOs or chairpersons from the likes of Sony Corporation and The Walt Disney Company, among others.

Yet something was also different this year when it came to Asia. Beyond discussion of growth and tensions in Southeast Asia, long-time economic laggard Japan also was back in the limelight with a panel dedicated to “Abenomics” – the nickname given to a 3-pronged economic revitalization effort being undertaken by Japan Prime Minister Shinzo Abe.

Amid concerns raised over revisionist statements coming out of Japan’s government and discussion of the impact to date of Japan’s fiscal stimulus and monetary easing policy under Abe, a critical question persisted: Is the “third arrow” of “Abenomics” – essential structural reforms – on target, particularly with the failure to announce any significant progress on Trans-Pacific Partnership trade talks during the recent visit of US President Barack Obama to Asia?

As we speak of structural reforms in Japan, it is hard to ignore the urgent need for such reforms in development institutions and aid agencies serving the Asia-Pacific region.

Let’s begin with the heavily Japan-influenced, if not dominated, Asian Development Bank (ADB). In an unwritten agreement, Japan, the co-equal largest shareholder of the ADB along with the US, has held on to key positions at the Manila-based international financial institution, with the president always coming from Japan. In a similar vein, the heads of the World Bank and the International Monetary Fund have been American and European respectively.

Just more than a year ago, long-time Manila resident Haruhiko Kuroda stepped down as ADB president to become the current governor of the Bank of Japan. He was one in a long line of bureaucrats from the Japanese Ministry of Finance to take the reins of the ADB, an institution that is set for reform should Abe choose to direct his attention there.

This reform process and change is both inevitable and necessary because the new Asia demands new approaches.

If any economist said on Dec. 19, 1966, when the ADB was founded, that in just 45 years China would become the world’s second-largest economy and India the fourth in terms of purchasing power parity, he – and no doubt it would have been a man – would have been scoffed at, dismissed or perhaps even considered a bit insane.

But time would have proven him right.

So, should the ADB take a self-congratulatory bow and leave the stage? Nearly 5 decades on, parts of Asia are awash in capital and foreign direct investment, and numerous showcase infrastructure projects in the region are the envy of the world.

Yet, despite these impressive top-line statistics, there remain many pockets of tremendous poverty in the region. Asia’s journey toward more sustainable economic development, equal opportunity and the most efficient utilization of financial and human capital is far from over despite billions of dollars in development loans and official development assistance.

At the 47th annual meeting of the ADB, held May 2 to 5, in Astana, Kazakhstan, it was clear that the institution must continue to re-evaluate its strategies to address the reality beyond the glowing headlines of a region on the rise.

Take India as an example. A recent report by McKinsey estimates that 680 million Indians today lack the means to meet their essential needs: 57 million are excluded from economic opportunity, 210 million are impoverished and 413 million are vulnerable. On average, India’s citizens lack access to 46% of the basic services they need and just 50% of government spending actually reaches the people for whom it is intended. Such “leakages” and corruption must be addressed. McKinsey also estimates that critical government reforms could help 500 million Indians cross the “economically empowered consumption threshold” by 2022.

What role can the ADB play in this? How best to strengthen the ability of India and other developing nations in Asia to address such stark realities?

As we have argued in leading development blog Devex and more traditional media across the region, the ADB must do more to keep pace with a changing region. We suggest some near-term steps so the ADB can lead the way and perhaps set the pace for change at its sister organization, the World Bank, as well.

First, ADB should address outdated internal incentive and management systems that undermine development effectiveness. More emphasis must be placed on the quality, rather than the quantity, of lending and other assistance provided in the name of development. Too often the measure of success by management and staff remains board approval of and size of a loan – the bigger and faster, the better – and not the consequences and outcomes that follow.

An example of this is the so-called multi-tranche development loans. These, in theory and following initial board approval, allow subsequent tranches of funds to be denied if original objectives are not met. Politics and management pressures can, however, contribute to a rubber stamp go-ahead of second and third tranches even when experience with the first tranche would suggest otherwise. This approach needs to be modified.

Second, ADB must recommit to helping the smallest and least-developed nations in Asia. The limited ability of small nations – whether Afghanistan or tiny Nauru – to make effective use of development assistance, be it grants or loans, works against them in a system where attention is unwaveringly focused on the biggest borrowers, including India, Indonesia and even China, which continues to borrow despite the size of its economy.

Third, and in a break from its erstwhile pattern, ADB should place immediate and forceful emphasis on skills training and education. The demographics of many parts of Asia are heavily tilted toward the young, who will increasingly fail to gain employment without the skills required in a knowledge economy.

Every day, new developments in technology displace workers. With such “progress,” manufacturing will no longer provide the large numbers of jobs sought after by one-time agricultural workers hoping to take advantage of the region’s overall growth. It is thus imperative that ADB re-evaluates static approaches based on old models of growth, and also its own abilities to deliver the best people, best experiences and best ideas to developing Asia. This will include also taking better advantage of the many Filipino staff at the ADB who find limited opportunities to advance due to outdated approaches to people management.

In short, ADB is in need of its own third arrow of reforms.

Creating and sustaining a fertile ecosystem of prosperity will require more than spending money, no matter how efficiently and transparently such funds are used. With employment mainly driven by small- and medium-sized enterprises, creating an environment in which entrepreneurship can flourish is essential. That, in turn, rests on an ecosystem where innovation flourishes. How can development banks help in this regard? This is a question all of the region’s development partners need to ask themselves.

Scoff at us, dismiss us or even call us a little insane, but we believe there is room in development for strong, viable and relevant institutions that place precedence on loan quality over quantity, ensure access to quality education and skills, and prize innovation and entrepreneurship as a means to job creation.

Let us envision the Asia of tomorrow in order to best prepare for it. As Asia’s economic growth continues to drive the global economy, it is time to bid farewell to systems and institutions that help ensure development money flows without regard to results, impact and outcome. The Philippines and the rest of Asia deserve better. – Rappler.com

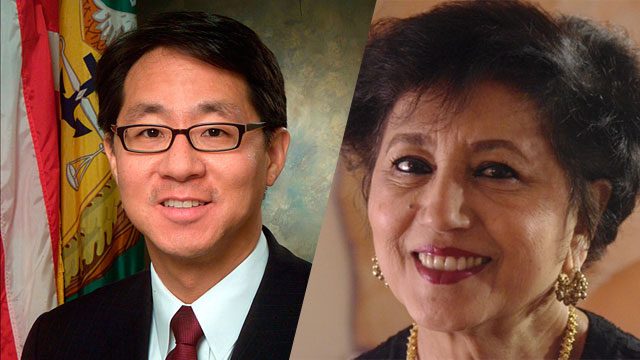

Curtis S. Chin, a former US ambassador to the Asian Development Bank under Presidents Barack Obama and George W. Bush, is a managing director with advisory firm RiverPeak Group LLC. Meera Kumar, a public relations professional and a regular contributor to Gateway House (Indian Council on Global Relations), worked at the ADB in the 1990s. Curtis can be followed on Twitter at @CurtisSChin

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.