SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

What’s a travel tax? Is it the same as the airport terminal fee? How can I pay it?

A travel or departure tax is imposed or collected when you leave our country regardless of your destination, as provided for by Presidential Decree (PD) 1183 (as amended).

No. It’s not the same as the airport terminal fee or international air carrier service charge (IPSC), as this is collected for the maintenance and security of airport operations.

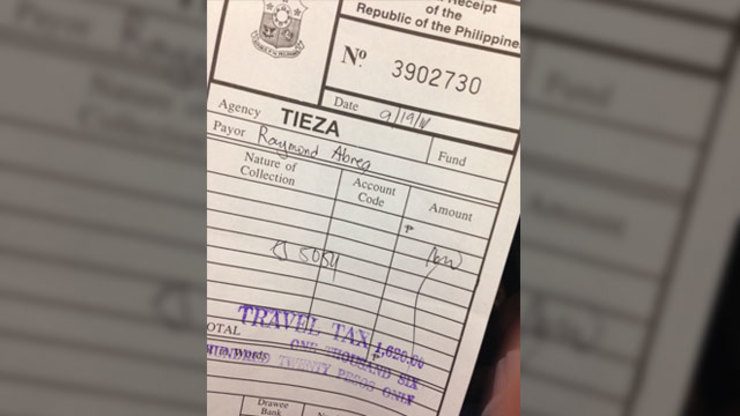

In fact, effective October 2014, the terminal fee will be included in the cost of airline tickets, while the travel tax has to be paid directly – on top of the airline tickets – to the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) travel tax counter at the airport or through airline ticket offices and travel agencies.

How much travel tax do I need to pay?

Travel tax rates vary, depending on whether you are a first or economy class passenger, and whether you are qualified for reduced rates or not. (Rates from the TIEZA website):

| Travel tax rates | First class passage | Second class passage |

| Full travel tax | P2,700 ($60.67*) | P1,620 ($36.40) |

| Standard reduced travel tax | P1,350 ($30.31) | P810 ($18.20) |

| Privileged reduced travel tax for OFW dependents | P400 ($8.99) | P300 ($6.74) |

I am an Overseas Filipino Worker (OFW). Am I required to pay travel tax when I visit the Philippines?

No. OFWs are among those exempted from paying travel tax.

You may visit the TIEZA website for the complete list of passengers qualified for exemption in paying the Philippine travel tax. You’ll also see how to apply the exemption.

You may visit the TIEZA website for the complete list of passengers qualified for exemption and how to apply for one.

Got a question about taxes? #AskTheTaxWhiz! Tweet @rapplerdotcom or email us at business@rappler.com. – Rappler.com

Mon Abrea is a former BIR examiner and an advocate of genuine tax reform. He serves as chief strategy officer of the country’s first social enterprise, the Abrea Consulting Group, which offers strategic finance and tax advisory services to businesses and professionals. Mon’s tax handbook, “Got a Question About Taxes? Ask the Tax Whiz!” is now available in all bookstores nationwide. Follow Mon on Twitter: @askthetaxwhiz or visit his group’s Facebook page. You may also email him at consult@acg.ph.

*$1 = P44.50

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.