SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Lending app BillEase secured a $20-million (P1-billion) debt facility from Lendable, an emerging market credit provider, for the expansion of its buy-now, pay-later services in the Philippines.

The latest funding round adds to the recent $11-million (P576-million) Series B equity raised from Burda Principal Investments, MDI Ventures, and KB Investment, bringing total fresh funds to $31 million.

Georg Steiger, chief executive officer of First Digital Finance Corporation, which operates BillEase, said the fresh funding will help in the company’s customer onboarding and loan portfolio expansion.

“The Philippines represents a very large and untapped opportunity for fintech. The population is young, tech savvy, and largely underbanked. Several regulatory initiatives are coming together to significantly improve market infrastructure – instant retail payment networks, national ID, national credit bureau, digital banking licenses, just to name a few,” Steiger said.

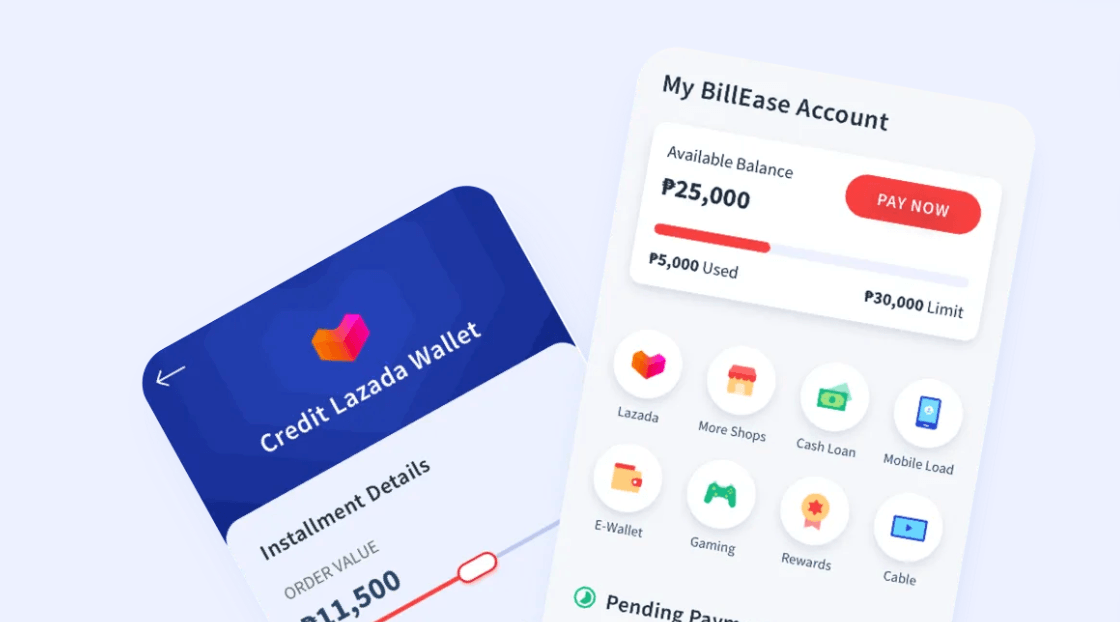

BillEase, founded in 2017, provides low-cost, installment cash loans, e-Wallet top-ups, prepaid mobile load, and gaming credits.

BillEase said its volumes grew five times in the first quarter of 2022 compared to the same period in 2021, with the company achieving profitability last year. – Rappler.com

$1 = P52.37

Add a comment

How does this make you feel?

![[ANALYSIS] Rule of 120: A practical method of asset allocation and minimizing investment risk exposure](https://www.rappler.com/tachyon/2024/02/tl-rule-120-02222024.jpg?resize=257%2C257&crop=274px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.