SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I have said this once and will say it again: It doesn’t really matter to me who will be the next Philippine president as we get the kind of leader we deserve.

If majority of the voters who are not even registered taxpayers, or are on the payroll of one or two politicians, elect Vice President Jejomar Binay as the next Philippine president, then so be it. (READ: Who is running for president, vice president)

I won’t get any direct benefit anyway. I will still have to work for more than 8 hours a day, 7 days a week, and pay my taxes monthly whoever wins in the May 2016 presidential election.

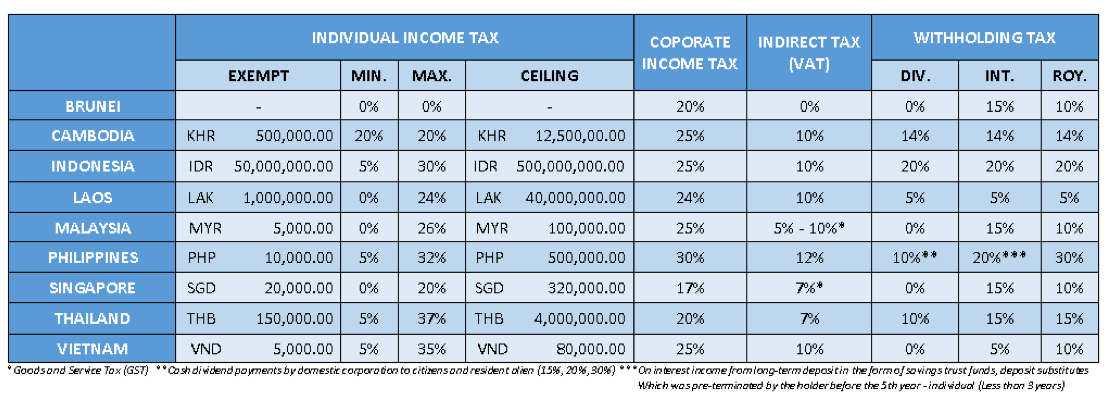

But to push for genuine tax reform, we need somebody with political will to move the tax reform bills in Congress and start overhauling our outdated and overly burdensome and complicated tax code. (READ: Why PH has 2nd highest income tax in ASEAN)

Even the Bureau of Internal Revenue (BIR) examiners get confused among themselves. Believe me, if you give them a competency exam today, we will run out of qualified examiners to check the books of more than 24 million registered taxpayers. They are now less than 3,000 only, covering all Revenue District Offices (RDOs) across the country.

If Binay pushes for genuine tax reform as his priority bill, I will vote for him. (READ: Big business groups to Aquino: Reform taxes)

I will not necessarily campaign for him as we have differences in values and governance principles; but as a tax advocate, I will always help make our tax administration more efficient and tax-friendly, unlike now.

Forget about the revenue losses as we have been losing billions, if not trillions, of pesos every year due to our inefficient tax system.

Employees involuntarily pay their taxes as it is withheld at source, while businesses and professionals find ways of paying less than necessary.

BIR audit has never been (and will never be) the solution to increase voluntary compliance, as it almost always leads to illegal compromises — a connivance between the examiner and taxpayer, and worse, even with tax agents mediating.

We have shared the blueprint for genuine tax reform where 3 strategic areas have been identified for reform: legislative, administrative, and business practice.

The overriding principle is to promote honesty in paying taxes, and make it easy and affordable for every taxpayer.

The BIR must be on board discussing any tax reform bill to help them broaden their taxpayer base, and stop them from harassing few taxpayers who will always be at their mercy.

Taxpayers must actively participate in formulating a tax regime that will encourage honesty and increase voluntary compliance without BIR audit.

Given our over 100 million population, only 14 million are registered individual taxpayers, of which 12 million are employed. Is it fair to make the less than 20% of the population shoulder the tax burden of funding government spending, while more than 80% elect whoever will give them cash, relief goods, or any form of assistance?

The poor and marginalized don’t care if Binay is corrupt, or if all politicians are. The same way they weren’t bothered when they elected former president Erap Estrada as city mayor of Manila after being ousted for graft and corruption, or Senator Bongbong Marcos – son of the dictator president Ferdinand Marcos – and now running for the 2nd highest position in our government. Why should I?

Same goes in reforming our tax system. I don’t think I am the first one who said that our tax systems are overly burdensome and the rates are way too high compared to our neighboring countries.

But what have we done to address the problem? Did we not benefit from the inefficient tax system? Are we even expecting to be globally competitive come ASEAN integration by yearend?

Whether it’s Binay, former interior secretary Manuel Roxas II, Senator Grace Poe or whoever, we need a president who is primarily honest and supports businesses to be nationally responsive in providing real employment and being globally competitive.

The issue of revenue losses is real but very parochial. It’s a trade off to make our businesses survive, thrive and compete in the midst of integration and globalization.

In the end, I would like to appeal to the at least 13 million registered employees who have contributed at least P232 billion in taxes (20% of the total collections) in 2014 to please support our call for the lowering of income taxes, especially for employees who are the real victims of an overly burdensome tax system.

Let our voices be heard as their “bosses” and ask our current administration to end the inequity and injustice causing death by taxes.

Let them know we will not forget if they abandon us now, and our votes in May 2016 will remind them of this.

Join #BlackPaydayFriday this Friday, October 30, to pressure Malacañang and Congress to pass income tax reform.

How to take part?

1. Wear something Black at work. Encourage your co-workers to do the same.

2. Change Profile Pic to black or add our official #TaxReformNow Twibbon to your profile pic https://twibbon.com/Support/tax-reform-now-2.

3. Take a selfie or groufie on that day at work while wearing black with a #TaxReformNow sign.

4. Tweet or post a status message on what tax reform means to you using the hashtag #TaxReformNow.

May you enjoy a tax-free lifestyle!

Mr Tax Whiz

Got a question about taxes? #AskTheTaxWhiz! Tweet @rapplerdotcom or email us at business@rappler.com. – Rappler.com

Mon Abrea is a former BIR examiner and an advocate of genuine tax reform. He serves as chief strategy officer of the country’s first social consulting enterprise, the Abrea Consulting Group, which offers strategic finance and tax advisory services to businesses and professionals. Mon’s tax handbook,Got a Question About Taxes? Ask the Tax Whiz! is now available in bookstores nationwide. Follow Mon on Twitter: @askthetaxwhiz or visit his group’s Facebook page. You may also email him at consult@acg.ph.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.