SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Is it true that Bureau of Internal Revenue (BIR) audit is suspended during the holidays? If yes, until when? What will BIR examiners do in the meantime?

Yes. The suspension is from December 16, 2015, until January 5, 2016, per Revenue Memorandum Circular 75-2015 issued on December 14, 2015.

The circular says: “All field audit and other field operations of the Bureau of Internal Revenue relative to examinations and verifications of taxpayers’ books of accounts, records and other transactions are hereby ordered suspended for the period December 16, 2015, to January 5, 2016. Thus, no field audit, field operations, or any form of business visitation in execution of Letters of Authority/Audit Notices, Letter Notices, or Mission Orders should be conducted.”

BIR examiners should make use of this period to do office work on their cases and to complete the report on those with already completed field work.

I am an employee from January to September of 2015. After my resignation, I started a small business but it’s not yet making profit. Am I required to file the annual income tax return (ITR)? Do you have a list of those who are required to file thru eBIR and/or eFiling and Payment System (eFPS)? Who are exempted from filing ITR?

If you have registered your small business with BIR, the answer is yes. You’re considered a mixed-income earner and you need to consolidate your compensation income with your business income or loss.

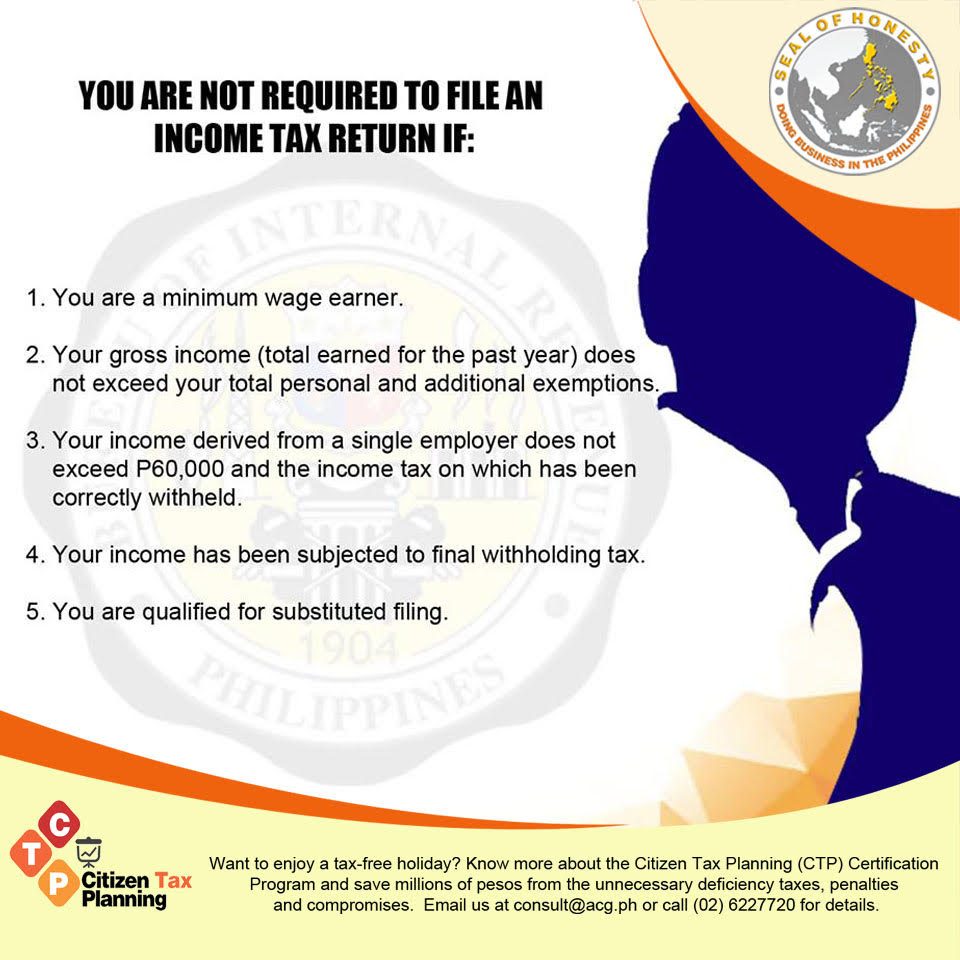

However, if you haven’t registered the business, you don’t need to file a separate annual income tax return (ITR) because you’re still qualified for the substituted withholding tax system as an employee with single employer in a given tax period.

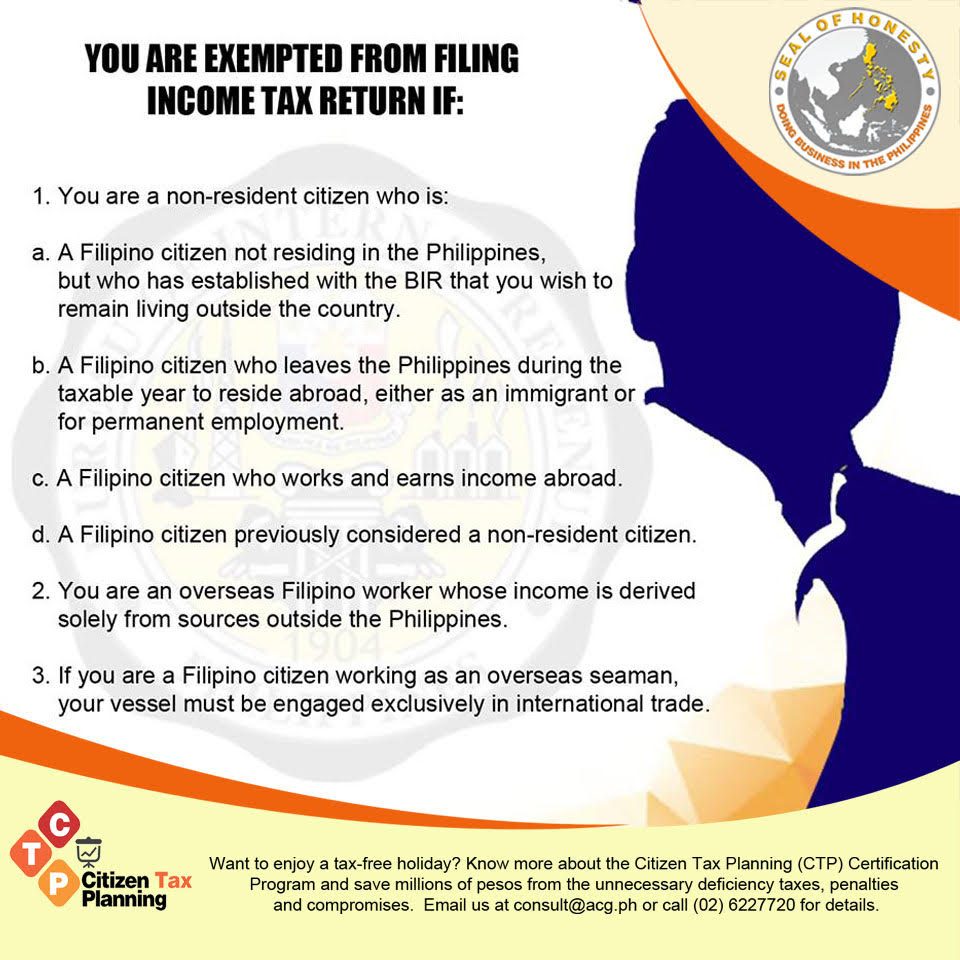

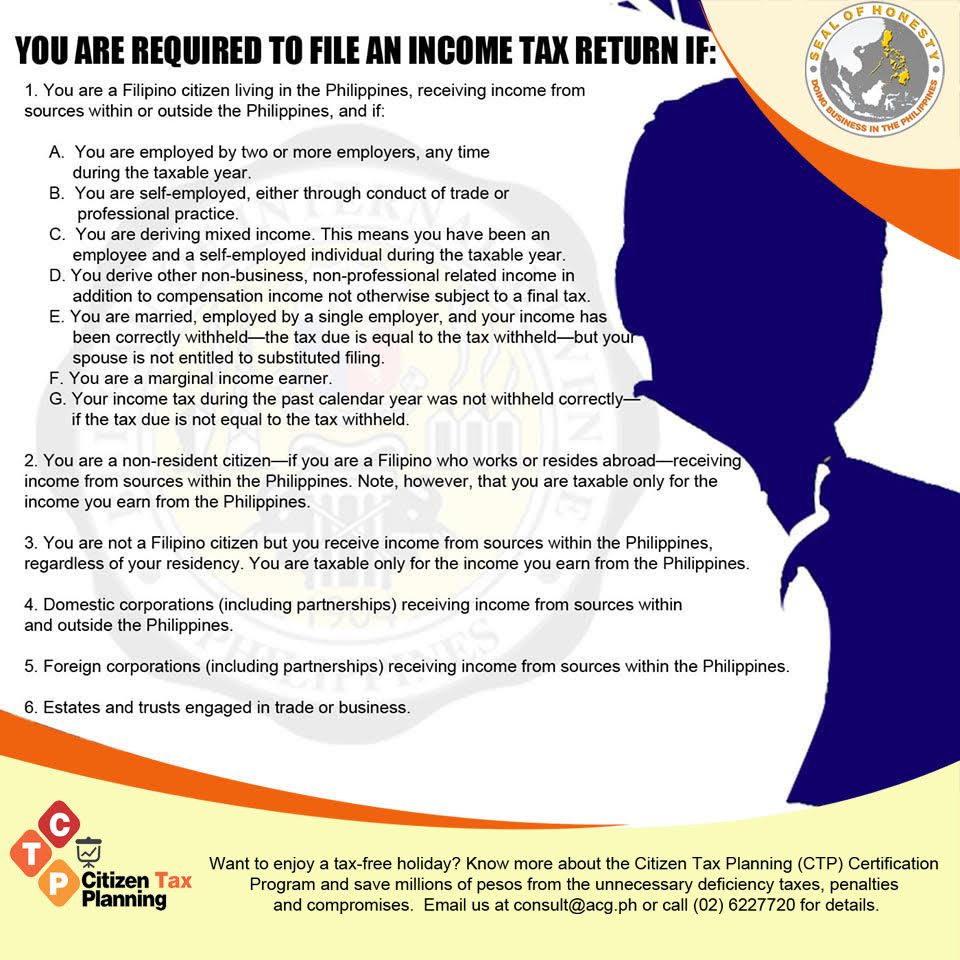

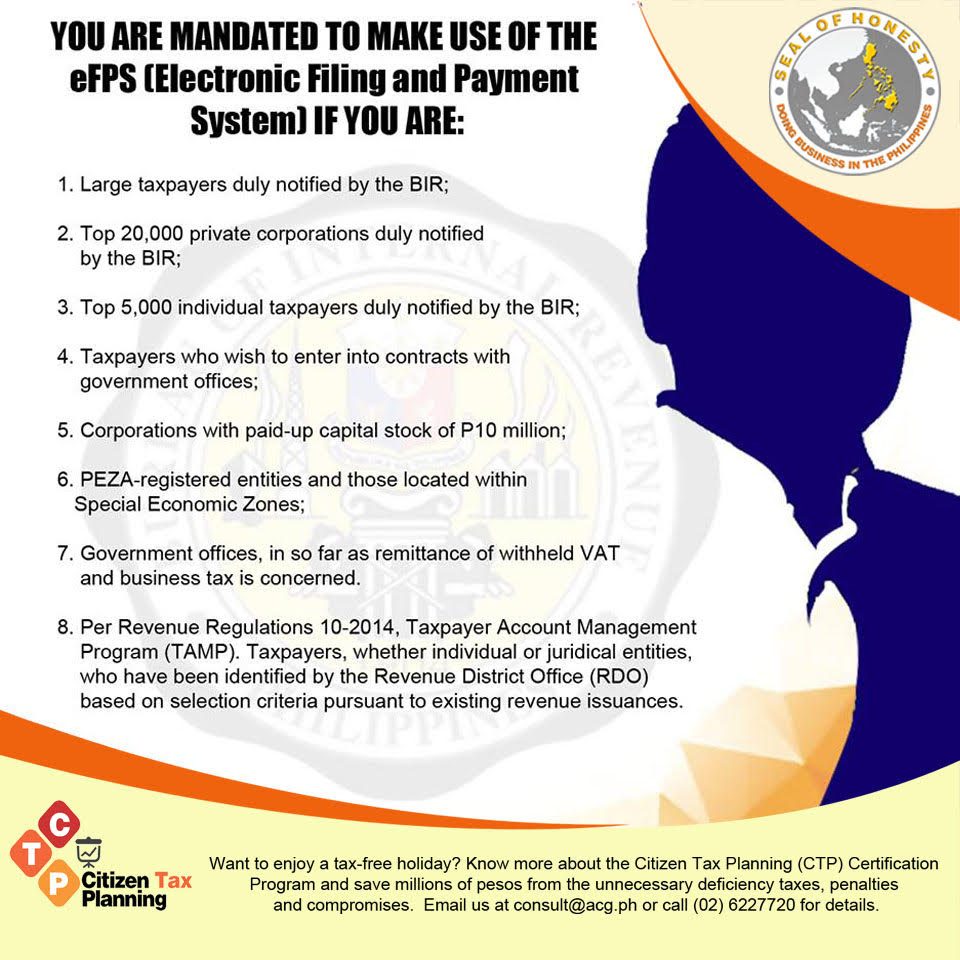

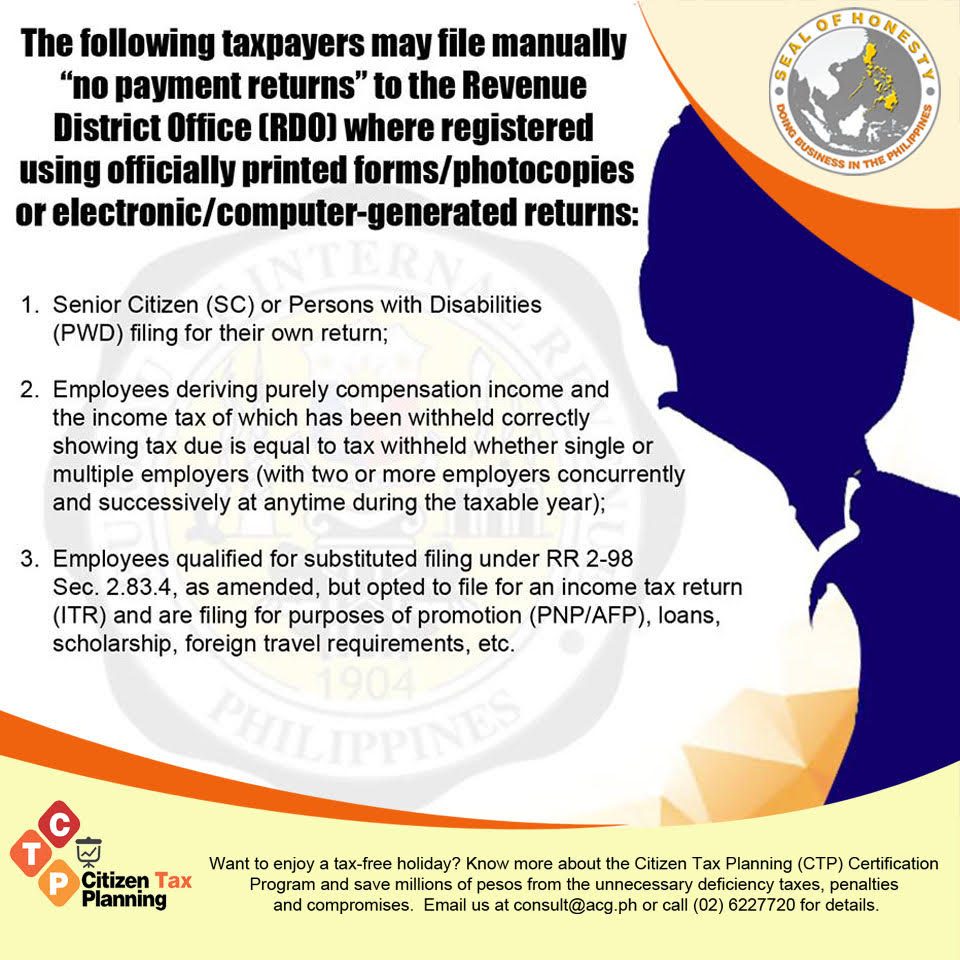

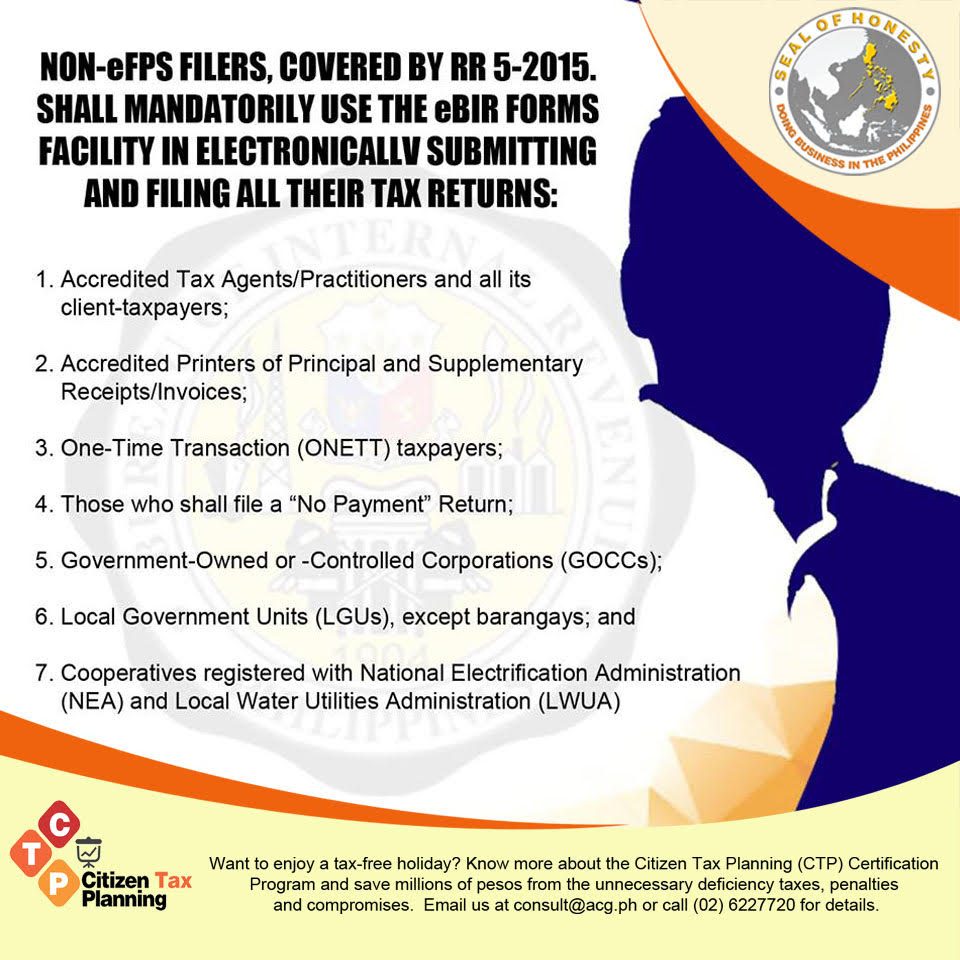

Here are the list of those required to file thru eBIR and eFPS, as well as those exempted from filing ITR:

As a taxpayer, what are the things that I need to know? Most of my friends with business are guilty of compromising or bribing BIR examiners to avoid paying huge deficiency taxes with penalties. They all say that it’s really part of the business. Do you agree? Is there a way to do business and pay the right taxes correctly?

As a taxpayer, you need to know the following:

a. Your classification as a taxpayer i.e., fixed income, mixed income, self-employed, or professional;

b. Your tax obligations and deadlines i.e., monthly value added tax (VAT) due every 20th for self-employed or professionals with annual gross receipts above P1,919,500 ($40,961.32);

c. Documentary requirements i.e., books of accounts, summary list of sales and purchases (SLSP), etc.

No. Our enemy is not the BIR, but our ignorance, arrogance, and greed. We need to hire professionals to handle our tax compliance. We need to consult experts and not fixers if we encounter problems with the BIR. Be prudent and extra cautious in signing contracts. We need to have our tax returns reviewed before we sign and file them – or at the very least conduct annual tax audit and compliance review.

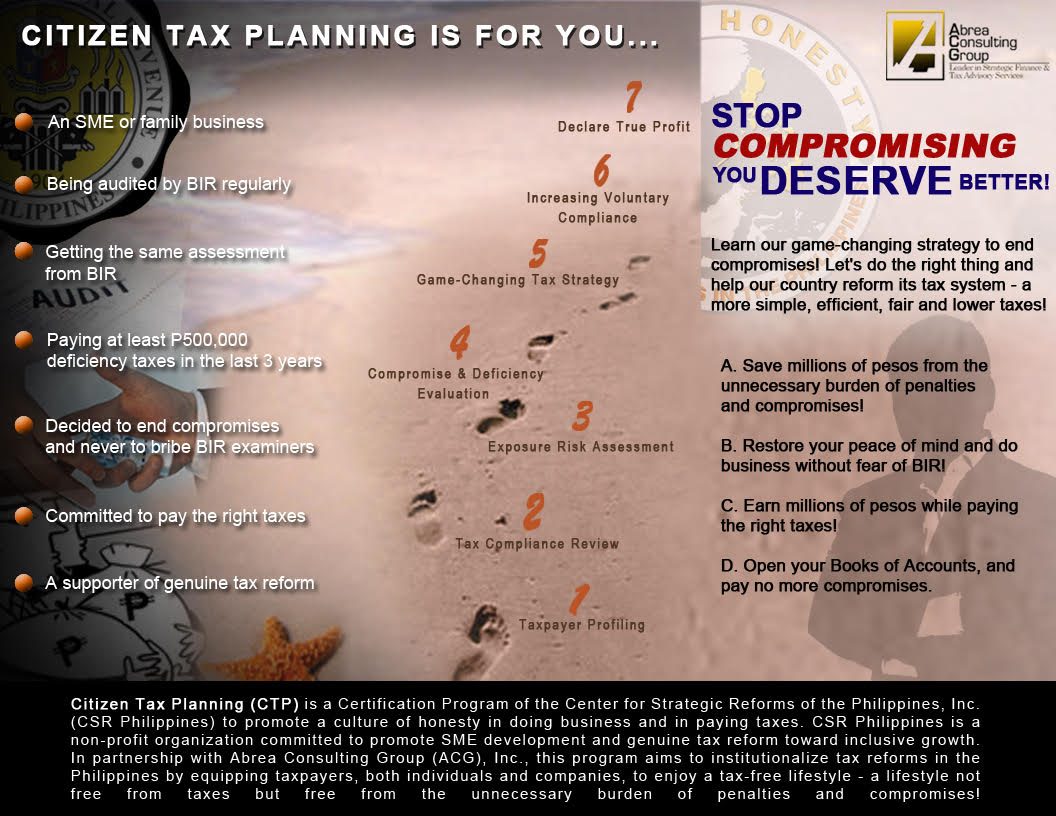

For those who have been heavily and frequently exposed to compromises during BIR audit or have bribed a BIR examiner at least once, you may want to know about the Citizen Tax Planning (CTP) Certification Program and how it can help you enjoy a tax-free lifestyle – a lifestyle not free from taxes but free from the unnecessary burden of penalties and compromises.

Got a question about taxes? #AskTheTaxWhiz! Tweet @rapplerdotcom or email us at business@rappler.com. – Rappler.com

Mon Abrea is a former BIR examiner and an advocate of genuine tax reform. He serves as chief strategy officer of the country’s first social consulting enterprise, the Abrea Consulting Group, which offers strategic finance and tax advisory services to businesses and professionals. Mon’s tax handbook, Got a Question About Taxes? Ask the Tax Whiz! is now available in bookstores nationwide. Follow Mon on Twitter: @askthetaxwhiz or visit his group’s Facebook page. You may also email him at consult@acg.ph.

*$1 = P46.86

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.