SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Dear Mr. Tax Whiz,

Every Holy Week, I really offer all the difficulties I encounter in complying with the Bureau of Internal Revenue (BIR) as my Lenten sacrifice, especially in filing my annual income tax return (ITR).

It’s quite ironic our government promotes doing business in the Philippines, but they make it difficult for us to pay our taxes correctly.

Instead of getting assistance, we are slapped with penalties and compromises more than our tax due that force us to negotiate with BIR examiners. I know it’s wrong to bribe BIR examiners, but they make it the only way for us to survive.

Now that the April 15 deadline for ITR filing is fast approaching, I compiled some of the frequently asked tax questions which can help all anxious and confused taxpayers out there. I hope you can answer them to help us prepare for our ITR, and as you have been advocating, for us to enjoy a tax-free lifestyle – a lifestyle not free from taxes, but free from the unnecessary burden of penalties and compromises:

1. My friend is a licensed architect. He was advised to use Optional Standard Deduction (OSD) instead of Itemized Deductions because he has no supporting documents i.e., official receipts or invoices, for his expenses. Is that correct? What’s the difference and/or advantage of using OSD?

2. Employees are exempted from filing an ITR, right? Are there exceptions to this exemption? I’m asking because my officemate who used to work for another company was asked by our accounting office to file her own ITR. Can she complain and ask our company to file on her behalf?

3. Our neighbor has a small sari-sari store. He asked me if they are required to file an ITR, and if they need to hire a CPA to sign their financial statements. Are they not exempted from taxes? Do they need to hire the professional services of a CPA? I hope not as they cannot afford to hire a CPA.

4. An accountant advised us to prepare all our Books of Accounts and supporting documents including receipts and invoices before we file our ITR on April 15. Are we supposed to submit supporting documents when we file our ITR? Can we file before April 15? Where?

5. Are employees allowed to claim deductible expenses? How about exemptions? My friend has 5 children, but she’s only allowed to claim 4 dependents. Can I claim my senior citizen parent and/or nephews as exemptions to reduce my income tax? How are withholding taxes on compensation computed?

Honestly, your #AskTheTaxWhiz column via Rappler is very helpful but do you give a tax seminar so we can attend? How do we get in touch with you?

Sincerely,

Guilty Taxpayer (GT)

***

Dear Mr. GT,

Thank you for your very timely and relevant tax questions. If the government wants taxpayers to pay taxes correctly, they really need to make things simple and easy for all of us to comply. I hope our government will soon realize that before it’s too late.

As I always say, taxes are meant to uplift the lives of the people. If people die or get compromised in the process, then something is wrong in our tax system. And if we decide to bribe or compromise, we are making it worse.

Anyway, I will answer your tax questions now and hopefully you can share it to your colleagues and friends.

1. Yes. Although it is costly at 40% OSD, it does not require official receipts or invoice to support the standard deduction. This means if you have P1 million gross receipts or revenues, your taxable income subject to income tax is P600,000 (net of the 40% OSD).

Aside from not having to substantiate expenses with official receipts, individual taxpayers like your licensed architect friend, if he chooses OSD over itemized deduction, need not secure certification from a Certified Public Accountant (CPA) for their financial statements.

2. Yes. Employees are exempted from filing an ITR if they are qualified for the substituted filing tax system. (READ: #AskTheTaxWhiz: Filing income tax returns)

However, since your officemate was employed by more than one employer during the same taxable year, she is required to consolidate and to file her income tax return.

3. No. Only those with Barangay Micro Business Enterprise (BMBE) certification are exempted from income tax, provided they presented it to the Revenue District Office (RDO) of the Bureau of Internal Revenue where they are registered.

However, if their gross quarterly receipts or sales do not exceed P150,000, they are not required to file audited financial statements. Therefore, they don’t need to hire the professional services of a CPA.

4. No. You don’t need to submit it to the BIR. However, you need to have it audited to make sure all balances are correct and reconciled with those reported in the monthly and quarterly tax returns filed to the BIR.

Yes, you can file your ITR before April 15. In fact, it is recommended to file early to avoid penalties and compromises. You can file in any of the accredited agent bank (AABs) of the RDO where you are registered.

5. No. Employees are not allowed to claim deductible expenses. Only personal exemption at P50,000 ($1,121.58) and additional exemptions at P25,000 ($560.79) per child, maximum of 4, are available to employees to reduce their income tax. (READ: #AskTheTaxWhiz: Is 13th month pay really taxable?)

You can access the withholding tax calculator here to compute your withholding taxes. (READ: #AskTheTaxWhiz: How are withholding taxes computed?)

It is good to know we are helping you, and a lot of confused taxpayers out there.

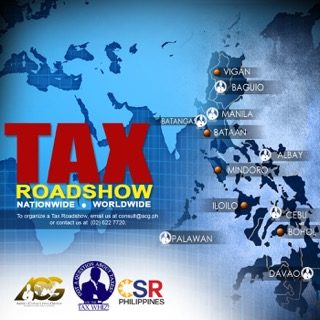

Our non-profit organization, the Center for Strategic Reforms of the Philippines (CSR Philippines), conducts a regional tax roadshow every month, free of charge.

On March 18-19, we are going to Vigan, and on April 1-2, we will be in Iloilo. For details, email us at consult@acg.ph or call (0917) 8248491.

Got a question about taxes? #AskTheTaxWhiz! Tweet @rapplerdotcom or email us at business@rappler.com. – Rappler.com

$1 = P46.77

Mon Abrea is a former BIR examiner and an advocate of genuine tax reform. He serves as chief strategy officer of the country’s first social consulting enterprise, the Abrea Consulting Group, which offers strategic finance and tax advisory services to businesses and professionals. Mon’s tax handbook, Got a Question About Taxes? Ask the Tax Whiz! is available in bookstores nationwide. Follow Mon on Twitter: @askthetaxwhiz or visit his group’s Facebook page. You may also email him at consult@acg.ph.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.