SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

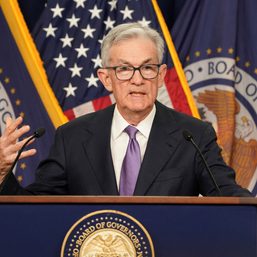

TOKYO, Japan – Expected interest rate hikes by the US Federal Reserve may delay emerging Asia’s economic recovery and keep pressure on policymakers to guard against the risk of capital outflows, a senior International Monetary Fund (IMF) official said on Tuesday, January 25.

Rising inflationary pressure, China’s economic slowdown, and the spread of coronavirus cases from the Omicron variant also cloud the region’s outlook, said Changyong Rhee, director of the IMF’s Asia and Pacific Department.

“We are not expecting a US monetary normalization to cause big shocks or large capital outflows in Asia, but emerging Asia’s recovery may be retarded by the higher global interest rates and leverages,” he told Reuters in a written interview.

As worries over a more hawkish Fed roils global markets, investors expect the US central bank to signal on Wednesday, January 26, its plan to raise rates in March. Markets have priced in a total of four rate increases this year.

Rhee said there was a risk US inflation could turn out higher than expected, and require a “faster or greater” monetary tightening by the Fed.

“Any miscommunication or misunderstanding of such changes may provoke a flight to safety, raising borrowing costs and resulting in capital outflows from emerging Asia,” he said.

In an updated World Economic Outlook released on Tuesday, the IMF slashed emerging Asia’s growth projection for 2022 to 5.9% from its October forecast of a 6.3% expansion.

The downgrade was largely due to a hefty 0.8% point cut in China‘s 2022 growth estimate to 4.8%, which reflected the impact of property sector woes and the hit to consumption from strict COVID-19 curbs.

“China is still the factory of the world. Weakening of China’s domestic demand will also reduce neighboring countries’ external demand in general,” Rhee said.

Asia may also see inflation emerge as among risks this year, contrary to last year when delays in economic recovery, as well as muted gains in energy and food prices, kept inflation subdued compared with other regions, he said.

“In 2022, as the recovery strengthens and food prices rebound, the persistent impact of high shipping costs could put an end to the benign inflation Asia has enjoyed in 2021,” Rhee said.

“Global energy prices are expected to stabilize in 2022 after a large rise in 2021, but they have been volatile lately.” – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.