SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

QUEZON, Philippines – Smartphones, fitness armbands, global positioning system (GPS), and other web-connected devices are seen to disrupt the Philippine insurance industry, posing a possible financial threat to the sector.

With GPS telling people how to drive more carefully and fitness armbands alerting them when they are exceeding the normal sugar level, more people are beginning to think they face less health risk.

“There are positive and negative implications of technological advances to insurance companies,” Pru Life UK President and CEO Antonio de Rosas said on the sidelines of an insurance seminar in Polillo Island, Quezon on Wednesday, September 23.

“The picky behavior of policy holders resulting from smart devices could be a threat. Conventional risk pools could decline as preventable accidents drop,” de Rosas said.

Policy holders, according to the chief of Pru Life UK, are “becoming selective” because of the tsunami of data that they get instantly and which allow them to improve their lifestyle.

“They know what they need. Most know the limitations and associated costs of healthcare, so they are becoming selective.” de Rosas explained.

“On the positive side, the technological advances make it easier for us, insurance companies, to track what they need and want,” the Pru Life UK CEO said.

“These [data-gathering devices] could reshape existing insurance business models, in a few ways, in the far future; but it will not spell doom for our bottomline,” he added.

Pru Life UK, according to its chief, eyes to “maintain or even surpass” its growth this year, by expanding distribution network and ramping up product offerings.

The local unit of Prudential PLC registered a compounded growth rate of 22% over the past 5 years.

“Year on year from 2010-2014 our compounded growth rate is 22%… we target to maintain or even surpass that,” de Rosas told reporters.

Pru Life UK said it will also step up efforts to further develop its regular and single premium products.

“Currently, 82% of Pru Life’s premium income comes from its agent sales, while 18% come from its broker bank partners,” de Rosas said.

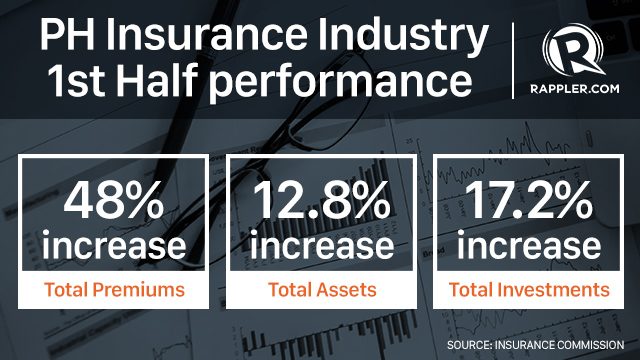

Pru Life UK said it is on track in hitting its previously recorded growth rate. “During the first half, the company has been able to maintain that growth rate,” de Rosas said.

For the rest of 2015, Pru Life UK said it wants to increase its current market share, which, as of 2014, stood at 12% of the insurance industry’s 1.5% penetration rate.

“We expect continued growth. Technological advances might spell some minimal disadvantages but these will be very helpful tools for insurers as well, making us re-think business models and innovate,” de Rosas said.

After all, the Pru Life UK chief said there are some dangers which even data-gathering devices cannot protect policy holders from. — Rappler.com

GPS and insurance plans photos from Shutterstock

Google watch photo from Android

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.