SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

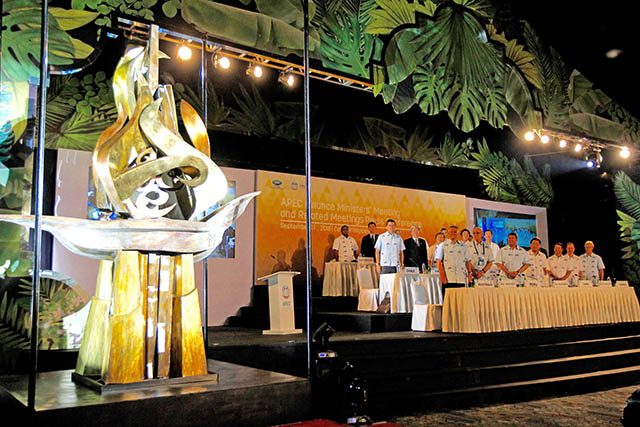

MANILA, PHILIPPINES – Ahead of the Asia-Pacific Economic Cooperation (APEC) summit, the Philippines, along with several international institutions, launched a platform to help transform financial systems in the Asia-Pacific.

Launched on Thursday, November 12, the Financial Infrastructure Development Network (FIDN) is a multi-sectoral platform designed to create a more inclusive economy around the region by making credit and other financial services region more accessible, especially for micro, small, and medium enterprises (MSMEs). (READ: Asia to be ‘world laboratory’ for financial inclusion)

This is inline with the APEC 2015 theme of building inclusive economies. It is one of the deliverables of the Cebu Action Plan announced in September.

The platform specifically targets MSMEs as they are seen to be crucial in accelerating poverty reduction.

“We’ve always said MSMEs are the life-force of the regional economy, contributing to over 60% of total employment, over 40% to GDP and over 15% to total exports among APEC economies. However, about 40% of the financing needs of MSMEs are unserved,” said Finance Secretary Cesar V. Purisima. (READ: APEC 2015: Robust Internet needed to link MSMEs to global supply chain)

“We are putting our money where our mouth is in putting more fuel to Asia-Pacific’s growth engine,” added Purisima, who served as chair of the APEC Finance Ministers’ Process that produced the Cebu Action Plan.

Multi-sectoral support

Aside from the Department of Finance (DOF), the platform will also be supported by the Bangko Sentral ng Pilipinas (BSP), the Securities and Exchange Commission (SEC), and the Credit Information Corporation.

Aside from the Philippines, which represents other APEC economies, the FIDN is also composed of the following institutions: International Finance Corporation (IFC), a member of the World Bank Group; the APEC Business Advisory Council (ABAC); the SME Finance Forum; and the Organisation for Economic Co-operation and Development (OECD).

It is further supported by leading global financial industry associations and firms that have joined the Asia-Pacific Financial Forum (APFF), a platform established by APEC Finance Ministers in 2013 to develop and integrate the region’s financial markets.

FIND initiatives

The World Bank said initiatives to be promoted through the FIDN across the Asia-Pacific will be geared toward 4 areas: credit information systems, secured transactions frameworks, insolvency frameworks, and factoring.

Initiatives may include proposed legislation and regulations that will create an enabling environment that facilitate greater access to credit.

1. Credit information systems

The FIDN will push for proposals that will help establish more credit information bureaus across the region, and make their operations more efficient.

It is believed that with sufficient credit information, such as those that can be provided by credit information bureaus, banks will be more inclined to lend to small borrowers who have good “reputational” collateral.

2. Secured transactions

FIDN will promote legal and policy reforms that will enable banks and other financial institutions to accept other forms of collateral, besides real properties, in extending loans. These include accounts receivables, inventory, and intellectual property, among other assets.

At present, many MSMEs have difficulty acquiring loans because they do not have real properties to serve as collateral.

3. Insolvency systems

FIDN will push for guidelines on how to deal with insolvency in a manner that respects the rights of both creditors and borrowers. With this kind of protection, banks and other financial institutions will be more confident in extending loans to small borrowers with good credit standing.

4. Factoring

“Factoring” is the selling of accounts receivables at a discount. This is one way of helping enterprises raise funds and meet immediate need for cash. The FIDN will call for initiatives that will make this common practice. – Chris Schnabel / Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.