SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

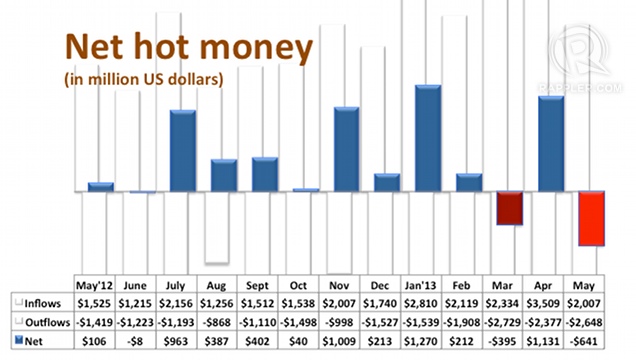

MANILA, Philippines – The country experienced a net outflow of foreign portfolio investments of $640.84 million in May, the highest since 1999, as foreign investors pulled back from emerging markets amid worries over an end to US stimulus measures.

“The announcement of a possible scaling down of quantitative easing (QE) in the United States” drove investors to withdraw funds from emerging markets such as the Philippines last month, the Bangko Sentral said in a statement on Friday, June 14.

The same concerns have been blamed for the bloodbath at the Philippine Stock Exchange this week. On June 13, the benchmark index suffered its steepest one-day fall since the stock crash in 2008, almost wiping out the gains for this 2013.

Also known as “hot money” for the ease by which they are put in and taken out of local markets, the last week of the month (May 27 to 31) saw the largest net outflow of $464.90.

The week after Standard & Poors granted the Philippines its 2nd investment grade rating, net outflow eased to $7.5 million (May 6 to 10). The week before that, May 1 to 3, $114.87 million flowed out of the country.

More investments left the country that entered it — a net outflow — also in March, but just reaching $395.14 million. Hot money swung back to a net inflow of P1.13 billion in April.

This cut the 5-month total to $1.577 billion from $2.217 billion in the first 4 months. The January-May total was still up 74.4% from the $904.16 million a year ago.

May breakdown

According to the BSP, the following hot money investments flowed into:

- Philippine Stock Exchange (PSE): $1.8 billion, accounting for 92% of total

- Government securities: $150 million, 7.5%

- Peso time deposits: $10 million, 0.5%

For the PSE-listed firms, the following sectors benefited the most:

- holding firms: $664 million

- banks: $297 million

- property firms: $205 million

- transportation services companies: $136 million

- food, beverage and tobacco firms: $135 million

Main sources of hot money inflows were:

- United States

- United Kingdom

- Singapore

- Luxembourg

- Hong Kong

– Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.