SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (2nd UPDATE) – Local shares followed the trajectory of other Asian markets and continued to rise for the 3rd consecutive day on Friday, June 28, as external concerns like the future of the US stimulus program and Chinese economy eased.

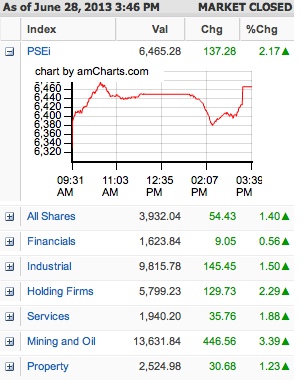

The benchmark Philippine Stock Exchange index climbed further to 6,465.28, up 2.17% or 137.28 points, marking the end of 5 straight weeks of decline.

The PSEi registered a 4.6% increase during the volatile week, which saw the index’s entry into the bear territory on June 25. The PSEi wiped out all gains for 2013 when it plummeted 25.7% to 5,789.06 from its record high close of 7,392.20 on May 15.

“The past few weeks have been very challenging,” COL Financial said in a research note on Friday, June 28. The online stock brokerage firm stressed the fundamental strength of the Philippine economy will sustain interest in local stocks.

“The Philippines is one of the rare gems in the world today moving from strength to strength, with the recently awarded investment grade rating by the two major ratings agencies and the surprising acceleration in 1Q (first quarter) GDP growth driven by higher investment spending.”

All sub-indices ended in the green on Friday, led by mining and oil companies, which rose 3.39% or 446.56 points to 13,631.84.

Total volume traded reached 7.532 billion shares worth P15.299 billion. Advancers beat decliners 96 to 71, while 47 issues were unchanged.

Other markets

Asian markets mostly rose Friday after a US Federal Reserve official moved to soothe fears the bank would wind up its stimulus program too soon.

Japan’s Nikkei index led the gains as the dollar edged back towards the 100 yen mark, helped by a better-than-expected batch of economic data.

Hong Kong and Shanghai were also supported by comments from the head of the central People’s Bank of China that it would “adjust” liquidity to ensure stability as financial markets suffer a credit squeeze.

Tokyo climbed 3.51%, or 463.77 points, to 13,677.32 and Hong Kong added 1.78%, or 363.21 points, to 20,803.29.

Shanghai closed a tough week on a high, putting on 1.5%, or 29.19 points, to 1,979.21, while Seoul finished 1.56% stronger, adding 28.62 points to 1,863.32.

But Sydney was hit by late profit-taking to close 0.18%, or 8.7 points, lower at 4,802.6.

Concerns on US stimulus

The upbeat outlook comes at the end of a tough month for global markets after Fed chairman Ben Bernanke indicated on June 19 that it could start to reel in this 2013 its $85-a-month bond-buying scheme, which keeps interest rates down.

Asia followed a rally on Wall Street, where investors welcomed comments from the Fed officials, including the bank’s New York president William Dudley, who said “a rise in short-term rates is very likely to be a long way off”.

Dudley said the bank’s policy deeply depends “on the progress we make towards our objectives” of pushing unemployment down to 6.5% and getting the economy back up to strength.

“This means that the policy — including the pace of asset purchases — depends on the outlook rather than the calendar.”

“If labor market conditions and the economy’s growth momentum were to be less favorable than in the (policy committee’s) outlook — and this is what has happened in recent years — I would expect that the asset purchases would continue at a higher pace for longer.”

Separately, Atlanta Fed president Dennis Lockhart added: “The chairman said we’ll use the patch,” referring to the aid smokers use to give up gradually. “And some in the markets reacted as if he said ‘cold turkey’.”

In New York trade the Dow rose 0.77%, the S&P 500 added 0.62% and the Nasdaq was 0.76% higher.

Chinese economy

Concerns about China’s economy were eased slightly by central bank chief Zhou Xiaochuan, who told a forum in Shanghai: “The PBoC will use all sorts of instruments and measures to adjust the overall liquidity level, so as to ensure the overall stability of the market.”

The announcement is the latest from the bank aimed at soothing confidence after global markets were rattled this week by a credit crunch in China’s financial system that has reportedly seeped into the wider economy.

However, despite the uptick in Shanghai shares on Friday the market lost more than 13% throughout June. Eyes will be on the release of manufacturing activity data due for release next week. – Rappler.com and Agence France-Presse

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.