SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

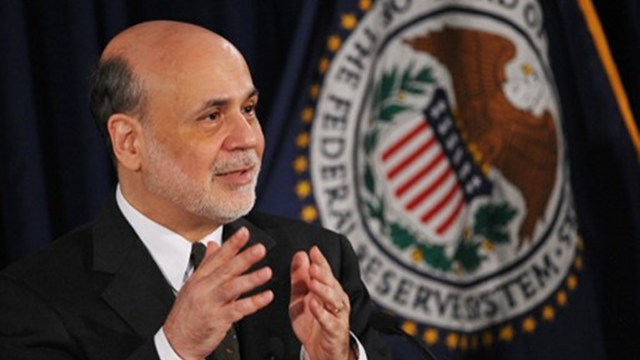

WASHINGTON, USA – US Federal Reserve Chairman Ben Bernanke reiterated Wednesday, July 17, that the Fed stimulus could be wound up in 2014 if economic growth remains steady as forecast.

But Bernanke warned that government spending cuts continue to threaten growth and that tapering the big bond-purchase program is “by no means” a “preset course”.

In prepared testimony to Congress, Bernanke stressed that the end to the $85 billion-a-month quantitative easing (QE) program did not mean the Fed was ready to begin tightening monetary policy with interest-rate hikes.

With unemployment still high and falling slowly and inflation very low, he said, “a highly accommodative monetary policy will remain appropriate for the foreseeable future.”

Bernanke repeated the path for the program that he laid out after the last policy meeting of the Federal Open Market Committee (FOMC) in June: that the Fed could begin cutting the bond investments later this 2013 and wind up the program entirely by the mid-2014, if the economy grows as the FOMC members expect.

But, addressing the jump in bond yields that answered that plan, he doubled up his message that the stimulus taper did not mean the Fed was ready to tighten its ultra-low interest rates.

And he stressed that growth remained vulnerable, and that QE would remain in place if needed, or even expanded.

“I emphasize that, because our asset purchases depend on economic and financial developments, they are by no means on a preset course.”

Indeed, he said, if inflation — which the Fed wants to see at 2% — stays much lower than that, and the jobless rate does not fall quickly enough from its current 7.6 percent level, bond purchases could be held at the current level or even increased if necessary.

The Fed has wrestled with an outsized jump in yields and market interest rates, by more than one percentage point, in the weeks since its path toward reeling in the stimulus became apparent in May.

Markets have tied the eventual drying up of easy-money injections to a likely rise in the benchmark federal funds interest rate, which has been near zero since the end of 2008.

The surge in rates, economists worry, could itself slow the recovery by slowing demand in the recovering housing sector, which has become a key contributor to growth.

Bernanke said the federal funds rate, now at 0% to 0.25%, would stay low “at least as long as” unemployment remains above 6.5% and inflation remains tame at 2% or below.

He stressed that even those numbers “are thresholds, not triggers” that would prod the FOMC to weigh changes to monetary policy, and not automatically result in a rate hike. – Rappler.com

Add a comment

How does this make you feel?

![[In This Economy] Can the PH become an upper-middle income country within this lifetime?](https://www.rappler.com/tachyon/2024/04/tl-ph-upper-income-country-04052024.jpg?resize=257%2C257&crop=295px%2C0px%2C720px%2C720px)

![[OPINION] Controversy over ASEAN’s ‘Swift’ week](https://www.rappler.com/tachyon/2024/03/tl-asean-swift-week.jpg?resize=257%2C257&crop=357px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.