SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – When the Supreme Court issued a ruling in late 2002 that Manila Electric Co (Meralco) was not allowed to pass on its income taxes to customers, the country’s biggest electricity distributor booked a loss of P27.9 billion in its restated financial statements that year.

The ruling raised worries it risked possible default on maturing obligations the following year. Understandably, Meralco’s fate was foremost in the minds of stock market investors when share prices of Manila Water Co fell 3.5% on July 4.

The chief water regulator, Emmanuel Caparas, told a number of television and radio stations then that the regulatory office of the Metropolitan Waterworks and Regulatory System (MWSS) had adopted a resolution disallowing private water companies serving Metro Manila and surrounding areas from charging income taxes to their customers.

Manila Water, owned mainly by the wealthy Ayala family, runs the water system in the eastern half of the MWSS franchise area. Maynilad Water Services, owned by the Consunji construction group and diversified conglomerate Metro Pacific Investment Corp, runs the water system in the western half. Share prices of MPIC also fell almost 2% that day.

“The issue brings to mind a similar controversy involving power distribution utility Manila Electric Co more than a decade ago,” wrote Laura Dy-Liacco of Maybank ATR Kim Eng Securities in a research note.

“To recall, Meralco returned some P30 billion to consumers after the Supreme Court ruled in November 2002 that Meralco could not pass on its income tax obligations to consumers, thereby nullifying the rate adjustments from 1994 to 2002.”

But, as Dy-Liacco herself pointed out, there are vast differences between Meralco’s case in 2002 and the situation facing Manila Water and Maynilad today.

Regulatory framework

First and foremost is the regulatory framework being used to set electricity and water rates.

While general laws on public utilities, including the 12% cap on the company’s return on rate base, applied to Meralco in 2002, the determination of water companies’ rates are based on the Concession Agreement signed by the water firms and the government in 1997.

The provisions of the Concession Agreement, particularly those that effectively guarantee a market-based return on the water companies’ expenditures, make it unlikely that Manila Water and Maynilad will suffer any loss from being disallowed to recover income taxes from water tariffs.

Also called the Appropriate Discount Rate (ADR), the market-based guaranteed return is roughly equivalent to the water companies’ average cost of capital.

Currently, the ADR for 5-year period ending 2012 stands at 9.3%. From 2003 to 2007, it was 10.4%. As part of the ongoing rate rebasing process, water companies are proposing that the ADR for the next 5 years should be set at 8.9%.

The water regulators want a sharply lower ADR considering that the cost of funds have gone down steeply in the last 5 years and are likely to stay low in view of the recent upgrades in the country’s debt rating to investment-grade.

Before or after tax

Whatever the new ADR that the MWSS Regulatory Office will adopt, that rate of return will have to be adjusted upwards if the MWSS Board of Trustees adopt and enforce the regulators’ recommendation to disallow the water companies from recovering income taxes from tariffs, according to water regulators themselves, analysts covering the water companies and a former MWSS consultant.

“The effect on the tariff is neutral. You removed income taxes (from recoverable expenses) but you increased the rate of return, so the tariff is the same,” said Felipe Medalla, the former economic planning chief who served as the MWSS consultant in early to late 2000s, during a discussion with UP Professor Solita Monsod in the July 15 episode of Bawal ang Pasaway on GMA News TV.

In his capacity as consultant, Medalla played a major role in determining rebased rates and the ADR in 2002 and 2007.

He added: “It all depends if the rate of return is before or after tax. If the rate of return is after tax, then the water companies should be allowed to include income taxes from recoverable expenses. If it’s before tax, they should not be allowed to.”

Indeed, the Concession Agreement defines the ADR on an after-tax basis.

The document says the ADR “means, at any time, the real (i.e. not inflation adjusted) weighted average cost of capital (after taxes payable by the concession business).”

If water firms are disallowed from passing on income taxes to customers, the ADR will need to be re-calculated on the pre-tax basis, which results in a higher ADR figure, implying that guaranteed returns for water companies will also go up.

The higher pre-tax ADR, in turn, will tend to push up higher rates, offsetting any rate lowering effect of disallowing income taxes as part of recoverable operating expenses.

Meralco’s tax case

Water regulators admit that the ADR will indeed have to be adjusted upwards if income taxes are disallowed as an operating expense, neutralizing the rate lowering effect of the new policy.

This is eventually what happened even in the case of Meralco, water regulators say.

The electricity utility’s average cost of equity and borrowings, was computed on a pre-tax basis when the Energy Regulatory Commission shifted from rate of return base (RORB) regulation to performance-based regulation (PBR), an approach that is closely similar to how MWSS Regulatory Office sets water tariffs.

“The model in the Concession Agreement really talks about a post-tax ADR,” admitted Emmanuel Caparas, the MWSS’ chief water regulator, during an interview in June.

“Now, if we’re going to take out income taxes, that’s no longer post-tax ADR. It should be pre-tax ADR instead. You have to be fair, you also have to make the concessionaires whole so they will continue the business. If you don’t do that, they’ll lose money and eventually quit.”

Still, water regulators insisted that overall water consumers will still enjoy a modest net decrease in water rates if income taxes are no longer considered part of the water companies’ operating expenses.

Moral vs economic basis

If the gains to consumer welfare are only modest at best, why have the MWSS regulators proposed changing the policy on recovery of income taxes in the first place and risk triggering a costly arbitration process and the usual criticism that government is again violating contracts?

Caparas said what the regulators are doing is merely correcting an apparent inconsistency between the terms of the Concession Agreement and the financial or economic model that governed privatization of water services in the MWSS franchise area.

The model suggests that income taxes can be passed on to consumers but “the problem is that income taxes are not specifically mentioned in the Concession Agreement,” he said.

“Should we just assume they’re part of Philippine business taxes when we know very well that income taxes are not part of business taxes?”

He explained: “The way we look at it at this point, any attempt at reconciling (the economic model with the terms of the Concession Agreement) should start with what is morally and legally acceptable, not with what is economically feasible,” he said.

Equally perplexing, why are the water companies vehemently opposing the change in the treatment of income tax payments if the effects will be offset by a higher pre-tax ADR anyway?

Financial impact

When asked about what they thought of Medalla’s argument, executives of the two water companies either said they have yet to study it or considered it speculative.

“We don’t have an official position on it yet. Both our lawyers and international economic consultant are studying the issue,” said Randolph Estrellado, Maynilad chief financial officer.

Ferdinand dela Cruz, Manila Water’s head of east zone business operations and head of corporate strategic affairs, said: “The CA (concession agreement) prescribes a post-tax ADR. (I) don’t want to speculate on items outside CA which government wrote.”

Unlike Meralco which suffered a big financial loss in 2002, the two water companies are likely to remain highly profitable even if they are disallowed from including income taxes among operating expenses that can be charged to customers.

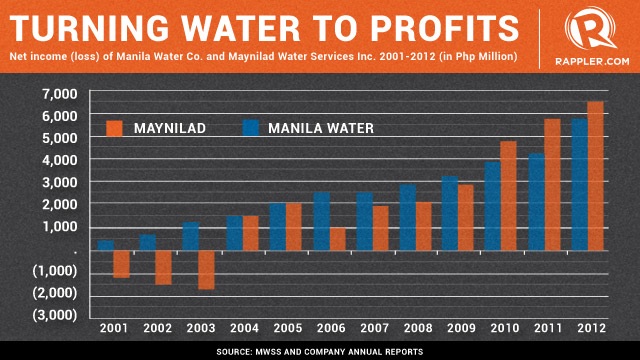

Manila Water’s net income, which hit P5.5 billion in 2012, has been rising by about 18% in the last 5 years. Maynilad’s profits, which last year reached P6.4 billion, has been climbing by an average of 32% from 2008 to 2012.

Guaranteed returns

The bigger risk to the water companies’ future profitability and market value is if the MWSS regulators adopt an ADR that is far lower than the 8.9% guaranteed return they are proposing.

ATR Kim Eng estimates that each percentage point decline in the ADR wipes out a tenth of Manila Water’s estimated net asset value. That translates to a P3.2 cut per share in the target price of the listed water company.

Water regulators also estimate that a percentage point change in the ADR results in either an increase or decrease of P1.4 per cubic meter in average basic water rates.

For water companies and consumers alike, it is time to shift the debate to what is the appropriate guaranteed return Manila Water and Maynilad are entitled to amid a sharp decline in the cost of equity and borrowings, and as well as country risk in the last 5 years.

Though many find the notion of the water companies passing on income taxes to consumers “unjust,” what really affects consumers’ pockets the most is the level of the water firms’ guaranteed returns. – Rappler.com

View the related articles of the author on how rate rebasing works, the status of the current process and the beginnings of MWSS water privatization published by Philippine Center for Investigative Journalism.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.