SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

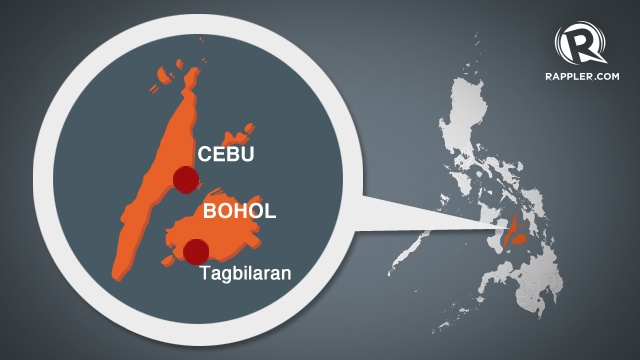

MANILA, Philippines – At least two of the country’s major banks and two state-run lending agencies announced ways to extend assistance to the borrowers who were affected by the quake that shook Central Visayas a week ago.

Major commercial banks Citi and Bank of the Philippine Islands are offering a payment relief to some clients, while state-run National Home Mortgage Finance Corporation (NHMFC) and Pag-Ibig Fund said affected borrowers could avail of a moratorium to their payment amortizations.

In an October 21 statement, the Citi group announced a payment holiday for CitiBank and CitiBank Savings credit cardholders and CitiBank Savings personal loan customers affected by the powerful quake that hit the island provinces of Cebu and Bohol.

Clients may ask for a payment relief of at least 30 days to settle their outstanding balance.

Qualified cardholders and personal loan customers will be entitled to an extra 30 days to settle their outstanding balance from their most recent payment due date. Late payment charges will be waived, and interest charges may be waived on a case-to-case basis.

Citi Philippines CEO Batara Sianturi in an October 21 statement noted that “through this program, we hope to give our clients time to settle their card bill or loan account and enjoy continued access to credit, which should be very useful to them in their current situation.”

In a phone interview with Rappler, Bank of the Philippine Islands (BPI) Assistant Vice-President for Corporate Communications Ma. Rita Canchela shared that “BPI Credit Card already has an existing facility to handle payment restructuring of clients for any catastrophes. These can be natural disasters such as earthquakes, fire or personal crisis.”

Canchela added that affected clients may call the bank where a representative of the restructuring team can discuss alternative modes of payment with the client.

6-month moratorium

The NHMFC, on the other hand, offers quake victims with a 6-month moratorium on payment amortization.

In a statement, Vice President and NHFMC Chairman Jejomar Binay shared that “earthquake-hit residents in Cebu and Bohol may avail of the program.”

For them to avail of this, “their accounts must be in current status or 0-3 months in arrears as of September 30, 2013,” Binay stressed.

Application for the moratorium should be filed on or before December 31, 2013.

Interest and penalty charges will not be imposed within the 6-month period, which takes effect upon the approval of the application.

Those who are no longer interested in returning to their respective homes, however, may choose dacion en ago, or payment in kind, to surrender their properties voluntarily.

“This program is NHMFC’s way of helping our countrymen to cope with the tragedy,” added Binay.

In his visit to Cebu and Bohol, Binay also shared that the Pag-Ibig Fund has allocated P4.5 billion for calamity loans at 5.95% annual interest payable in two years.

The Fund also implemented a 3-month moratorium on the payment of housing loan amortizations.

Residents are still reeling from the damage and continuing aftershocks after a magnitude 7.2 earthquake rocked Central Visayas on October 15. – with reports from Cecilia Cabiao/Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.