SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

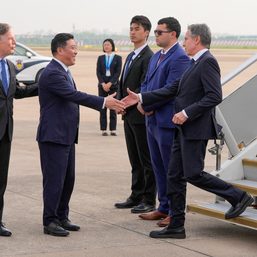

BONN, Germany – The United States does not have legal authority to seize Russian central bank assets frozen due to its invasion of Ukraine, Treasury Secretary Janet Yellen said on Wednesday, May 18, but talks with US partners over ways to make Russia foot the bill for Ukraine’s post-war reconstruction are starting.

Yellen also said it is likely that the special license granted to allow Russia to make payments to its US bondholders would not be extended when it expires next week, leaving Russian officials a fast-narrowing window to avoid its first external debt default since the 1917 Russian revolution.

Russia’s February 24 invasion of Ukraine is the central agenda item at this week’s gathering of Group of Seven finance ministers, and Yellen is calling for increased financial support for the war-torn country, which the World Bank estimates is suffering $4 billion in weekly physical damage.

“I think it’s very natural that given the enormous destruction in Ukraine, and huge rebuilding costs that they will face, that we will look to Russia to help pay at least a portion of the price that will be involved,” Yellen told reporters here ahead of this week’s meetings.

Some European officials have advocated that the EU, the United States, and other allies seize some $300 billion in Russian central bank foreign currency assets frozen by sanctions. The assets are held abroad, but remain under Russian ownership.

“While we’re beginning to look at this, it would not be legal now in the United States for the government to seize those” assets, Yellen said. “It’s not something that is legally permissible in the United States.”

US Treasury officials have also expressed concerns about setting precedents and eroding other countries’ confidence in holding their central bank assets in the United States.

At the G7 meeting in the Bonn suburb of Koenigswinter, Yellen intends to focus on Ukraine’s more immediate budget needs, estimated at $5 billion a month. On Tuesday, May 17, she pressed US allies to step up their financial support, while a German government official said the ministers would pledge $15 billion of new budget aid.

Russian default risks

Russia has some $40 billion of international bonds and has so far managed to keep current on its obligations and avoid default thanks to a temporary license from the Treasury granting an exception allowing banks to accept dollar-denominated payments from Russia’s finance ministry despite crippling sanctions on Russia.

The license expires on May 25, with the next major payment due that day.

On Wednesday, Yellen said Treasury is unlikely to extend the exemption. This could result in a technical default if Russia then resorts to trying to pay in roubles rather than dollars as required under the bonds’ covenants.

“There’s not been a final decision on that, but I think it’s unlikely that it would continue,” Yellen said, adding that a technical default would not alter the current situation regarding Russia’s access to capital.

“If Russia is unable to find a way to make these payments, and they technically default on their debt, I don’t think that really represents a significant change in Russia’s situation. They’re already cut off from global capital markets.”

Economy threats

Yellen outlined a number of threats to the global economy ahead of the G7 meeting, including spillovers from the war in Ukraine and sanctions on Russia, which have spiked energy and food prices, and a slowdown in China’s economy due to strict COVID-19 lockdowns. But she said she did not think a “synchronized” US, Chinese, and European recession was likely.

Yellen said China’s zero-tolerance COVID-19 policies appear to be impeding production of goods, compounding supply chain difficulties that have boosted prices and are contributing to its slowdown in growth.

“As one of the largest economies in the globe, China’s economic performance really has spillover impacts on growth all around the world,” Yellen said, adding that the Treasury was closely monitoring Beijing’s policy responses.

She confirmed that she is advocating within the Biden administration for dropping some US tariffs on Chinese goods that “aren’t very strategic” to limit pain on US consumers and businesses.

She said the G7 finance leaders will discuss further sanctions on Russia over its war in Ukraine and talk “about how best to design them to shield the global economy from the adverse effects while imposing maximum harm on Russia.” – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.