SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Lopez Holdings on Tuesday, December 1, filed a petition for voluntary delisting from the main board of the Philippine Stock Exchange (PSE) in an effort to “consolidate and streamline” its corporate structure.

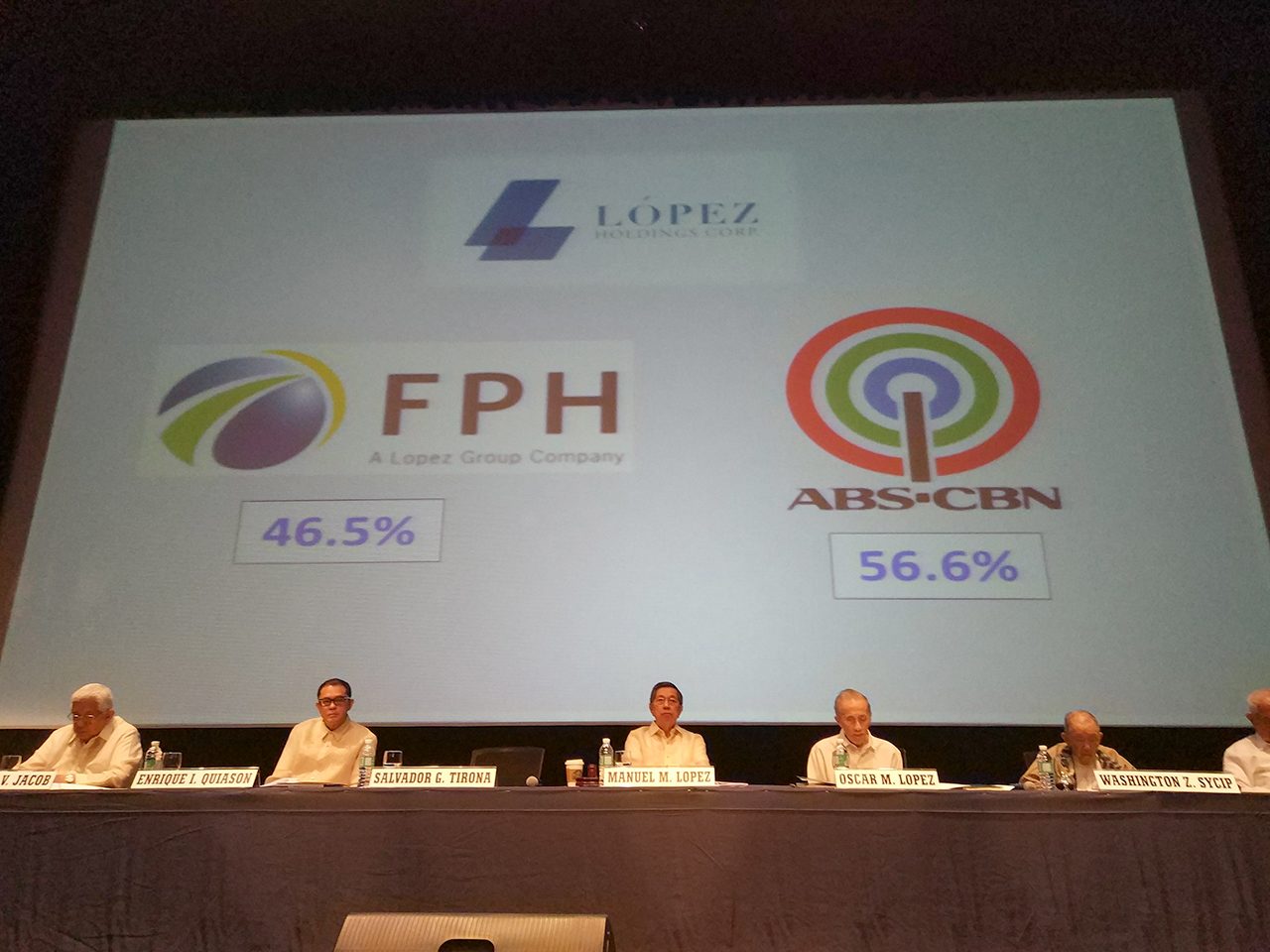

Lopez Holdings’ investees are embattled media giant ABS-CBN and renewable energy company First Philippine Holdings (FPH). (READ: GMA profits soar 79%, ABS-CBN losses mount)

FPH also announced its intent to conduct a tender offer to acquire from 908.5 million to 2.07 billion common shares of Lopez Holdings at a premium of P3.85 apiece.

Lopez Incorporated, the group’s ultimate parent company, will not participate in the tender offer.

The price is 25% higher than Lopez Holdings’ closing share price of P3.08 last November 27. The price also represents a 22% premium over Lopez Holdings’ 6-month closing high of P3.15 apiece.

Salvador Tirona, Lopez Holdings president, chief operating officer, and chief finance officer, stated that “if FPH’s tender offer is successful, Lopez Holdings will be delisted as part of the Lopez Group’s effort to consolidate the ownership of Lopez Holdings and to streamline the Lopez Group’s corporate structure by reducing the number of Group holding companies currently listed on the Philippine Stock Exchange from two to just one.”

“It is always a good sign when you see an offer for your shares with a significant premium over the market price. We will be happy for the shareholders who decide to avail of this opportunity to liquidate their investment,” Tirona added.

Lopez Holdings joined the PSE in November 1993. It currently has a market capitalization of P13.99 billion.

The PSE suspended trading of Lopez Holdings and FPH shares upon the announcement of the delisting and tender offer plans.

Lopez Holdings posted a P491-million net loss for the first 9 months of 2020, a 108% reversal of the P6.06 billion in net income in the same period last year.

This was due to the net loss recorded by ABS-CBN following the termination of its broadcast operations, as well as lower revenues from all business units of FPH. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.