SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Investing is one of the wisest financial decisions one can make.

Investing is one of the wisest financial decisions one can make.

With investing, people can earn more and cope with rising prices of goods and services.

A lot of people have not really gotten into investing. And a good number of those people who have do not know why they are investing and for what.

Investing is not like throwing seeds into the wind, leaving it to chance where they’d fall and grow. Investing is more like shooting arrows at a target – the target being no less than the bull’s eye.

Investing is done for very specific purposes: like a life event or future payments, all plotted to be achieved in certain periods and with price tags.

For instance, the goal can be a grand European vacation in 10 years’ time: year 2024 and worth P500,000 ($11,478.44). Or it can be a P20-million ($459,137.48) retirement fund in 30 years’ time. Or your children’s college tuition. By plotting out these specific goals, only then can investing can be seen in its right context – that it is imbued with purpose.

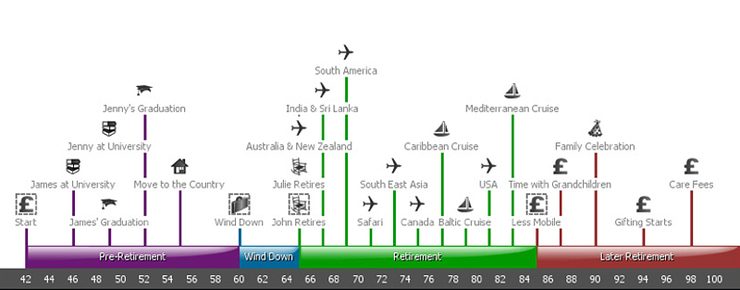

A timeline

That is why in planning your investments, you should draw a timeline of your financial goals, like this one:

But whatever the goal, financial planners can help determine how much should be invested, and in what financial instrument, to reach your target amount. It can be a one-time investment or a series of investments per year (or even per month), all building up for the same goal.

For instance, the P20-million retirement fund mentioned above can be achieved in 20 years’ time with a one-timeinvestment of P2.97 million ($68,191.24) today ina mutual fund or a Universal Investment Trust Fund that gives 10% return per year. Or it can be achieved through a yearly investment of P317,000 ($7,275.98) for the next 20 years at the same rate of return.

You may also opt to go directly to the market (whether the stock, bond or foreign exchange markets) and trade by yourself. But with direct trading, you should strive for a return of at least 10% per year. Of course, some years might have lower or even negative returns, but these should compound at an average of 10% per year.

Or it can be a mix of both: investing in funds and trading by yourself. Whatever the method, you should have an investment plan: what instruments or mix of instruments can give a 10% return compounded for the next 20 years? A yearly review should be done to track if the investment plan is working. Make adjustments as needed.

But this is just for one goal.

All throughout a person’s life, there will be many goals like vacations, a business, children’s education, 25th year wedding anniversary, and so on and so forth. Each of them has their own year stamp and price tag.

All goals will have their own investment plan. Miss one investment, then the goal shall be compromised. It may still be achieved, but the rates of return of other investments will have to be raised.

Now, one will never look at surplus money – or money earmarked for wants – the same way again. As all goals need investments, excess cash for wants is better allocated for these.

The best practice is to set aside investments first before buying the wants. I am not saying that one cannot enjoy life, but only that priorities be set.

Make a timeline. Make a plan. Invest and allocate funds for your future. – Rappler.com

Rienzie is also an accredited investment fiduciary of Pennsylvania-based fi360 and an international member of the Financial Planning Association, the largest association of financial planners in the US. You may reach Rienzie at rienzie.biolena@gmail.com, his Facebook account or Twitter @rbiolena.

*($1 = P43.57)

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.