SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The majority of Philippine investors are happy with their investment returns in 2014 and are optimistic about expected returns in 2015, with many relying on cash and property as the bulk of their investments, Manulife said Monday, May 11, citing its latest research.

For 2014, at least 76% of investors reported being happy with actual investment performance, while 2% said they were unhappy, according to Manulife’s Investor Sentiment Index in Asia (Manulife ISI) a quarterly, proprietary survey measuring and tracking investors’ views across 8 markets in the region.

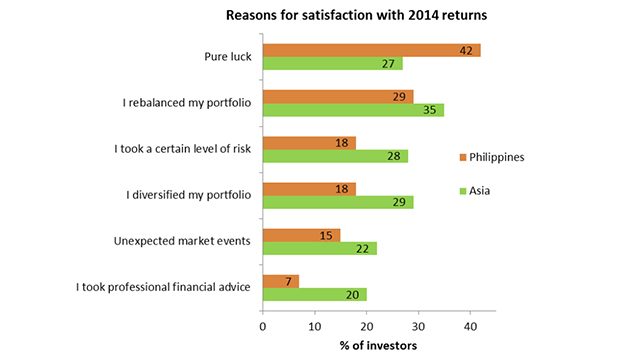

Of those who are happy, 42% attributed their performance to “pure luck” and 15% to unexpected market events that increased returns.

By comparison, satisfied investors elsewhere in Asia mostly attributed their success to prudent investment management, including actively rebalancing and diversifying their portfolios, and calculating risk.

Expected returns

Investors’ satisfaction also extends to the future, with 71% believing their financial situation will be even better in two years’ time.

On average, they expect returns of 12.4% in 2015, above the Asian figure of 10.2%, as one in 5 investors expect returns of 20% or more.

Local investors are also planning to learn more about different investment avenues.

“Our research shows that 35% of Philippine investors now say their top financial priority this year is to learn more about investing,” said Ryan Charland, president and CEO of Manulife Philippines.

He added that as sectors mature and population growth slows, they are likely to find that securing returns will require more investment knowledge.

Philippine investors also showed a strong preference for cash and property, as seen in their investment portfolios.

In the last quarter of 2014, investors increased their allocation to cash by 4% to comprise 41% of their portfolios, while allocation to investment property increased by 3% to 27%.

For this year, 40% of investors expect that investment property will be the best performing asset, followed by cash at 27%.

Only 7% believe equities will be the top performer, in contrast with their Asian peers who think equities will perform best.

This confidence in property and cash is also driving actual investment plans for the first half of 2015, with 71% of Philippine investors planning to invest more in cash and 57% saying they will invest more in investment property – both double the Asian averages.

By comparison, only 18% intend to buy equities, and even fewer said they will invest more in mutual funds or bonds, 15% and 14%, respectively.

Philippine investors are also largely limiting their activity to the local market, with only 3% ever having invested overseas.

Philippine investors most bullish

Manulife is skeptical that Philippine investors would be able to achieve their relatively lofty returns expectations based on current asset allocation.

“While many consider cash to be a safe and stable asset to hold, it usually generates little or no return, particularly if the impact of inflation is considered,” said Aira Gaspar, CFA, chief investment officer of Manulife Philippines.

But the latest survey showed that investors in the Philippines remain highly optimistic about the investment environment.

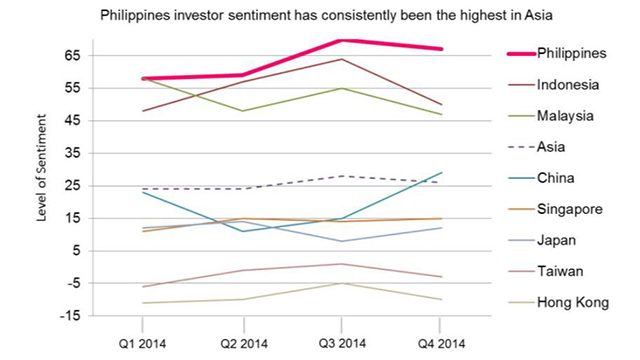

While the investor sentiment index for the Philippines was down slightly in the final quarter of 2014, by 3 points to 67, Philippine investors remain easily the most bullish in Asia, substantially above the Asian average of 26 points and outstripping second-highest Indonesia at 50 points.

“The Philippine economy has shown continued strength, with GDP (gross domestic product) growth beating expectations. The average retail investor in the Philippines appears to have benefited considerably, with 4 of 5 saying they are satisfied with their current financial situation,” Charland said.

The Manulife ISI is based on 500 online interviews in each market of Hong Kong, China, Taiwan, Japan, and Singapore; in Malaysia, Indonesia and the Philippines it is conducted face-to-face.

Respondents are middle class to affluent investors, aged 25 years and above who are the primary decision maker of financial matters in the household and currently have investment products. – Chris Schnabel/Rappler.com

Investment word collage image from Shutterstock

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.