SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Ask The Tax Whiz] What is the Annual Tax Compliance in the Philippines?](https://www.rappler.com/tachyon/2022/06/shutterstock-tax-payment-phone.jpg)

1. I am an employee, and my employment is my only source of income. Do I need to file an income tax return? If not, what’s the proof of the taxes paid on my behalf? If I don’t have an annual income tax return, what’s my proof of income other than pay slip if I want to apply for a loan or visa?

As an employee, it is possible that you no longer need to file any income tax return. Your employer should have already withheld the tax due from your monthly salary and remit the same to the BIR. This is known as “substituted filing” and has certain requisites for an employee to qualify:

- Receives purely compensation income regardless of amount

- Compensation from only one employer in the Philippines for the calendar year

- Income tax has been withheld correctly by the employer (tax due equals tax withheld)

Employees who want to avail substituted filing need to signify their intent to adopt substituted filing by signing BIR Form No. 2316 that their employer would issue them. BIR Form No. 2316 serves as the proof that the proper taxes have been withheld from your salaries, and also proof of your income in lieu of an annual income tax return.

The employers will need to submit the duplicate copy of BIR form 2316 on or before February 28, alongside the Certified List of Employees Qualified for Substituted Filing of ITR. Once this list is stamped “Received” by the BIR, it is tantamount to substituted filing by the qualified employees.

If you do not qualify for substituted filing, however, then you will need to file BIR Form No. 1700.

2. I have a business where I sell products online. What tax do I need to pay, and what form should I use?

How you pay and how much you pay will depend on whether or not you are doing your business as a sole proprietorship or as a corporation.

If your source of income is from sole proprietorship only, you are considered Self-Employed and would have to file either BIR Form No. 1701 or 1701-A, depending on the method of deduction that you will avail. You need to file a BIR Form No. 1701 if you are using itemized deductions, and BIR Form No. 1701-A if you are using either optional standard deductions (OSD) or the 8% flat income tax rate.

On the other hand, If you are earning both from sole-proprietorship and from employment you are considered a Mixed Income Earner and you’ll need to file BIR form 1701 regardless of the method of deduction you are using.

On the other hand, if your business is a corporation, then you will have to file BIR Form No. 1702-RT (if your corporation is subject to the regular corporate income tax), BIR Form No. 1702-MX (if your corporation is subject to multiple income tax rates or a special/preferential rate), and BIR Form No. 1702-EX (if your corporation is exempt from tax).

3. How can I file my tax returns? Do I have to go to the BIR and file manually?

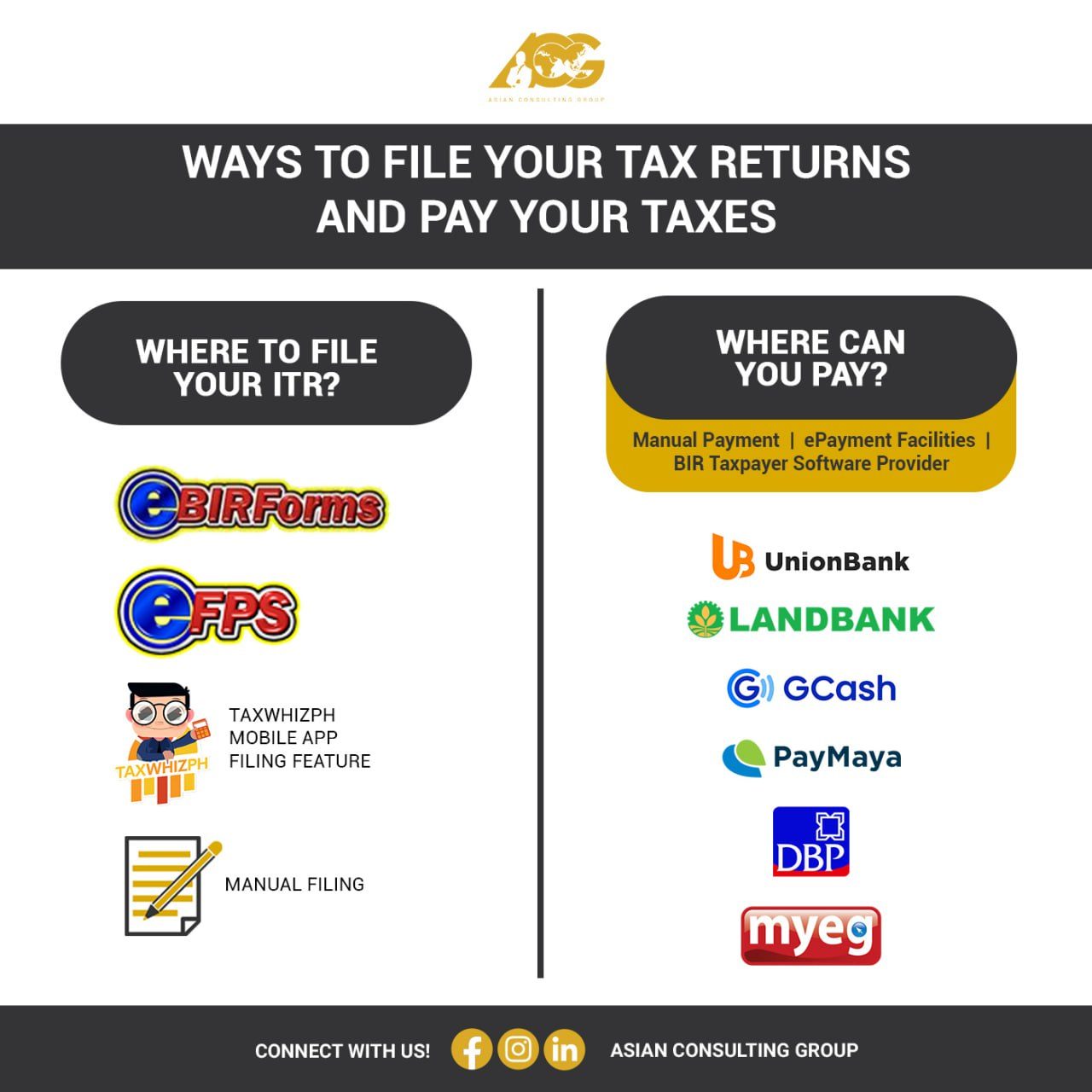

There are three ways to file your tax returns and pay your taxes: manually, by using eBIRForms, or by filing through eFPS.

In Manual Filing, you can go to the BIR Revenue District Office (RDO) to get your forms there or you can also download the forms online and print it. Once you have the relevant BIR Form, you can fill it up and file it with the RDO that you are registered in. Note that you can only do Manual Filing if you have tax due. If you have no taxes due, you have to file a “No Payment” return online through eBIRForms.

In eBIRForms, you download the Offline eBIRForms from the BIR website, accomplish the relevant forms, and submit them online. If you want to do manual payment, you can print the return, along with the Tax Return Receipt Confirmation, and pay via an Authorized Agent Bank (AAB) under the jurisdiction of the RDO where you are registered. Note, again, that if you have no taxes due, you only need to file the “No Payment” return.

Taxpayers required to use eFPS should file and pay their tax due the eFPS facility in order to avoid unnecessary wrong venue of filing the return.

On the other hand, you may also file your BIR Form 1701-A via TaxWhizPH Mobile app. You may download the app through Play Store or App store for a hassle free experience when filing your tax return.

To pay for your taxes due, taxpayers who file manually or use eBIRForms can pay manually by going to Authorized Agent Banks or, where not available, to the Revenue Collection Officer. Taxpayers may also pay via ePay Gateways (Land Bank, Development Bank of the Philippines, UnionBank, or through Taxpayer Software Providers such as GCash, Paymaya, or MyEG).

4. When is the deadline of filing Annual Income Tax Return?

The deadline for filing the Annual Income Tax Return is on April 17, 2023 since the original deadline, April 15, 2023, falls on a Saturday. Hence, it will be moved on its next working day. As for the payment of taxes, note that as provided under Bank Bulletin No. 2023-02, Authorized Agent Banks (AABs) will be open in the two Saturdays prior to the tax filing deadline (i.e., AABs will be open on March 25, 2023 and April 1, 2023). The AABs would also be extending their banking hours until 5PM from April 1 to 17, 2023.

– Rappler.com

Add a comment

How does this make you feel?

![[Ask The Tax Whiz] How to file annual income tax returns for 2023](https://www.rappler.com/tachyon/2022/11/tax-papers-hand-shutterstock.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.