SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Local small investors (LSIs) will now be able to subscribe to shares online whenever there is an initial public offering (IPO), the Philippine Stock Exchange (PSE) announced on Monday, June 3.

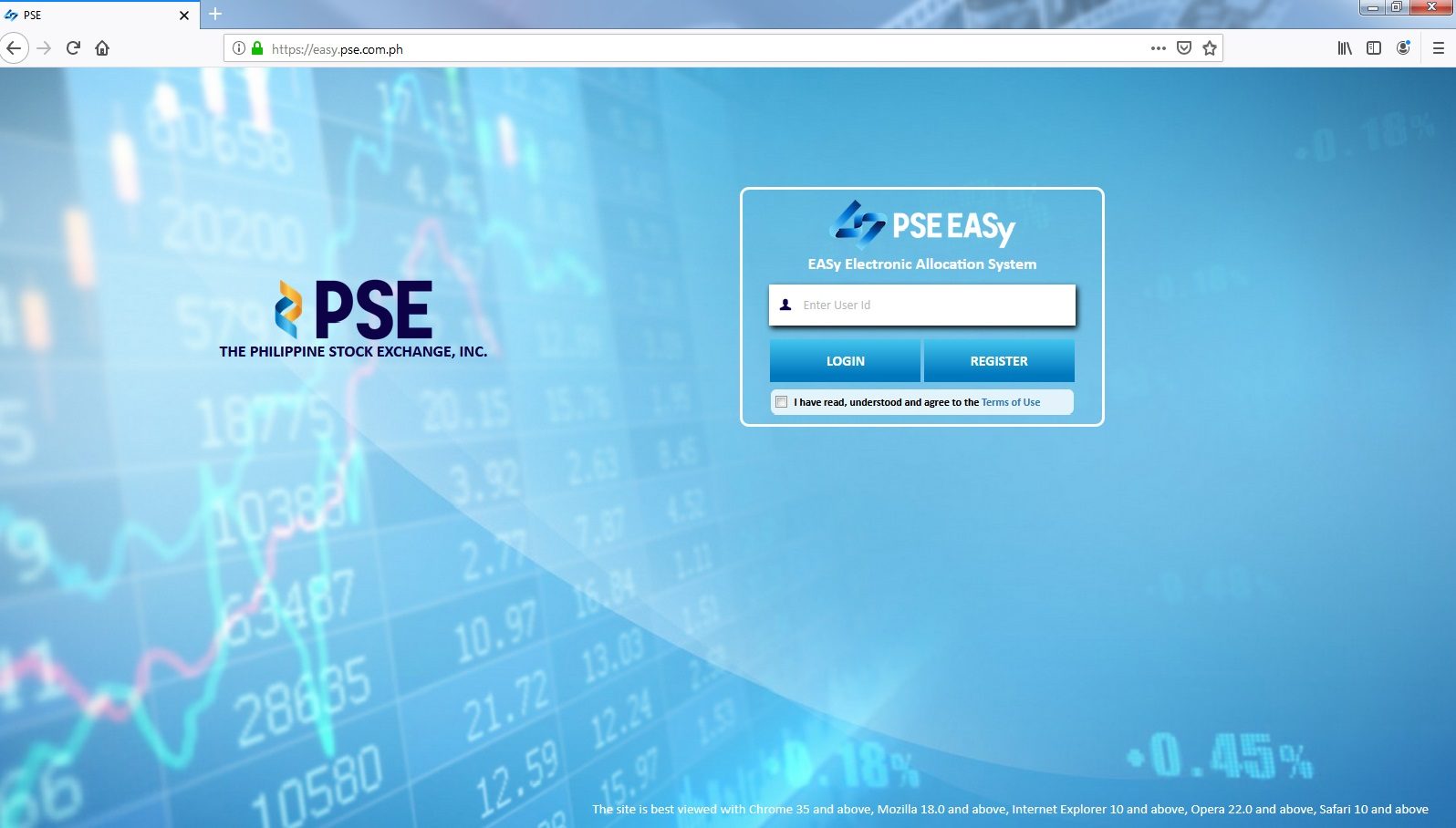

The local bourse operator rolled out a web-based platform called PSE Electronic Allocation System (PSE EASy), banking on users’ preference of using online platforms.

Prior to the website’s launch, LSIs had to go through a very cumbersome process, where they go to designated IPO kiosks in select Metro Manila malls to secure and fill up subscription forms. They then have to bring their form to brokers and have it approved, then bring the same form to the mall kiosk for payment.

“We noted that most of our investors now trade online and they are very savvy when it comes to using mobile apps. We want to continue leveraging on technology to make investing in offerings, particularly in an IPO, readily available to them,” said PSE president and chief executive officer Ramon Monzon.

The PSE also increased the maximum limit for LSIs from P25,000 to P100,000 per IPO. (READ: More Filipino middle class, millennials investing in stock market)

Investors who wish to take part in the LSI program of an IPO should create an account on the PSE EASy website.

The account must be confirmed by the stockbrokerage firm where the investor has an account. Once the account has been approved, the investor can participate in the LSI program whenever there is an IPO.

A mobile application will also be introduced in the 3rd quarter of 2019.

LSI shares are dedicated for the subscription of retail investors during an IPO. Companies are mandated to allocate 10% of an IPO for these investors.

So far, no company has made an IPO this year. Investors have long been anticipating companies like Del Monte, Cal-Comp, Allied Care Experts Medical Center, and AirAsia to go public this year, but none have pushed through yet as of writing. (READ: SEC approves planned IPO of Del Monte Philippines)

The PSE is aiming for at least 6 companies to go public in 2019.

In 2018, only property firm DM Wenceslao dared to go public, amid an uncertain bear market. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.