SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

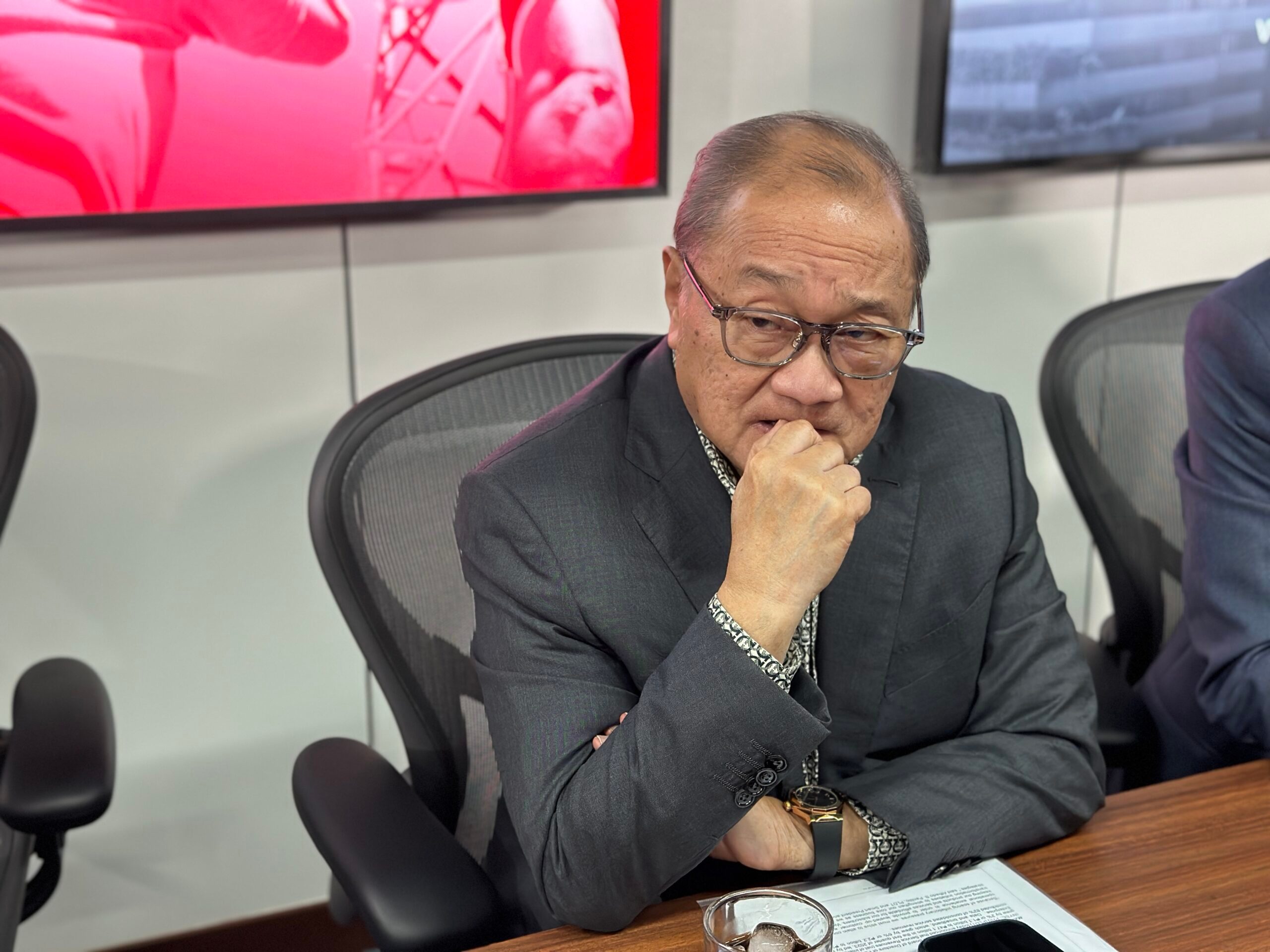

MANILA, Philippines– PLDT president and chief executive officer Al Panlilio said that 2023 is “a cleanup year” for the company, dealing with the aftermath of the P33-billion budget overrun on the telco’s finances.

Panlilo said that the issue on its capital expenditure overspend, which ran from 2019 to 2022, resulted in forming a team just for strict monitoring protocols, capex utilization, and validation of completed projects, as well as, a moratorium on purchase order (PO) issuances in the first three months of 2023.

“There was a moratorium for us in terms of PO issuances in the first quarter. It’s only now that (we’ve resumed in) the second quarter after settlement that happened in late March,” Panlilio said in a briefing on Thursday, May 4.

“It’s a painful experience,” Panlilio added.

PLDT appointed Danny Yu as chief financial officer on May 4, replacing Annabelle Chua who took an early retirement amid the issue.

Yu said that of the P33 billion capex overrun, P11 billion has been booked in the first quarter. The remaining amount may be paid this year or the next.

PLDT’s capex for 2023 is between P80 to P85 billion, around a third of which is earmarked to pay for the overrun.

“The capex overrun issues have largely been resolved; it is time in 2023 for PLDT to face forward, and move on. We should now channel our energies towards keeping the PLDT Group well-positioned for growth amidst this challenging macro-economic environment,” said PLDT chairman Manuel V. Pangilinan.

Several shareholder rights litigation firms in the United States are currently probing on behalf of investors of PLDT amid its budget overrun and violations of securities laws. PLDT shares are traded at the New York Stock Exchange through American Depositary Receipts with a ticker symbol of PHI.

Inflation pressures

After resolving most of what was deemed as a corporate governance concern, PLDT’s executives are focused on cost efficiency measures amid inflationary pressures.

In the first quarter of 2023, PLDT’s net income was flat at P9 billion, while revenues inched up 5% to P52.36 billion. Capex recorded in the first quarter was up 22% to P19.3 billion, which went mostly to infrastructure network and data center infrastructure.

Year-to-date, inflation stands at 7.9%, latest figures of the Philippine Statistics Authority showed.

“Because of soaring inflationary pressures, we must strive to attain cost-efficiency and operational excellence in order to provide leveled-up customer experiences while keeping our products and services affordable for our subscribers. We continue with our transformation initiatives to strengthen our core business as we plan for our growth strategies,” said Panlilio. –Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.