SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Gold purchases from small scale miners and traders by the Bangko Sentral ng Pilipinas (BSP) continued to go down amid smuggling and sales tax issues.

On Friday, December 28, the Mines and Geosciences Bureau (MGB) released data showing a 91% drop in volume and value of BSP purchases in the 3rd quarter to 159 kg and P317.8 million, respectively.

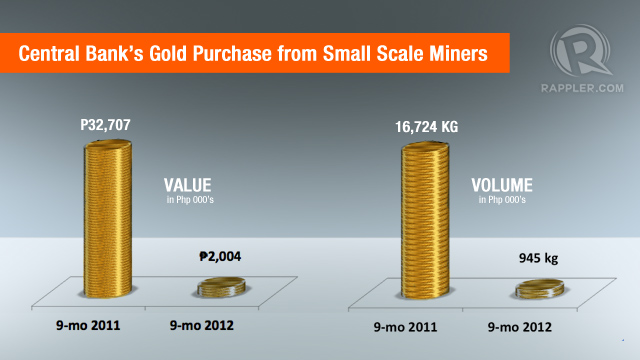

These brought the cumulative 9-month purchases to a dismal 945 kilograms valued at P2 billion. These reflected a 91% drop from the same figures a year ago.

Contributing to the decline was the slower production value of metallic materials, which fell by 18.85% in the first 9 months of the year to P97.99 billion, due to suspension of several mines and slow down in gold purchases by the BSP according to data from the mgb.

The suspension of operations following a tailings pond spill in August at the Padcal mine of Philex Mining Corp, the biggest gold producer in the country, was a major factor. Other mines suspended during the period were Shuley Mine and Nicua.

Gold contributed 34% to the total production value, while copper accounted for 16%.

Sales tax issue

The BSP admitted that the volume of gold it bought had shrunk significantly since 2011, when the Bureau of Internal Revenue (BIR) strictly enforced the collection of taxes on gold sales by setting up desks in the BSP’s gold-buying sites.

Proceeds of gold sold to the BSP are charged a 5% creditable withholding tax and a 2% excise tax, both based on the gross amount of gold sales. However, under the current tax system, only those who directly sell gold to the BSP are taxed.

Because of the controversial tax, significant amounts of gold are believed to be smuggled out of the country.

Low metal prices

Metal prices in the international market likewise remained languid with nickel, copper and nickel exhibiting negative nine-month averages year-on-year of 13.6%, 14.11% and 27.02%, respectively.

The slowdown in the global economy led prices to close at lower levels compared to the previous years, the MGB said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.