SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – At least 100 days before Christmas, the ‘ber’ mode kicks in, in the Philippines. Here the ‘ber’ months are typically used to refer to one of the longest holiday seasons in the world.

As early as September, Christmas songs start playing on radio stations and marketers launch holiday deals and promos, all with the intent of getting consumers in the mood to buy gifts, plan trips, and celebrate with their families and loved ones.

But are Filipinos’ shopping habits really aligned with these dates? And with growing concern about heavy traffic and poor public transportation in Metro Manila, how much shopping will be done online, and on which platforms? To find answers, Nerve, Rappler’s data research arm, recently conducted a survey among our readers.

Respondents were mostly millennials (aged 18-35) as well as adults aged 36 and up. The survey was served to visitors of the Rappler site from September 12 to 18. Majority (70%) of respondents hailed from the Philippines. There were slightly more female respondents (54%) than men (46%).

The survey’s margin of sampling error is +/- 3 percentage points, with a 99% level of confidence. The poll sheds light on the new shopping habits of a modern, digitally-savvy market.

Procrastinating shoppers

Though many retailers begin their Christmas campaigns in September, consumers aren’t making the bulk of their purchases that early.

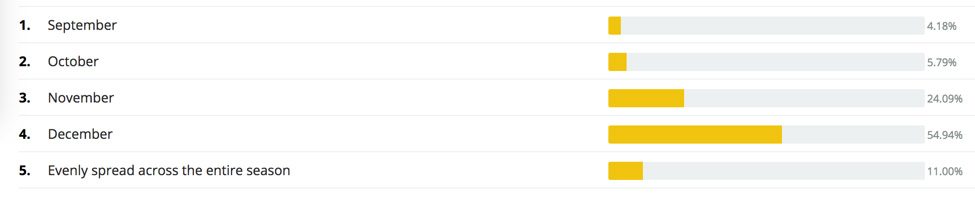

Among respondents, 55% indicated that December is the heaviest shopping month, with November coming in second at 24%. Only 5% of respondents said they shop in either September or October.

This means that early marketing and in-store retailing efforts spent on Christmas may largely be wasted. The classic marketer’s dilemma of “Right Message, Right Person, Right Time” is likely missing the time target.

November and December would be the best months to launch a holiday-themed campaign. So much for avoiding the rush!

Cash is still king

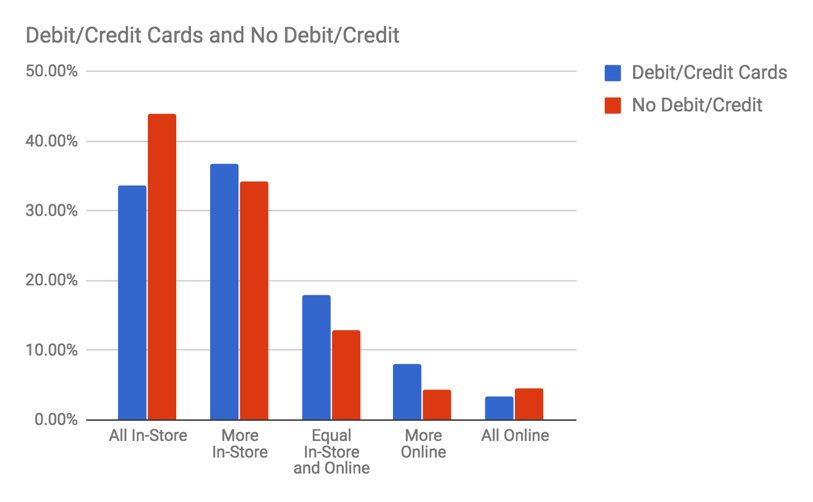

Most Rappler readers might still be bringing around cash to shop for gifts. Among respondents, only 35% of respondents said they own a credit card, while 48% still do not own a debit card.

While this may seem comparatively low on a global scale (90% of Singaporeans already own and use debit cards, for example), this is still a significantly higher number compared to the national average of 7% for credit cards and 43% for debit cards.

This preference for cash also affects where they will choose to shop as well.

Most shopping will be done in-store

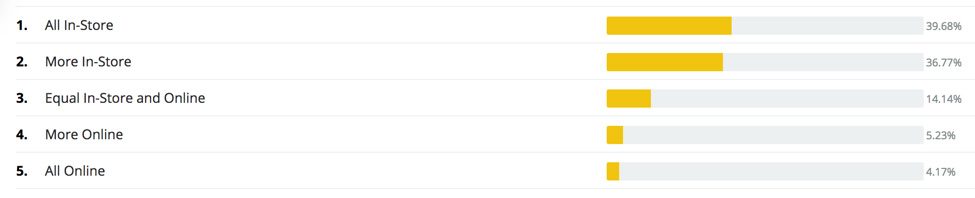

While e-commerce is rising in popularity in the Philippines, there is still a high preference for in-store buying.

When asked “How do you distribute your Christmas shopping between in-store and online?” majority responded they shop all in-store (39.68%) or more in-store (36.77%).

Among debit and credit card holders, however, it was observed that slightly more would also choose to shop online.

For marketers, this means that online campaigns can be focused on building awareness rather than driving instant purchase. They should improve their brand message and searchability when consumers look for reviews or pricing about a brand.

Clothing is top online purchase

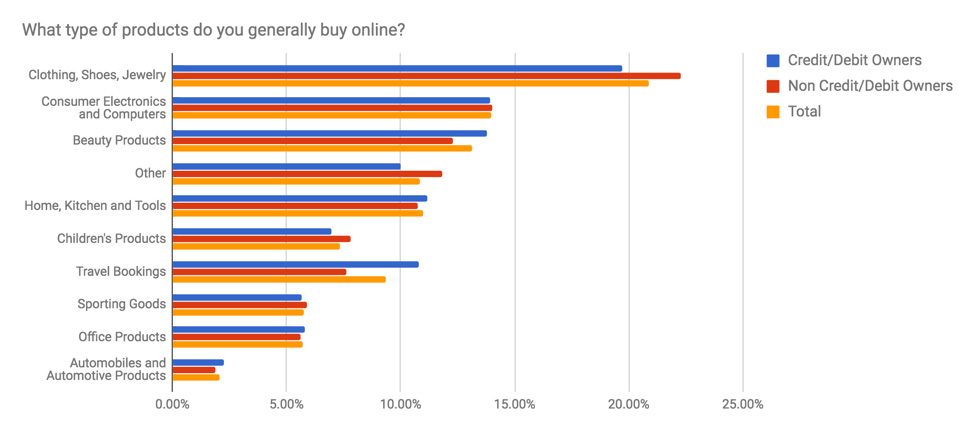

When asked what products they buy online, majority of respondents said they check out clothing, shoes, and jewelry, followed by consumer electronics and computers.

This matches global trends showing fashion as the leading online shopping category. Beauty, home, and kitchen products are also frequently bought – this is something to consider for those who want to venture into e-commerce next year.

Men more into e-commerce?

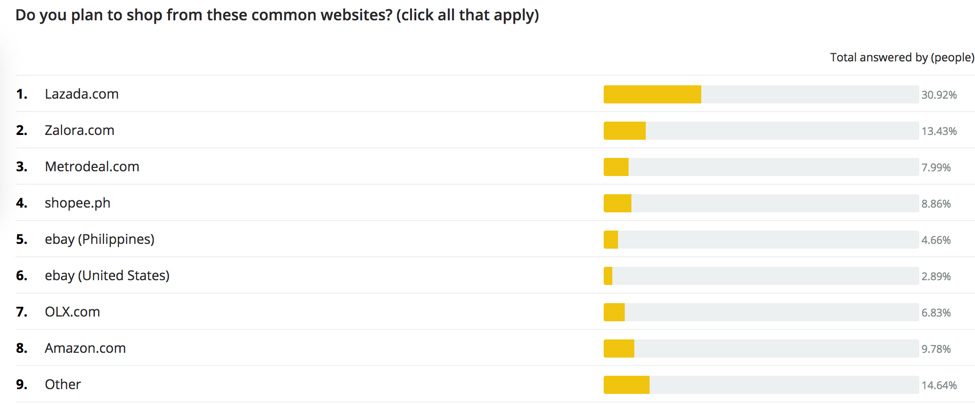

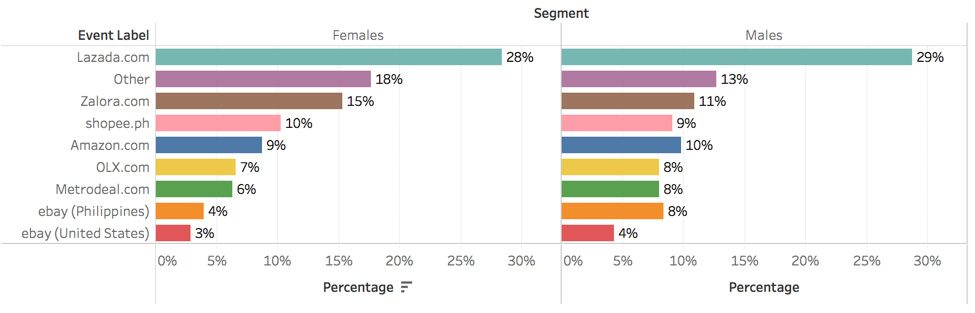

Among local online retailers, Lazada is the most used website, with 30% of responders saying they would shop there this season.

Of sites other than Lazada, it’s interesting to note that men shopped across a wider variety of stores than women, though women skewed heavier in the “other” category. This could indicate a long-tail of new e-commerce opportunities emerging for the Filipino market.

Rappler Nerve is the data research extension of our already robust investigative practice. Drawing on big and small data research methods, we leverage internal and partner data to help identify digital trends and consult on strategies to drive loyalty and growth. – Rappler.com

Add a comment

How does this make you feel?

![[PODCAST] Beyond the Stories: Ang milyon-milyong kontrata ng F2 Logistics mula sa Comelec](https://www.rappler.com/tachyon/2021/11/newsbreak-beyond-the-stories-square-with-topic-comelec.jpg?resize=257%2C257&crop_strategy=attention)

![[Free to disagree] How to be a cult leader or a demagogue president](https://www.rappler.com/tachyon/2024/04/TL-free-to-disagree.jpg?resize=257%2C257&crop_strategy=attention)

![[OPINION] Can Marcos survive a voters’ revolt in 2025?](https://www.rappler.com/tachyon/2024/04/tl-voters-revolt-04042024.jpg?resize=257%2C257&crop=251px%2C0px%2C720px%2C720px)

![[Edgewise] Quo vadis, Quiboloy?](https://www.rappler.com/tachyon/2024/03/quo-vadis-quiboloy-march-21-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[OPINION] Sara Duterte: Will she do a Binay or a Robredo?](https://www.rappler.com/tachyon/2024/03/tl-sara-duterte-will-do-binay-or-robredo-March-15-2024.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.