SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

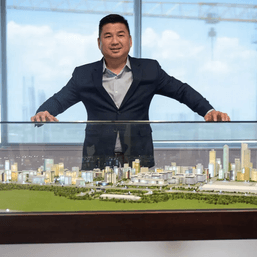

Dennis Uy-led Udenna Corporation maintained that there was nothing wrong with its acquisition of a Chevron subsidiary with a 45% operating stake in the Malampaya gas field.

In a statement sent to Rappler on Tuesday, November 2, Udenna spokesperson Raymond Zorrilla said the company is “aware of the allegations and false narratives” surrounding the issue.

“Let us be clear that there is no law requiring approval of transfer of shares of companies that have interest in Malampaya. Therefore, no party has the legal ability to rescind the Chevron and Shell transactions,” said Zorrilla.

Udenna issued the statement two weeks after a group of concerned citizens filed a graft complaint with the Ombudsman, naming Uy and Energy Secretary Alfonso Cusi, among others, as respondents.

Zorrilla said the Chevron and Shell share buyouts “underwent strict bidding processes” by multinational oil and gas players.

“The share sales were aboveboard and legal and had to pass thorough scrutiny by Philippine regulators, international lenders, and the said private multinationals involved,” he said.

Udenna also slammed as “fabrications” the claims that it would have earned a minimum of P21 billion yearly from operating Malampaya.

It also said the government would have spent billions of pesos if it decided to exercise its right-to-match option.

“Any government agency purchasing the Shell and Chevron shares [have] to first pay these international oil majors P50 billion to purchase offshore companies. Recovery of this government money is [a] high risk given Malampaya is a rapidly declining field with late-life engineering and quality challenges,” Zorrilla said.

Udenna aims to focus on how to “rejuvenate” the gas field, Zorrilla added, but “sadly, Malampaya has been made a political battlefield.”

‘Qualified’

Udenna also maintained that its subsidiary UC Malampaya Philippines is “clearly qualified” and added that the same people who were with Chevron and Shell are now part of the current management and operations team of the gas field.

“We were awarded because of the depth of our understanding of the business – how it should be managed and how it can be rejuvenated,” Zorrilla said.

The Uy-led firm also called on the Senate, along with “misinformed ‘concerned’ individuals,” to instead focus on the conditions of the gas field.

“Given the decline of the field, and the exit of the foreign players in Malampaya, the asset will only be able to service 6% of Luzon by 2024 unless immediate actions are taken to arrest its quick decline and prevent its eventual end by 2027,” Zorrilla said.

In 2019, Udenna announced that UC Malampaya acquired all of Chevron Malampaya LLC’s shares. Roughly one and a half years later, in April 2021, the Department of Energy (DOE) approved the Udenna-Chevron deal, after evaluating the technical, financial, and legal capability of UC Malampaya.

The members of the consortium holding an operating interest in Service Contract (SC) 38 or the Malampaya gas-to-power project also included Shell Philippines Exploration and the Philippine National Oil Company. SPEX previously held 45%, while PNOC still has 10%.

Similar to the Chevron deal, Uy’s Malampaya Energy bought SPEX, effectively getting hold of its 45% operating interest. Pending review by the DOE, Uy virtually has a 90% operating interest in SC 38.

In a series of Senate hearings in 2021, Senator Sherwin Gatchalian alleged that the DOE “bent rules” in order to accommodate Uy’s entry into the operations of the gas field.

Gatchalian also said the Chevron transaction could be a “midnight deal” given that talks on extending SC 38 supposedly moved “faster” after Uy’s entry into the consortium.

Cusi denied any irregularities in the review of the Udenna-Chevron deal and maintained that the DOE did not have to do the review in the first place because the transaction was merely a transfer of shares.

But critics, including retired Supreme Court associate justice Antonio Carpio, say that the Udenna-Chevron buyout would be the “biggest presidential gift to a crony” if SC 38 is extended. Uy is a friend of President Rodrigo Duterte and one of his campaign donors. – Rappler.com

Add a comment

How does this make you feel?

![[Vantage Point] Dennis Uy and Lady Luck](https://www.rappler.com/tachyon/2023/11/TL-dennis-uy-lady-luck-November-28-2023.jpg?resize=257%2C257&crop_strategy=attention)

![[Vantage Point] Quo vadis, Dennis?](https://www.rappler.com/tachyon/2022/06/quo-vadis-dennis-uy-June-15-2022.jpg?resize=257%2C257&crop_strategy=attention)

![[ROUNDTABLE SERIES] Powering up: Building a bright future with energy security](https://www.rappler.com/tachyon/2024/04/Omnibus-with-guests.jpg?resize=257%2C257&crop_strategy=attention)

![[OPINION] Fossil fuel debts are illegitimate and must be canceled](https://www.rappler.com/tachyon/2024/04/IMHO-fossil-fuel-debt-cancelled-April-16-2024.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.