SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Hefty taxes are a burden both for regular wage earners and wealthy businessmen.

For example, various sectors have been calling for the lowering of income taxes to provide workers more take-home pay. But has Congress – which has the duty to “evolve a progressive system of taxation” – been able to heed this call?

The 16th Congress tried.

Rappler looked into the initiatives of the legislative branch and found that several members of the 16th Congress have been persistent in efforts to rationalize the current taxation scheme.

We learned that 10 bills have been filed with the House of Representatives to lower income tax rates.

Taking note of the fact that the 19-year-old taxation system was pegged at the 1998 consumer price index (CPI), these 10 measures seek to amend Section 4 of the National Internal Revenue Code. (READ: Why PH has 2nd highest income tax in ASEAN)

Amending this would restructure the income brackets setting the minimum taxable income to P20,000 from the current P10,500 and reducing the tax rates imposed on each wage group. For instance, those earning P500,000 and up would pay 30% tax instead of 32.

Several lawmakers also proposed minimizing corporate tax rates.

House Bills 4941, 4996, and 4925 seek to gradually reduce tax rates of businesses in 3 to 5 years with the end goal of reducing cases of tax evasion and thereby improving collection.

At least 11 bills were also filed proposing to give additional exemption to taxpayers. (READ: Is the Filipino middle class over-taxed?)

.jpg)

Seven (7) measures aim to give tax reliefs by exempting workers who have disabled and aged dependents. Other bills intend to protect vulnerable workers such as those casually employed and “marginal” self-employed individuals (e.g. fisherfolk, farmers, or owners of sari-sari stores) to be exempted from tax.

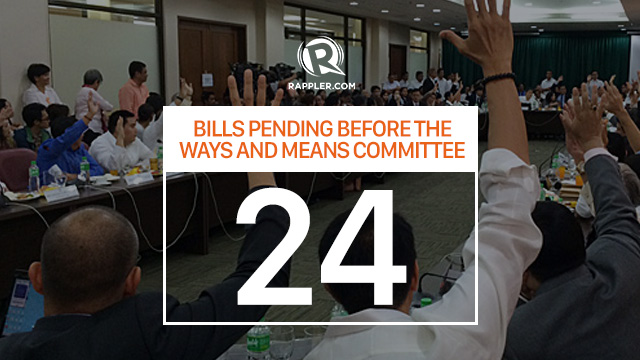

Significant and beneficial as these reform proposals may be, all remained stagnant at the House Committee of Ways and Means since 2014.

This means they haven’t reached the plenary for second and third readings – a long way to go in the legislative process.

Lack of data, lack of time

What could be the reason for this?

Analysts say this is because President Benigno Aquino III himself does not see this as priority. (READ: Lower income tax rates? Aquino ‘not convinced’ it’s good idea)

But Marikina 2nd District Representative Romero Quimbo, chairperson of the ways and means committee, cited two hurdles: lack of data and lack of time.

Quimbo told Rappler that the Department of Finance (DOF) and the Bureau of Internal Revenue (BIR) have inconsistent data on the losses the government would incur should income tax reduction be enacted into law.

“They have been guessing as far as income tax is concerned,” the Marikina lawmaker said, referring to the amount of revenue losses.

He added: “Up to today we are asking what their inputs are for the different proposals – whether it is adjusting to inflation, reducing corporate income tax from 30 to 25% or having a graduated reduction… they have not submitted anything on record on what the impact is and the manner by which they were able to get that amount or that figure”

This “inability of the DOF” inhibits the President from being “confident” about the proposal. (READ: Palace: ‘No debate on need for tax reforms’)

“When the executive is faced with that it’s very difficult to take the risk. Do you take the risk getting into a particular reform when you really don’t know what the impact is going to be?” said Quimbo, who is also the ruling party’s spokesperson.

Quimbo said time isn’t also in their favor because this should have been decided a “year before the election, so that the election fever will not cloud it.”

According to the lawmaker, they have started their first hearings as early as 2014 but the finance department asked to postpone talks until next year, “when things have stabilized in terms of total macro situations of the economy.”

Legacy for the 17th Congress

So is income tax reform dead?

At least for this administration the House leadership has raised a white flag.

“There’s no time for a real big tax reform, which is needed. Because adjusting the levels of taxable income to inflation is a very partial reform. We should have more time for bigger reform,” Speaker Feliciano Belmonte Jr said on Tuesday, November 24.

“You better spend your time on something that will get approved rather than on what will not be approved. Our time is better spent on other things that are doable, desirable,” he said.

Belmonte said he’s confident that the next Congress would be able to pass the reform given previous discussions on it.

“People will pick it up in the next Congress for sure.”

A holistic approach

Asian Institute of Management (AIM) Policy Director Dr Ronaldo Mendoza said it’s possible to complete the debates and its enactment within a president’s 6-year term.

“It’s just a matter of putting them together. Obviously, there’s a whole considerable amount of debate with income tax reforms and people have a good understanding about it,” Mendoza told Rappler in a phone interview.

However, he noted that tax reform should be done holistically and not through a piecemeal approach. As of now, most of the public discussions focus on just the income tax.

“Package the entire reform agenda under a coherent umbrella which is to look at the entire tax system under the key goals – competitiveness, equity, efficiency. It cannot just be about providing tax relief,” Mendoza said.

“We [also] want people to be encouraged to pay their taxes. We also want to lower collection in the tax system and [those] are the types of things we now need to think about,” he said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.