SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

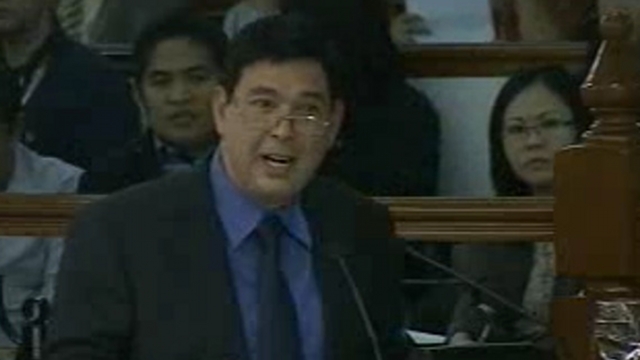

MANILA, Philippines – Senator Ralph Recto should resign as chairmain of the Senate committee on ways and means for “watering down” the sin tax measure, according to an anti-tobacco group.

“We will demand for his resignation, even his ouster from that committee. It only shows that Senator Recto is defying the administration. He is defying the Department of Health. He is defying the Department of Finance. He is defying President Aquino, who has considered this a priority bill,” said Action Economic Reforms coordinator Filomeno Sta. Ana.

Recto’s committee endorsed to the plenary Senate Bill 3299, which seeks to raise P15 billion to P20 billion additional revenues from the proposed tax increases for tobacco and alcohol products. It is much lower than the already watered down version approved by the House of Representatives in June, which is expected to raise P31-billion.

Sta. Ana said Recto waged war against sin tax reform and health advocates by further diluting the House bill.

“He wants war, then war we will give him. We will fight this war,” he added.

Sta. Ana said the “absurdly low” tax rates under the Recto bill will keep Philippine cigarettes as one of the cheapest in the world.

He added it will make local cigarettes “cheaper” over time as higher-priced brands move to lower tax categories.

Dr. Antonio Dans of the University of the Philippines College of Medicine also lamented the Recto bill’s “blatant disregard for health.”

“[If we pass this version] we have given up on 55,000 lives. Ganoon na ba ka-mura ang buhay ngayon na we’re willing to forget 55,000 lives just to protect an industry (tobacco) that doesn’t deserve protection from our legislators?”

“The fact that it was watered down – not even watered down, but rather drowned – we’ve settled for nothing,” Dans said. “We should not tolerate such disregard for the poor.”

Recto denied that the Senate version diluted the House sin tax bill. He said rates under the Senate version are “realistic, reasonable and responsible.”

Reforming the sin tax law by increasing excise taxes will make tobacco and alcohol products more expensive for the young and the poor. Health advocates said the decrease in consumption will result in lower incidence of “sin”-related diseases, which in turn, will reduce medical and other costs to the economy. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.