SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Two Senate bills have been recently filed to improve the tax system in the Philippines.

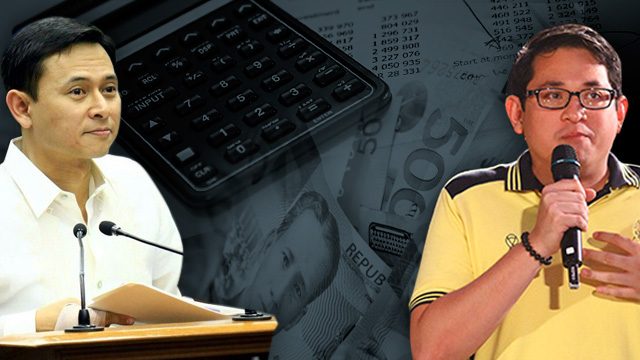

To stimulate growth, Senator Paolo Benigno Aquino IV calls on the government to include small tax reform for small businesses in its tax reform package. Senator Juan Edgardo “Sonny” Angara, meanwhile, seeks to raise awareness on the rights of taxpayers through his proposed bill.

Aquino, on Sunday, October 2, said that it is already certain that personal income tax reform will be passed so it is now best to focus on small businesses.

“With all the support from the executive, we’re certain the personal income tax reform will be passed,” said Sen. Bam, referring to his Senate Bill No. 169. “What we should also focus on is the Small Business Tax Reform Act na makakatulong sa mga maliliit na negosyo na nagsisilbing kabuhayan ng maraming pamilyang Pilipino. (What we should also focus on is the Small Business Tax Reform that will help small businesses which serve as means of livelihood of many Filipino families.)”

Aquino’s proposed Senate Bill No. 169 or the Small Business Tax Reform Act, seeks to provide small businesses with lower income rate, a simplified process of filing of taxes, and VAT exemption, among others.

Lower tax, other privileges

Under this measure, all small businesses will be exempted from paying income tax for the first 3 years of its operations from date of establishment, then will be subjected to lower income tax rates afterwards.

The bill plans to exempt from income tax small businesses earning less than P300,000 ($6,918). Meanwhile, those whose income range from P300,000 up to P10,000,000 ($266,614) will be subjected to 10% income tax.

In addition, the measure seeks to provide to small businesses a special lane and assistance desks, tax audit exemption, and installment payments, among others.

The need for simpler taxation, according to Aquino, is immediate as the Philippines recently placed 126th out of 189 economies in Ease of Paying Taxes based on a study by the World Bank.

Streamlining the country’s tax system, he added, will boost the chances of local enterprises to succeed and eventually generate prosperity and livelihood to more Filipinos.

“This must change,” Aquino said. “The Small Business Tax Reform Act will simplify tax procedures and unburden our small businesses of the complex tax process.”

Enforce taxpayers’ rights

Angara, meanwhile, emphasized the need for a law that enshrines taxpayer’s rights.

In a statement, Angara highlighted that although taxpayers’ duties are well-known and are performed well, they do not fully know the rights they are entitled to. A “Taxpayer’s Bill of Rights,” therefore, will ensure that “those who pay must be protected.”

In his proposed Senate Bill No. 308, the rights of taxpayers are grouped into 3: Basic rights, rights in civil cases, and rights in criminal cases.

Basic rights include the right “to available information and prompt and accurate responses to questions and requests for tax assistance” rights during civil cases include the “right to request cancellation, release, or modification of liens erroneously filed by the Bureau of Internal Revenue and Bureau of Customs.”

Rights in criminal cases, meanwhile, provides that a taxpayer shall have the right to seek the assistance of competent and willing counsel and the right to be given ample opportunity to present proof and prepare the defense, including the right to present witnesses, among others.

An Office of the National Taxpayers Advocate will be established under the proposed measure to enforce the rights of taxpayers. According to Angara, the office’s duty is to “promote and promote the rights of the Filipino taxpayers.” – Rappler.com

$1=P48.28

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.